Creating Expense Claim

Whenever Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a service related to a shipment like palletisation, fumigation, packaging etc, while doing custom clearance for the shipment. Or they paid for their medical supplies, for office travel expense etc.

Let's try to record an expense claim for activities related to a shipment. For example while clearing and moving a shipment you incurred expenses for Palletization, CMC , Examination and Phytosanitary Certificate

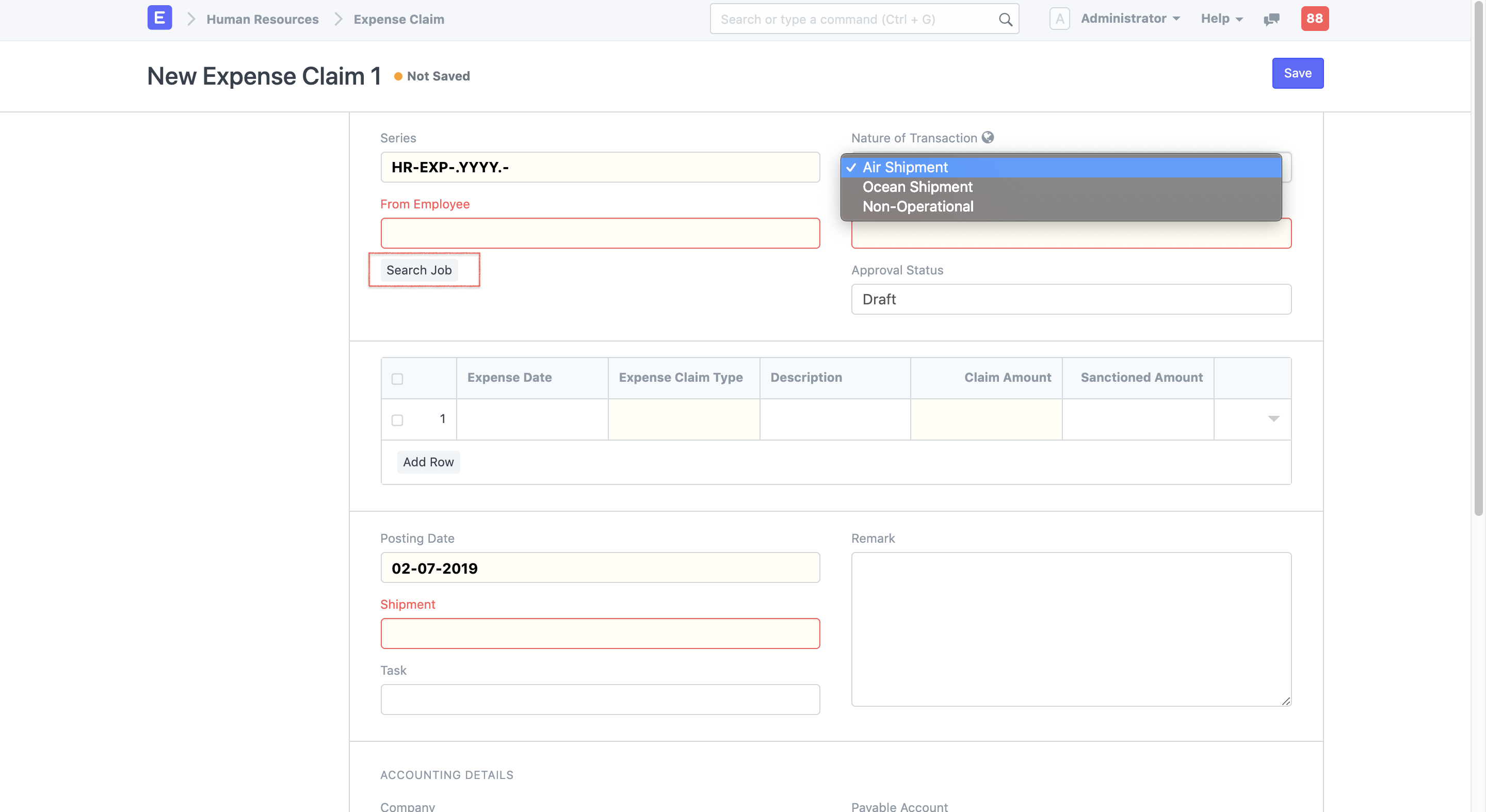

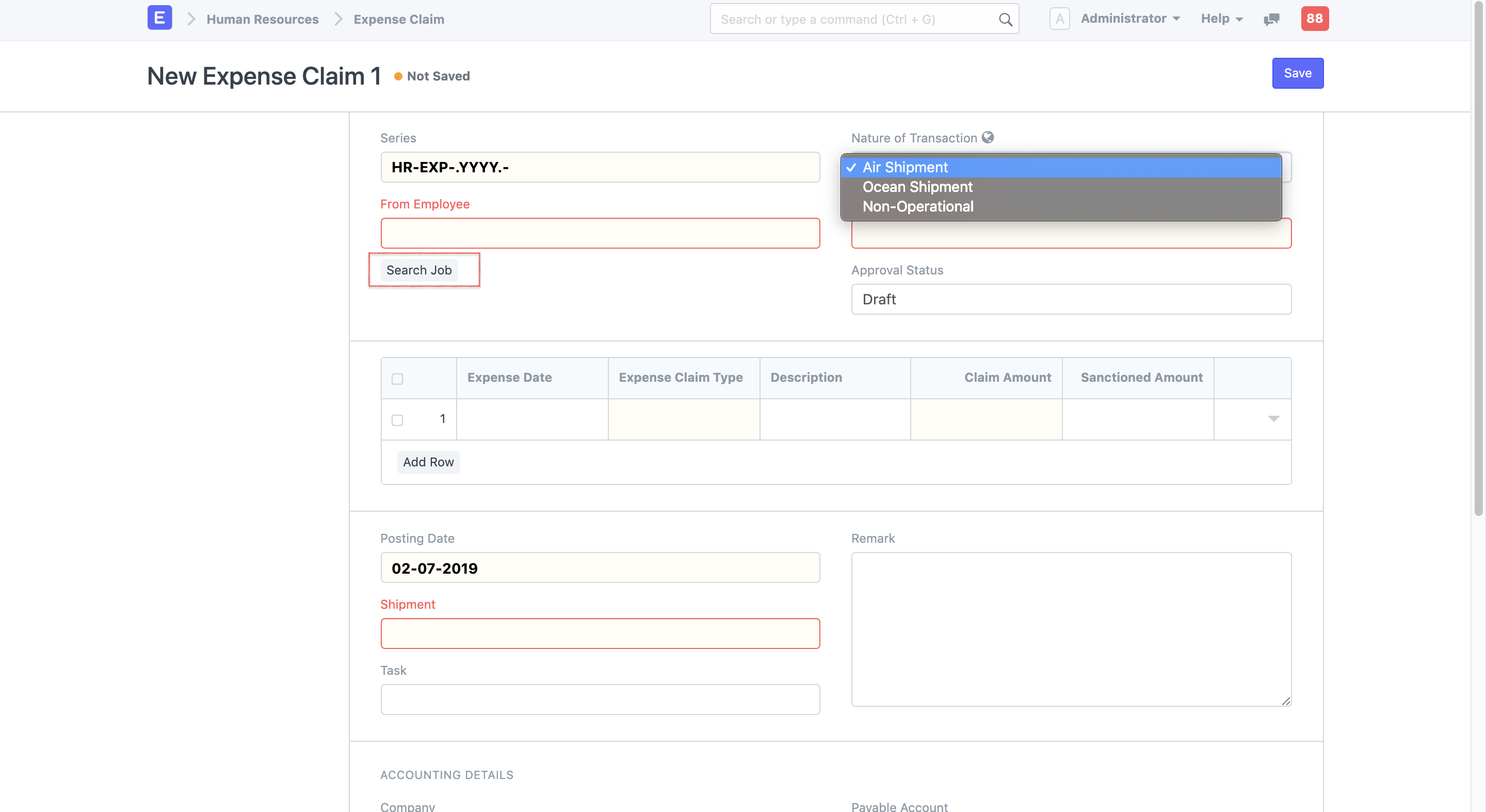

Select the Nature of Expense Claim, this determines whether it was incurred it done for a Air Shipment, Ocean Shipment or it is not related to shipment

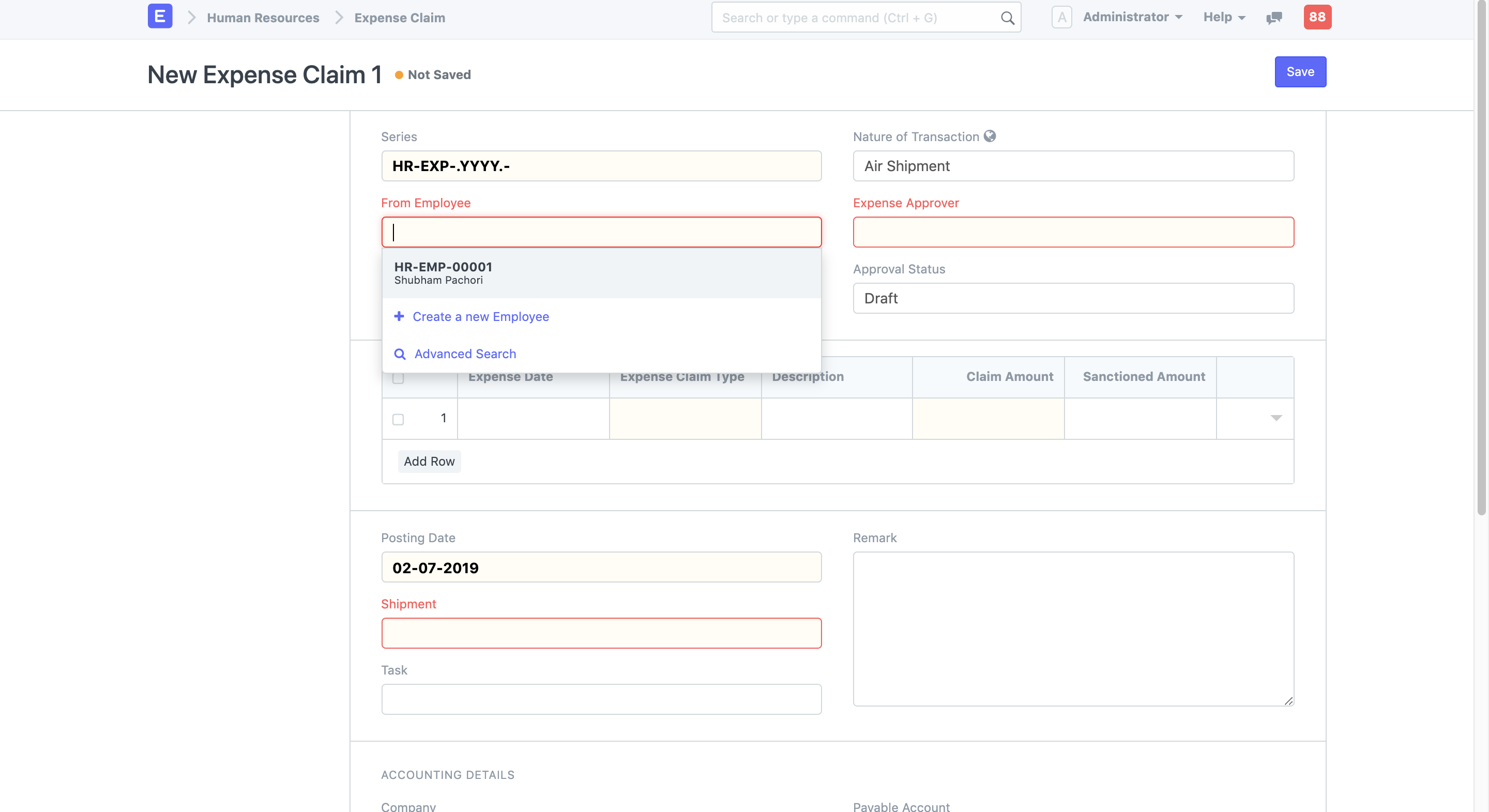

Enter the name of the Employee who paid for this expense & the name of the team member, (generally some one from finance team) who is approver for this expense

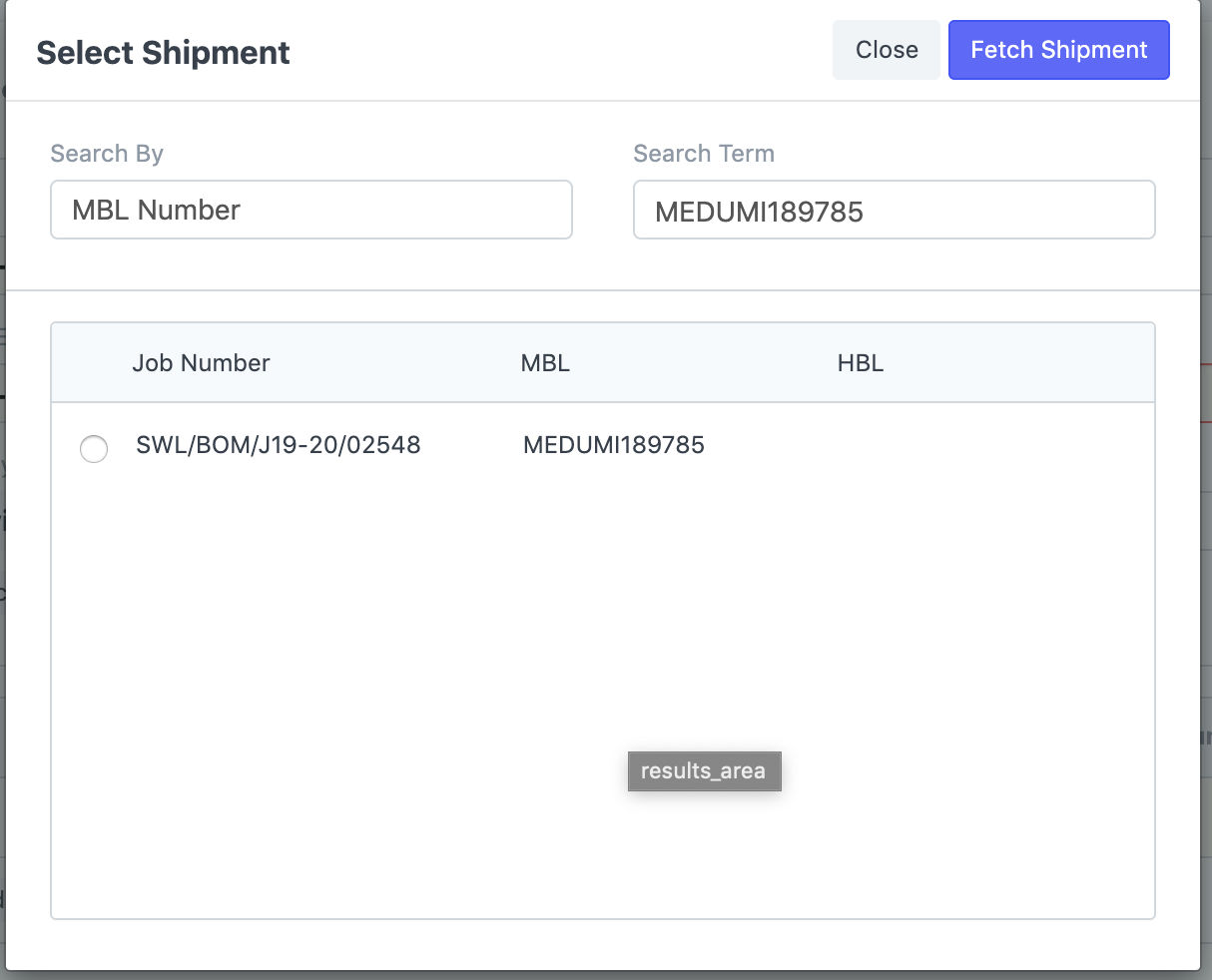

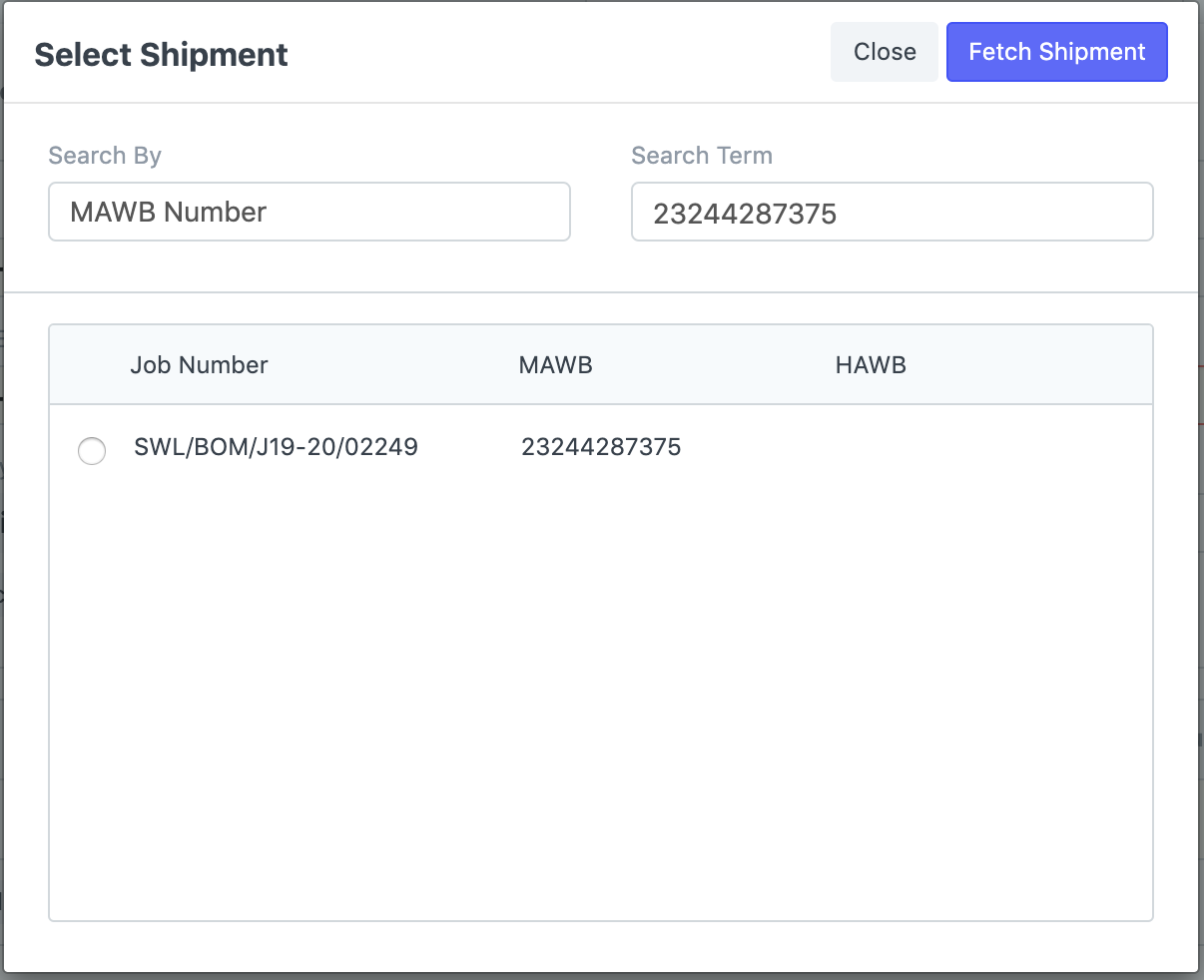

If expense has been done for a shipment, click on Search Job and search shipment by various reference numbers like MAWB #, BL#, Container Number ..... select the shipment

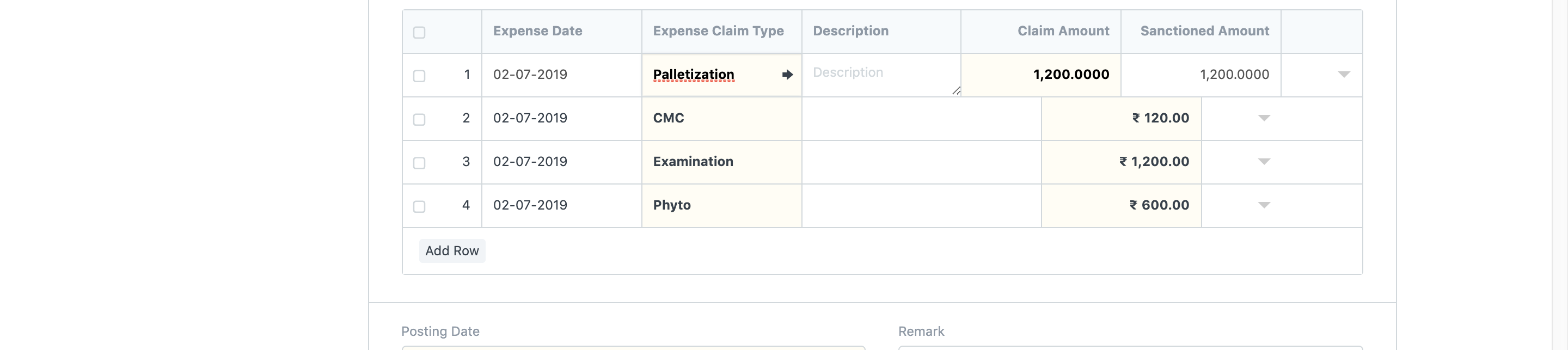

Enter the item wise details of the expenses incurred by searching the relevant expense claim type for each activity and enter the amount spent for each one of them

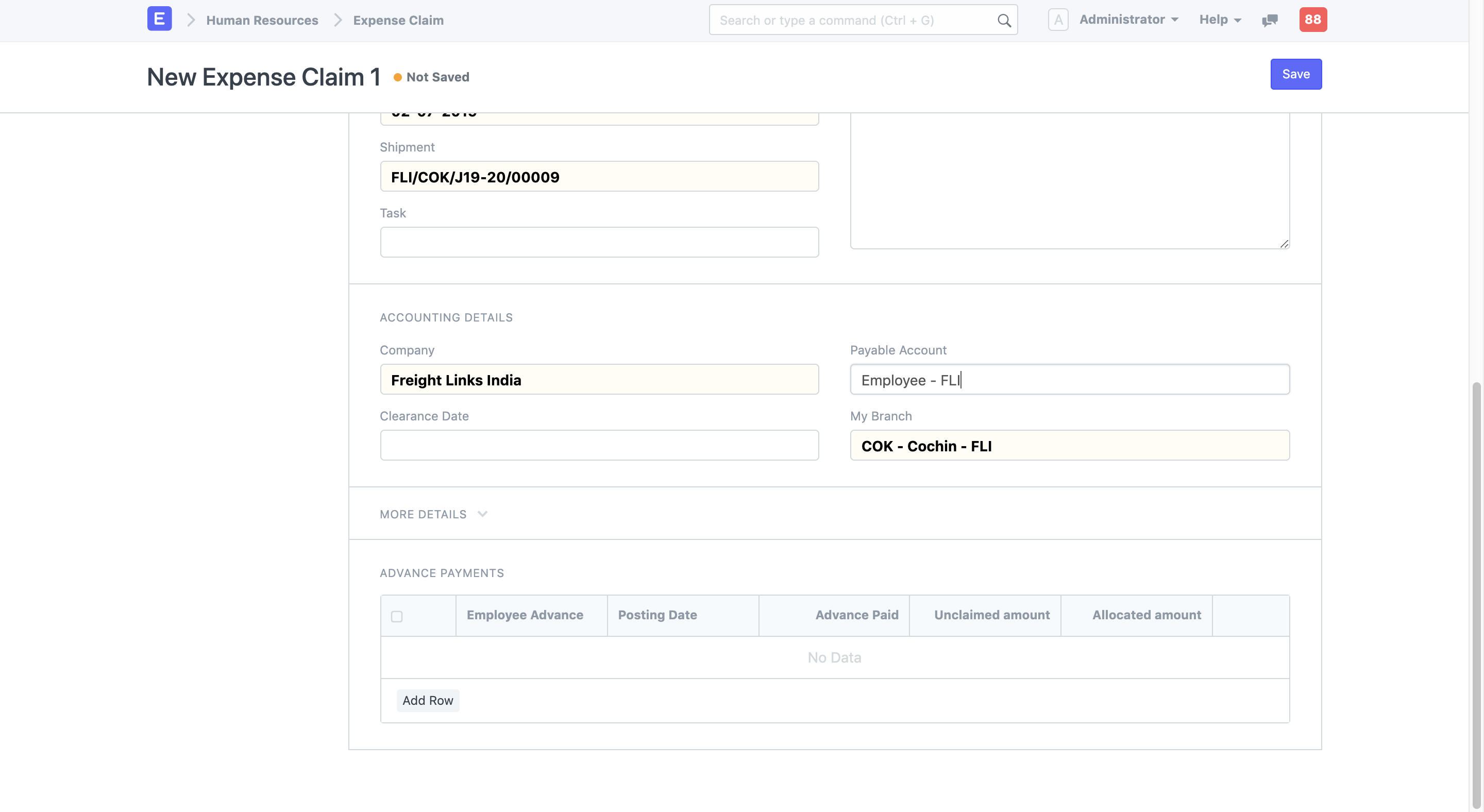

Basis on the branch of the shipment, Employee payable account ledger will automatically be selected, you can change the payable account manually if you want to post this expense claim to any other payable account

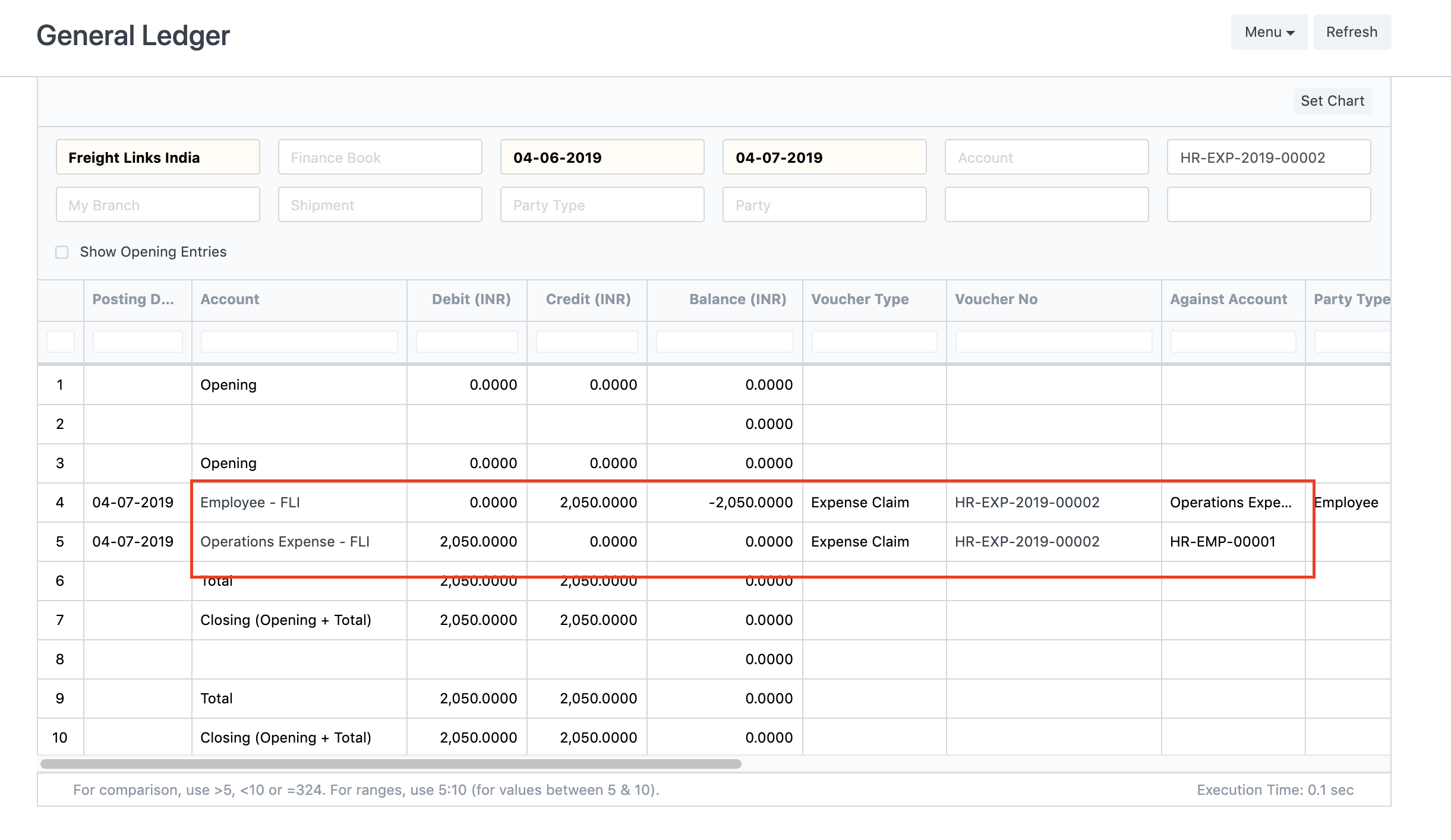

Once you submit an expense claim system books an expense against the expense accounts mapped with the expense claim type and the employee payable account

In articles of payment entries we will see how you can payment entries for the expense claim recorded

Did this answer your question?Related Articles

Creating Expense Claim Type

Creating Expense Claim Type How to create expense claim type for shipment and other cash expenses Shubham Pachori Expense Claim is made when Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a ...Creating Expense Claim Type

Creating Expense Claim Type How to create expense claim type for shipment and other cash expenses Shubham Pachori Expense Claim is made when Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a ...Creating Expense Claim

Creating Expense Claim How to record cash expense for a shipment Shubham Pachori Whenever Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a service related to a shipment like palletisation, ...Making Payment For a Cash Expense

Making Payment For a Cash Expense How to reimburse your employee for a cash expense Shubham Pachori Case on case basis reimbursement In case where an employee has already paid for expense claim you can may reimburse the employee by making a payment ...Making Payment For a Cash Expense

Making Payment For a Cash Expense How to reimburse your employee for a cash expense Shubham Pachori Case on case basis reimbursement In case where an employee has already paid for expense claim you can may reimburse the employee by making a payment ...