Creating Expense Claim Type

Expense Claim is made when Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a service related to a shipment like palletisation, fumigation, packaging etc, while getting the shipment. Or they paid for for medical supplies, for office travel expense.

To ensure that such expenses are recorded under standardised categories so that an invoice can be raised to a customer if the expense has been approved by customer and proper analytics can be run for to see pattern of cash expenses done over a shipment.

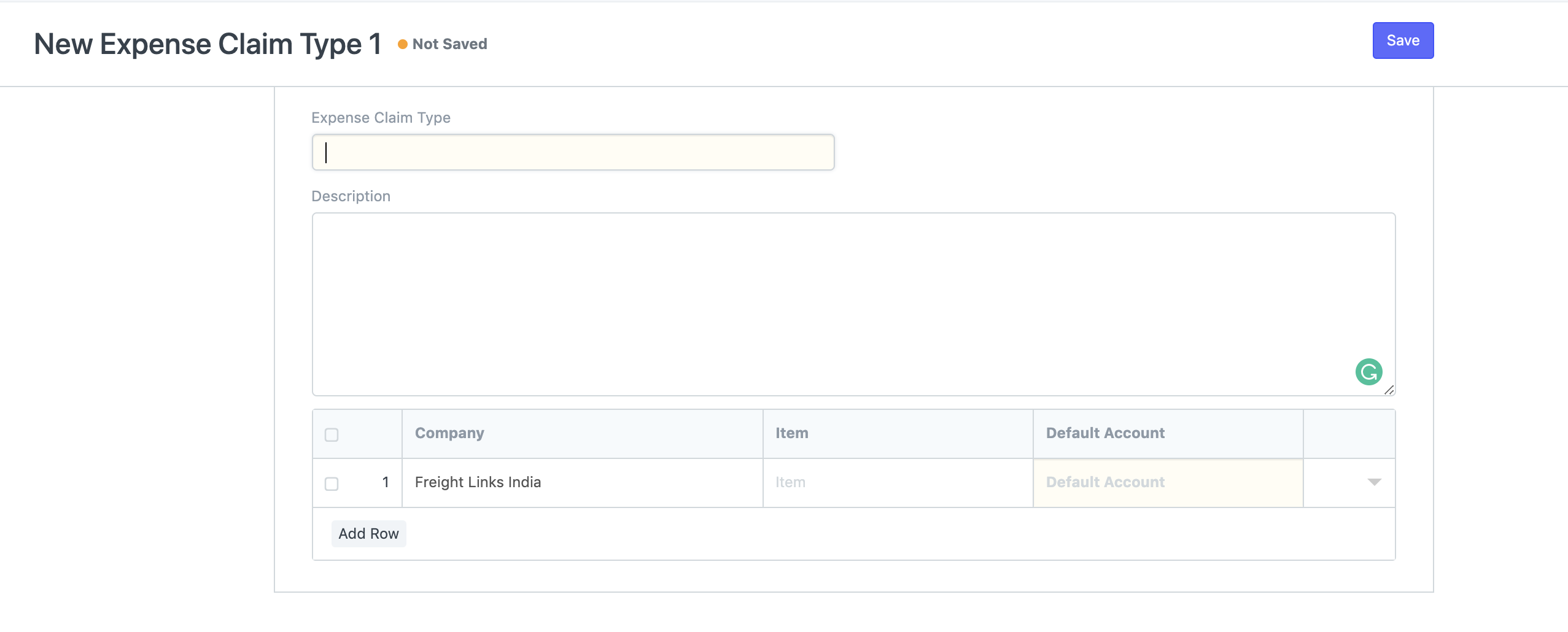

Let's try to create expense claim type which will be used for reporting cash expense incurred for palletising cargo of a shipment

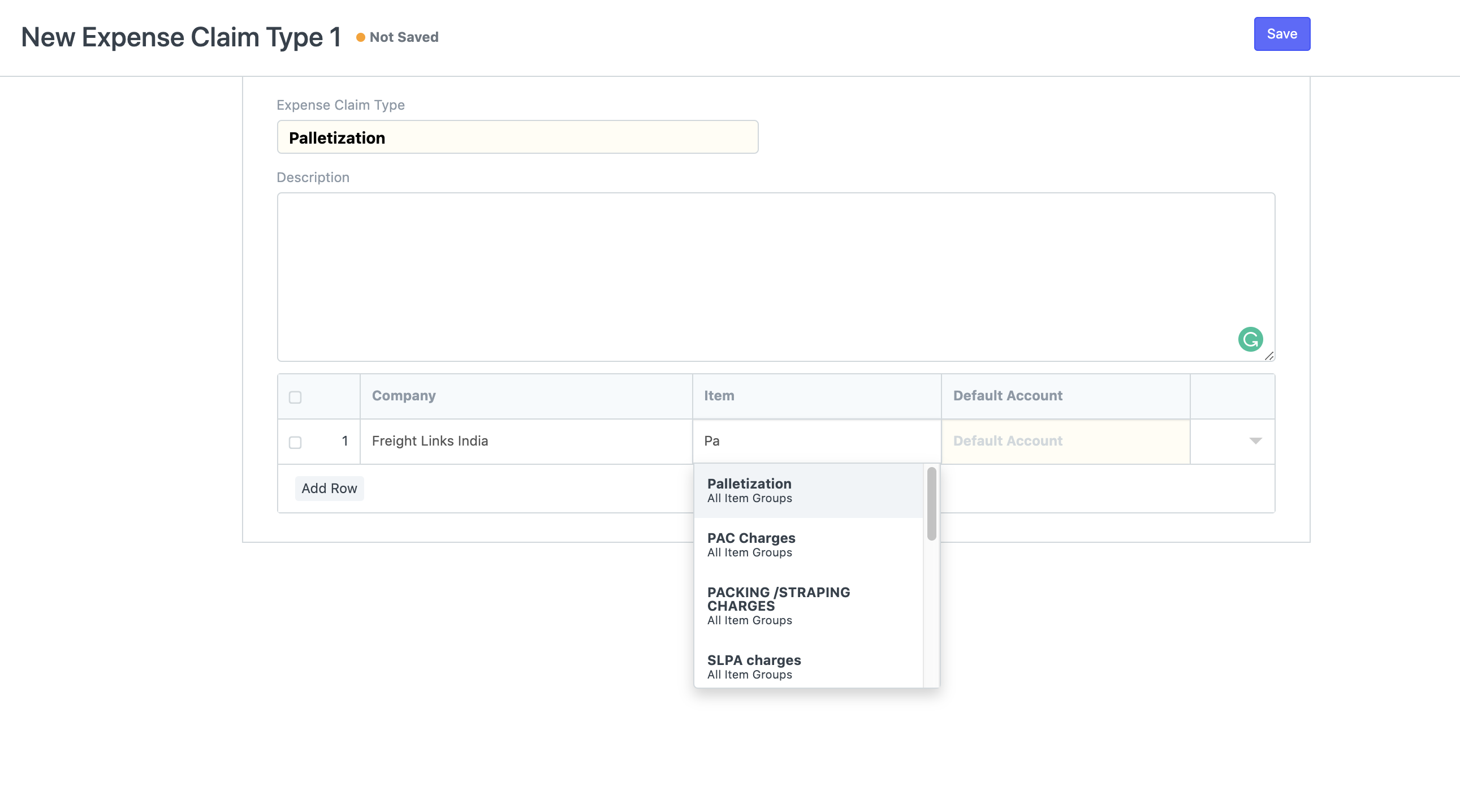

- In Expense Claim Type enter the name of activity for which cash expense will be done. In this case we will fill palletisation.

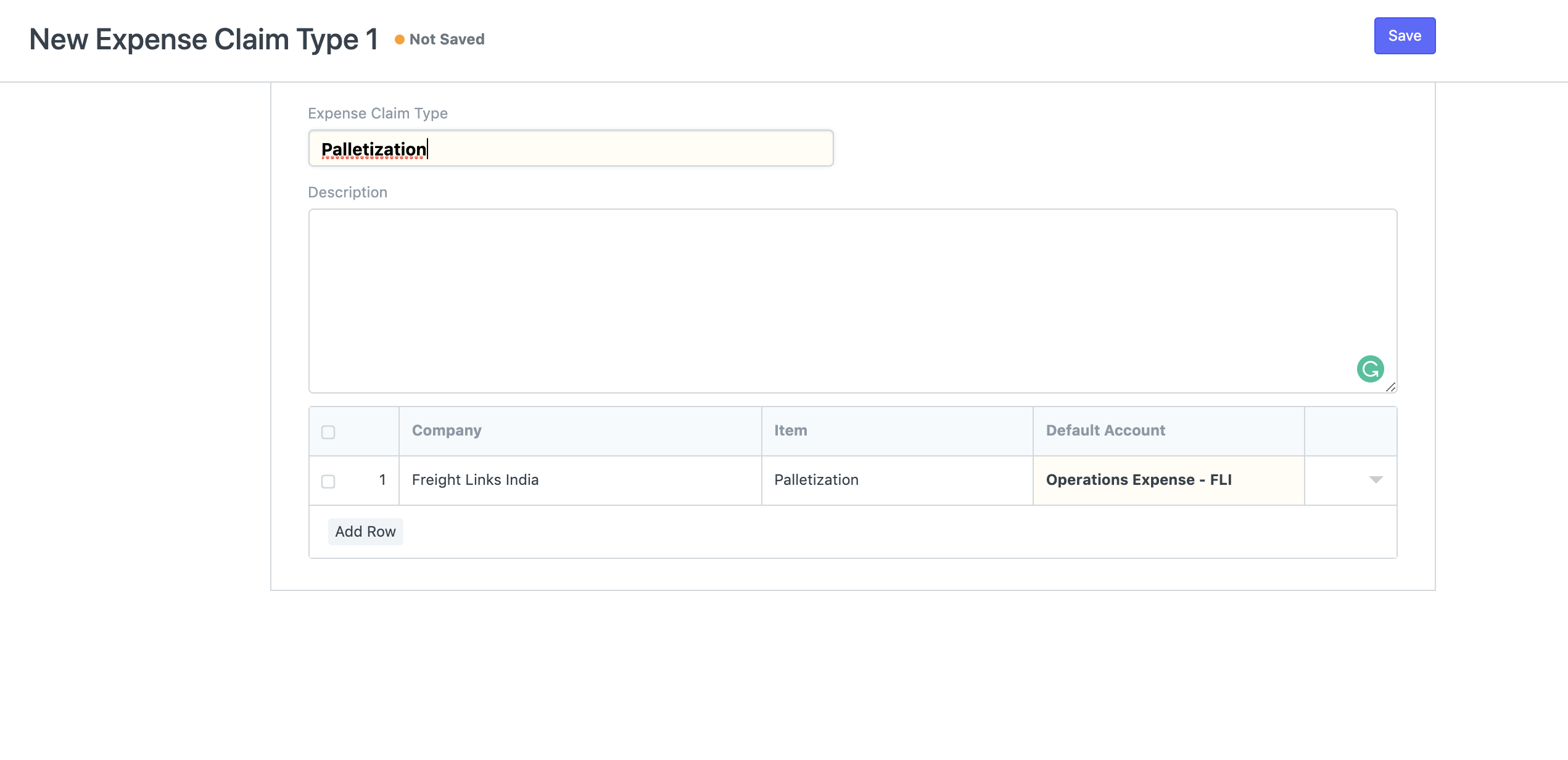

2. In Item field map your expense claim type to a standard item which you may use for raising invoice to your customers. Once you map it to a standard item, default expense account mapped to that item will be used for posting this cash expense to accounts.

Let's try to create an expense claim type which will be used for reporting cash expense incurred by employees for activities not related to a shipment. For example medical expense, travel expenses etc.

The steps described above remains the same, you just don't need to map expense claim type to a standard item. Just map a default account from Indirect Expenses group

Related Articles

Creating Expense Claim Type

Creating Expense Claim Type How to create expense claim type for shipment and other cash expenses Shubham Pachori Expense Claim is made when Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a ...Creating Expense Claim

Creating Expense Claim How to record cash expense for a shipment Shubham Pachori Whenever Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a service related to a shipment like palletisation, ...Creating Expense Claim

Creating Expense Claim How to record cash expense for a shipment Shubham Pachori Whenever Employee’s make expenses out of their pocket on behalf of the company. For example, if they paid for a service related to a shipment like palletisation, ...Making Payment For a Cash Expense

Making Payment For a Cash Expense How to reimburse your employee for a cash expense Shubham Pachori Case on case basis reimbursement In case where an employee has already paid for expense claim you can may reimburse the employee by making a payment ...Making Payment For a Cash Expense

Making Payment For a Cash Expense How to reimburse your employee for a cash expense Shubham Pachori Case on case basis reimbursement In case where an employee has already paid for expense claim you can may reimburse the employee by making a payment ...