GST Itemised Report

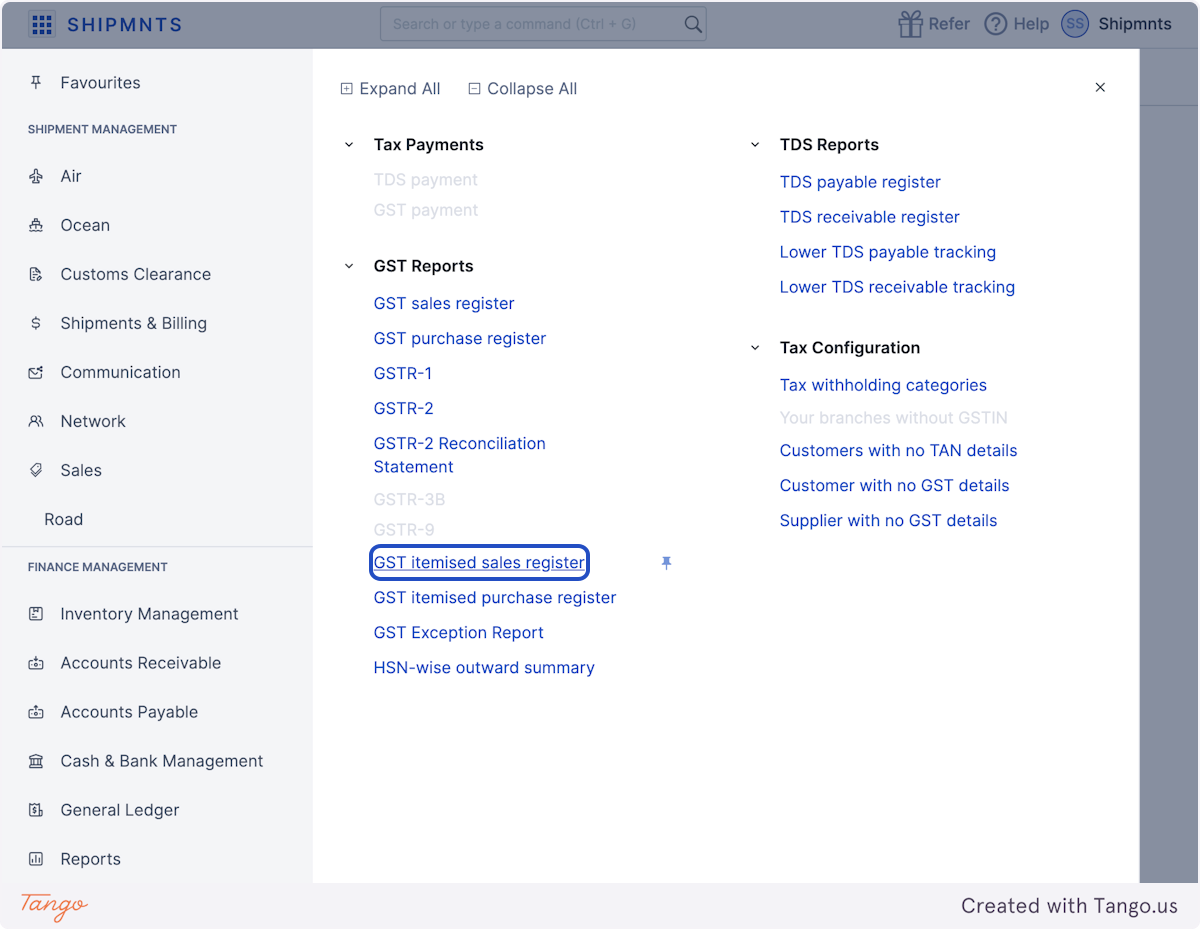

2. Click on GST itemised sales register

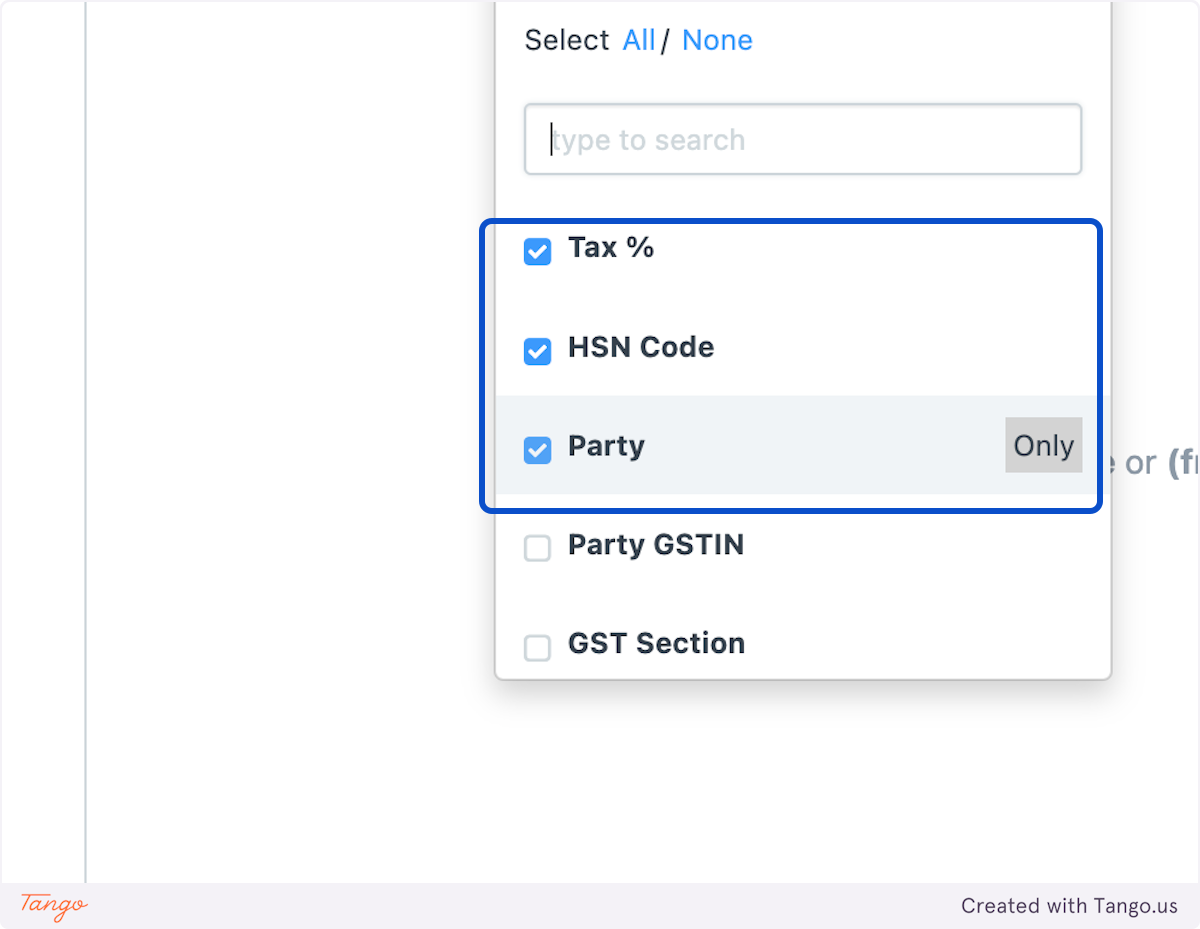

3. For maximum impact we recommend using Group By option

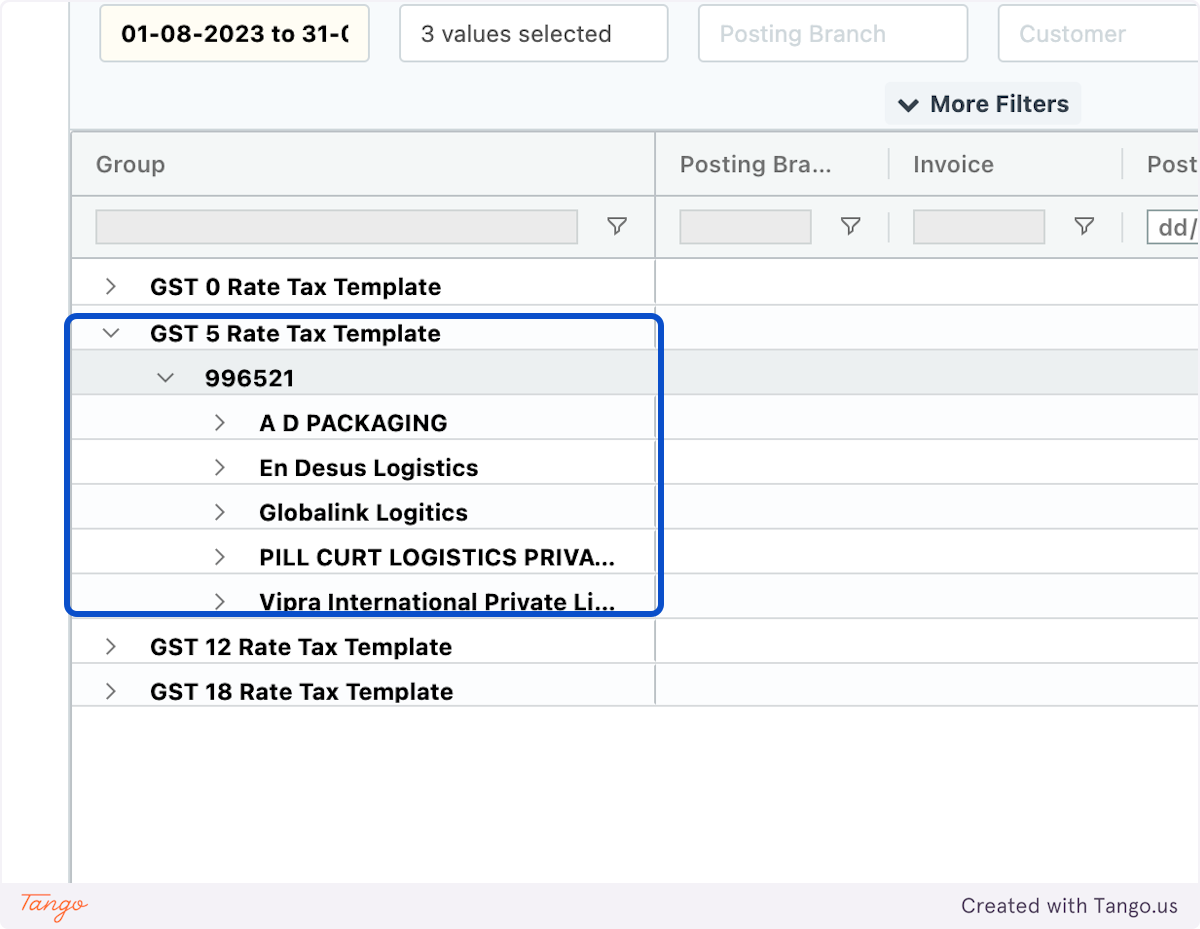

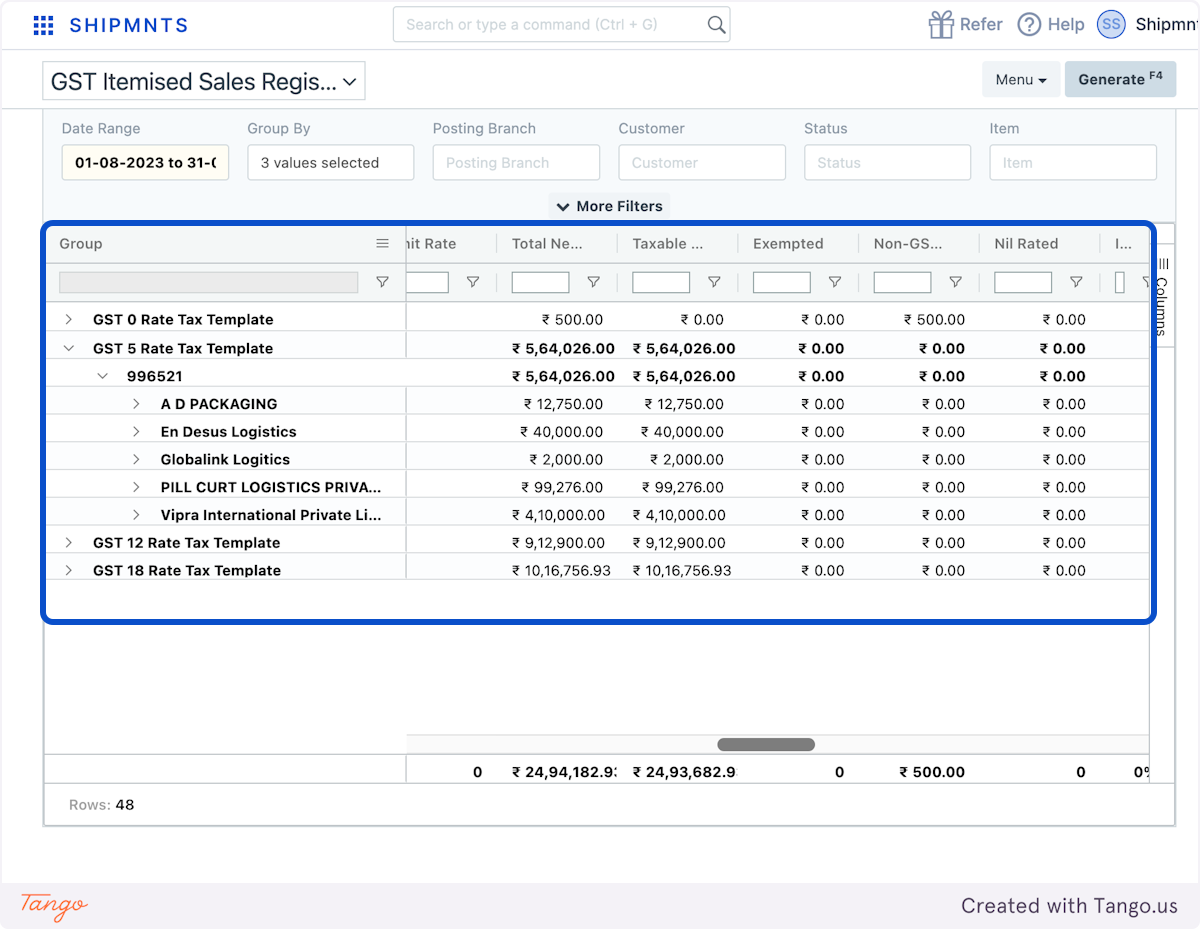

4. In our example we are grouping by Tax%, HSN code and Party

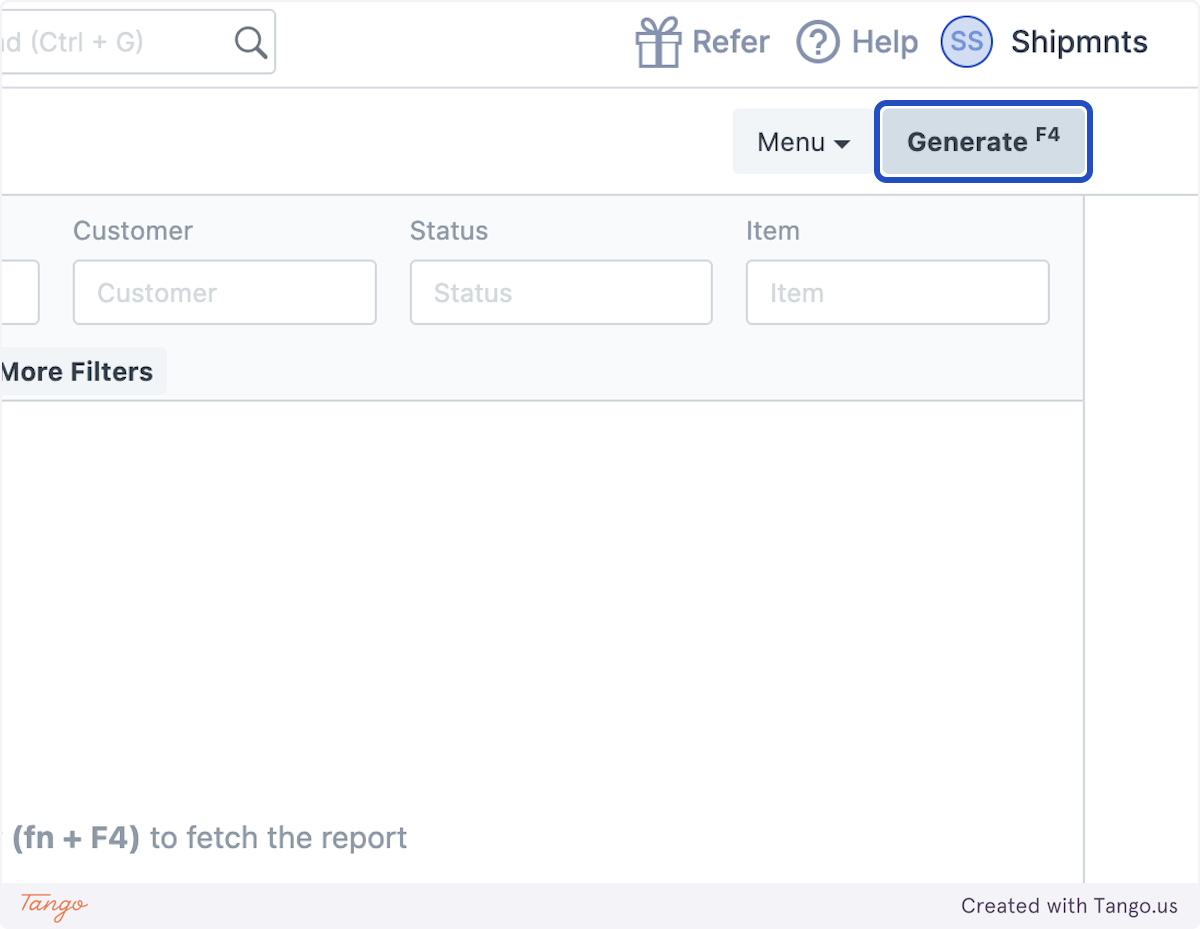

5. Click on Generate or F4

6. Expand the grouping to see more details.

7. You can add more filters/ specifications as needed further.

Created with Tango.us

Related Articles

GST Itemised Report

Shipmnts Pulse - 28/04

Enhancement: Group By Tax Slab or Tax Rate in Itemised GST Sales and Purchase Register is possible now. Option to not reset TDS allocation on revision in collection entry will now be available. Container tab will now allow bulk update actions. ...How to run Sales Register detailed and summary report

How to run Sales Register detailed and summary report Helps you find list of sales invoices raised in both detailed and summarised format Alok Patel It is a statement which lets you find out the list of sales invoices raised for your customers along ...How to run Sales Register detailed and summary report

How to run Sales Register detailed and summary report Helps you find list of sales invoices raised in both detailed and summarised format Alok Patel It is a statement which lets you find out the list of sales invoices raised for your customers along ...Ledger Report

A ledger is a book or digital record containing bookkeeping entries. Ledger Report contains detailed transaction information for one account and type of transactions. Ledger Report Can be Generated in different formats - Compact, Vertical Horizontal. ...