How to book bulk purchase Invoice (PD)

Once you have configured your upload format, you can book the purchase invoice for the same.

To make purchase invoices you need to follow a two-step procedure for the same

- Upload the Excel and verify the transaction entries

- Book purchase invoice

How to upload excel sheet for PD

To upload the excel sheet that you have prepared (as per configuration) you have to follow the given procedure

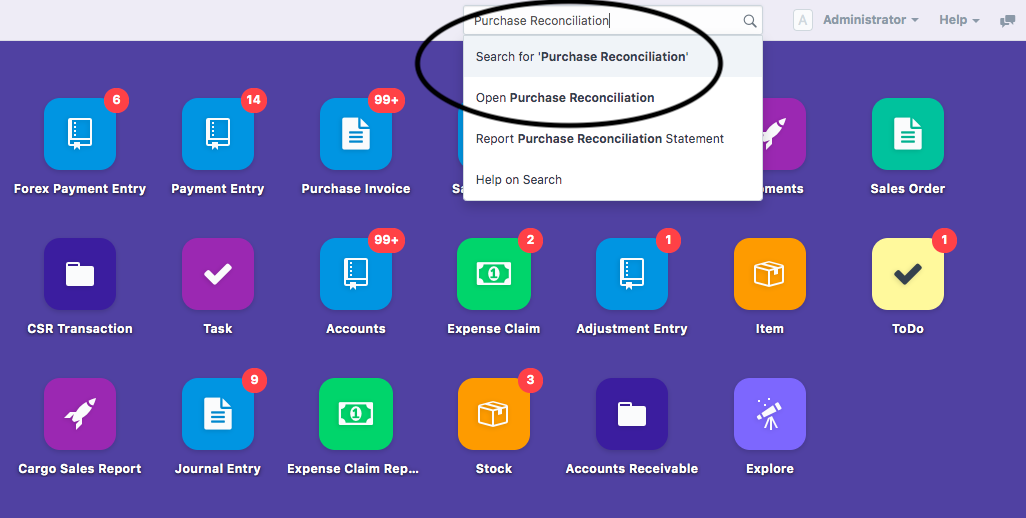

- On the dashboard of finance module search for "Purchase Reconciliation" and select "Open purchase reconciliation" (as shown in figure)

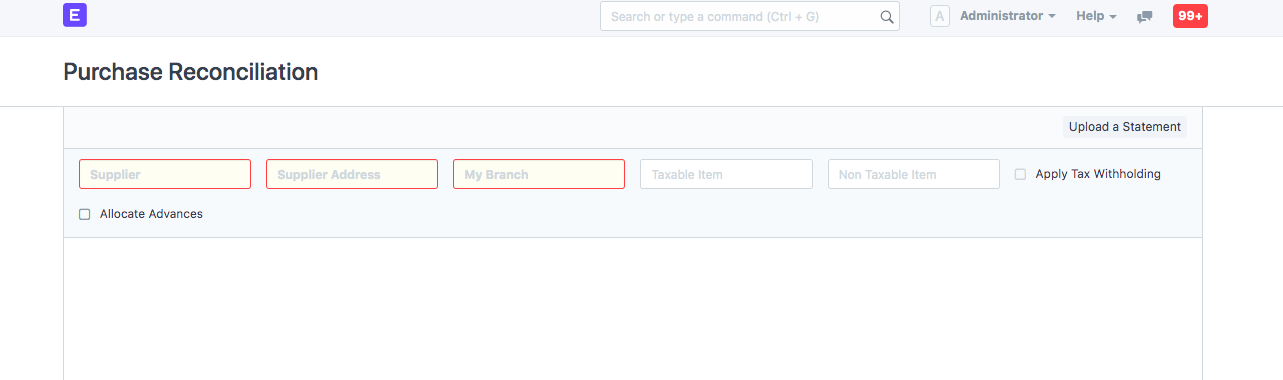

Following page will open up (as shown in figure)

You need to select the following details to start making the purchase invoice

- Supplier: Supplier for whom the purchase invoice is being made

- Supplier Address: Address of the supplier for which the invoice is raised

- My Branch: Your branch from where this purchase invoice is supposed to be raised

- Taxable Item-Item/Head/Charge for which the invoice is being raised

- Non-Taxable Item-Item/Head/Charge on which tax is not levied

You can choose either one (Taxable/Non-Taxable) or both depending on your PD sheet

Note: In case if you have both taxable and non-taxable item, you need to use CHA file

You can tick the check-box "Apply Tax With-holding" in case you want to apply TDS category for the same

Remember to tick the box before uploading the statement, else it will not be applied.

Secondly, you can also tick the box, "Allocate advances" to make the adjustment for advances paid for the same

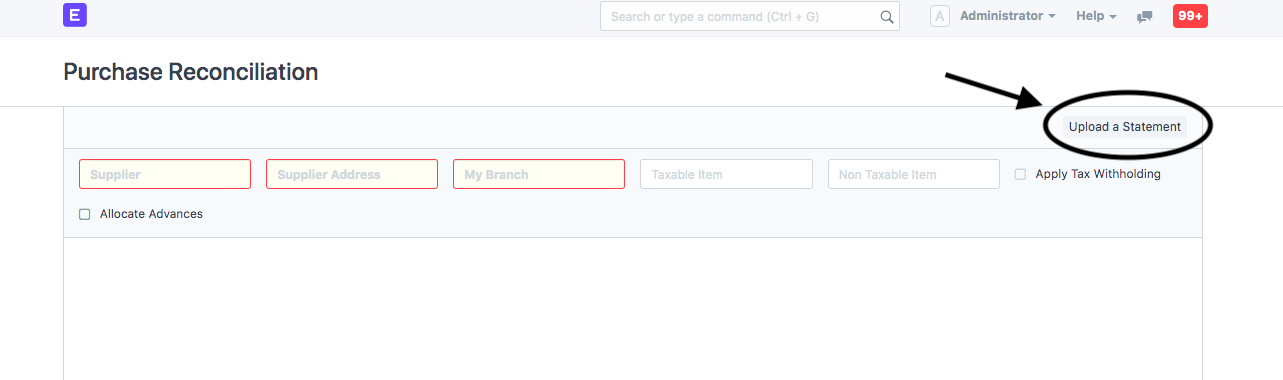

- Click on "Upload a statement" to upload the document (as shown in figure)

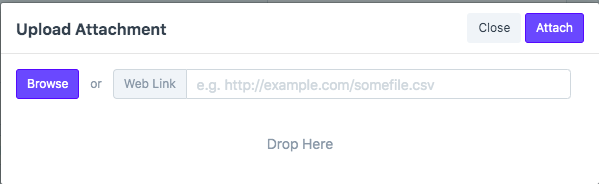

Following pop-up will appear:

- You need to browse the required excel or CSV file to upload and click on Attach (as shown in figure)

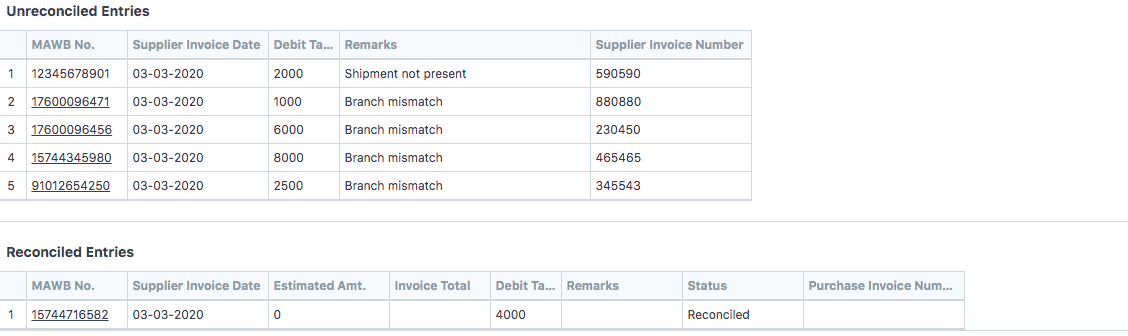

- Once you upload the file, a list of transactions will be shown with both reconcile and unreconciled entries (as shown in figure)

How to make rectification for unreconciled entries

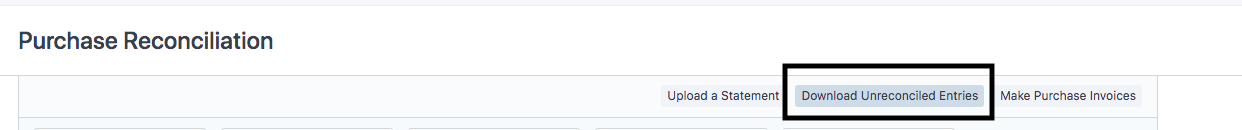

If there are unreconciled entries, you can download them, make necessary changes and upload the sheet back (Refer figure)

How to make Purchase Invoice after upload

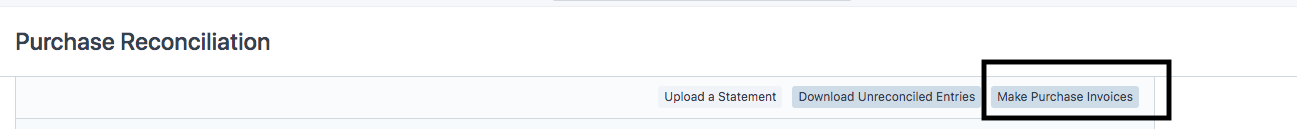

Once you have reconciled and you want to make purchase Invoice, click on "Make Purchase Invoice" (as shown in figure)

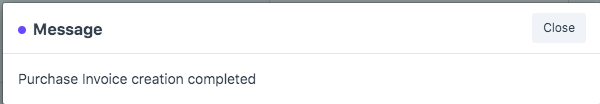

You will see a message pop-up as "Purchase Invoice Creation Completed" (as shown in figure)

Did this answer your question?

Did this answer your question?Related Articles

How to book bulk purchase Invoice (PD)

How to book bulk purchase Invoice (PD) Helps you upload the purchase transactions in bulk, verify the unreconciled entries and make purchase invoices Alok Patel Once you have configured your upload format, you can book the purchase invoice for the ...Purchase Invoice Training

Learn with us How to Book Purchase Invoice in SHIPMNTS Video with Timestamp 0:00 Intro 0:01 Navigation Purchase Invoice Pending Report 0:17 Purchase Invoice Pending Report Mechanism 3:07 Estimate for the Purchase (Buy Rate) 3:31 Add Supplier against ...Purchase Invoice Training

Learn with us How to Book Purchase Invoice in SHIPMNTS Video with Timestamp 0:00 Intro 0:01 Navigation Purchase Invoice Pending Report 0:17 Purchase Invoice Pending Report Mechanism 3:07 Estimate for the Purchase (Buy Rate) 3:31 Add Supplier against ...How to prepare a configuration for Uploading Bulk Purchase Reconciliation Format

How to prepare a configuration for Uploading Bulk Purchase Reconciliation Format Helps you configure an upload format for PD and link it to a particular supplier Alok Patel Pre-deposit Amount or PD is a statement that helps you make purchase invoices ...How to prepare a configuration for Uploading Bulk Purchase Reconciliation Format

How to prepare a configuration for Uploading Bulk Purchase Reconciliation Format Helps you configure an upload format for PD and link it to a particular supplier Alok Patel Pre-deposit Amount or PD is a statement that helps you make purchase invoices ...