How to configure Lower TDS Exemption received from a supplier ?

How to configure Lower TDS Exemption received from a supplier ?

Helps you in configuring Lower TDS Exemption certificate along with rates and validity for a supplier Shubham Pachori

Did this answer your question?

Did this answer your question?

In cases of where you have high volume and value transactions happening with a supplier (vendor), that supplier may file for a lower TDS deduction certificate with the income tax department. Once the certificate by the income tax department, he will share the certificate and instruct you to deduct at lower TDS rate as per the certificate instead of the standard deduction rate applicable as per the applicable TDS category section.

You can configure and update Lower TDS deduction details by following below steps

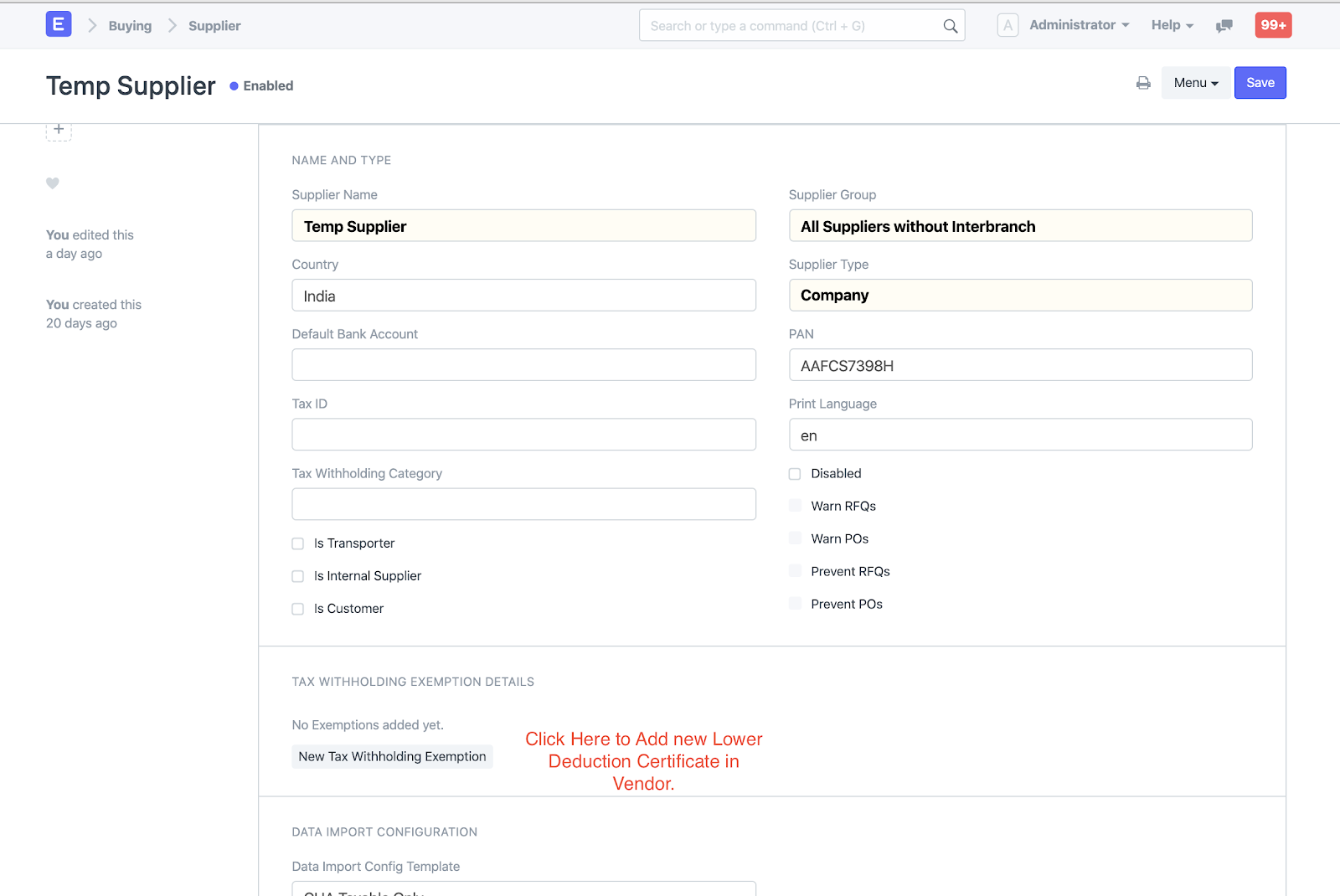

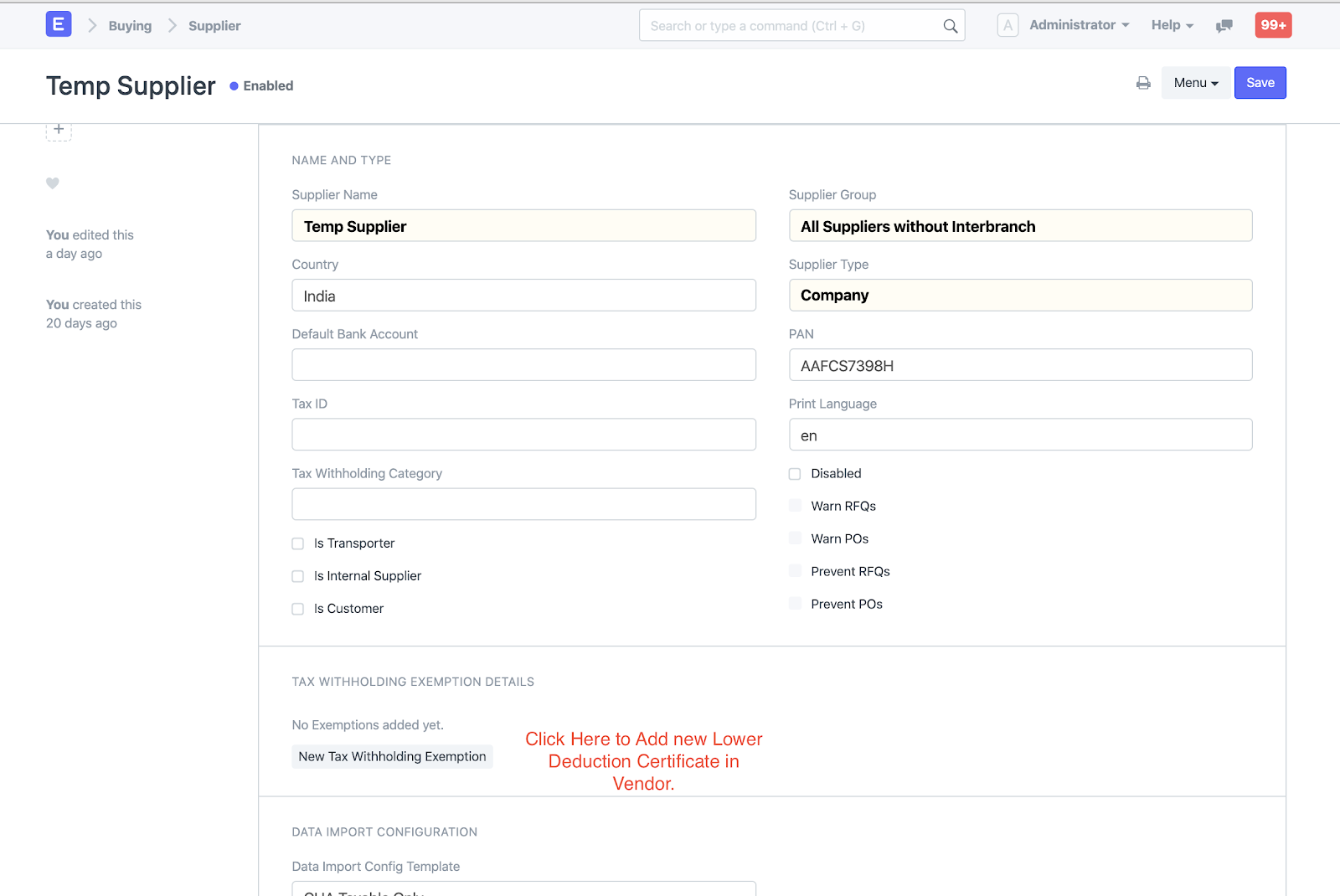

- Go to supplier list view and search for the supplier which has shared the lower TDS deduction certificate

- In the supplier detail screen you will see Tax With Holding Exemption Details section New Tax

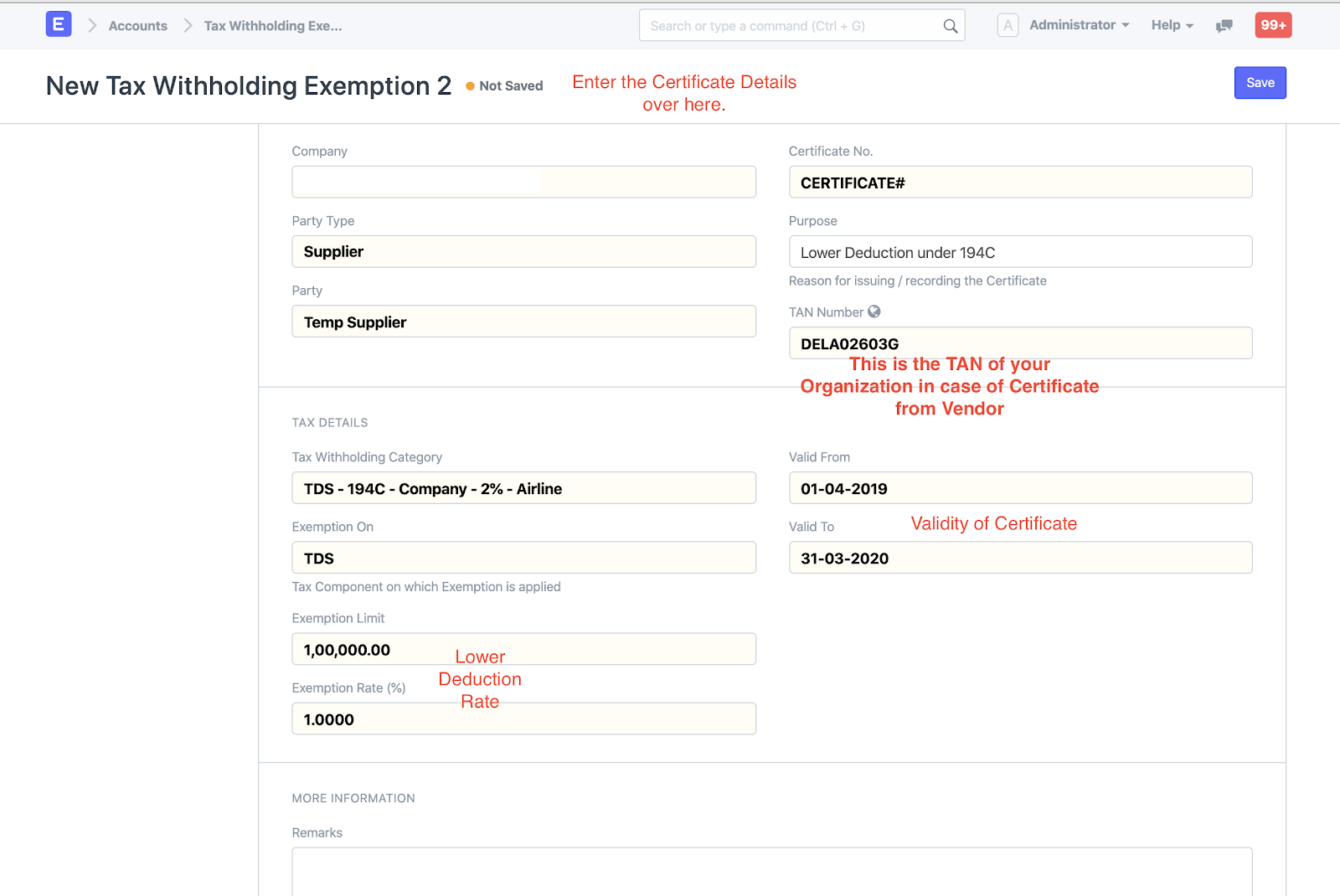

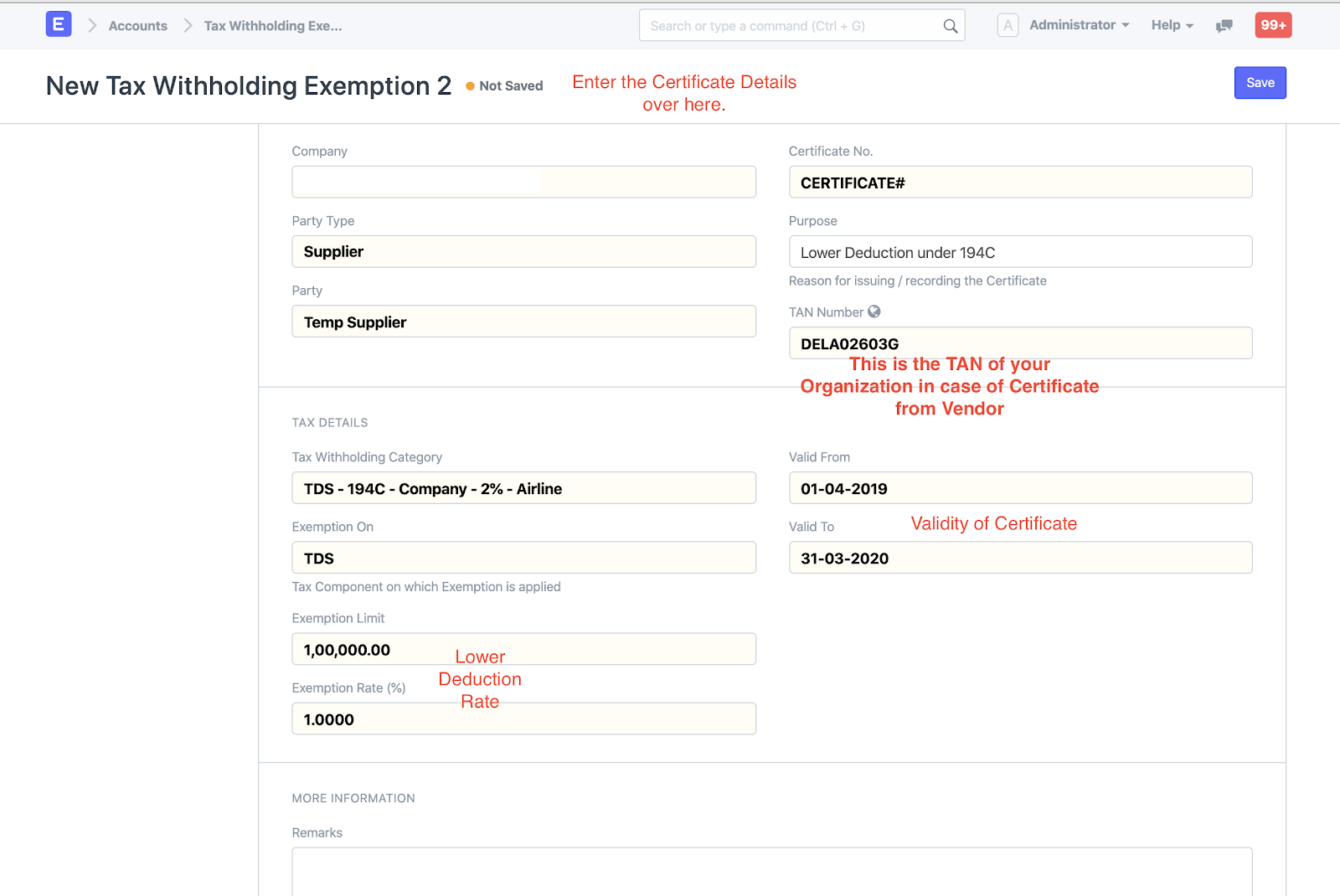

- On Clicking of New Tax With Holding Exemption button, you will be redirected to new screen where you can enter the Certificate given by your vendor

You will have to enter following mandatory details to set it up

- Certificate No - Certificate number as per the certificate provided

- TAN # - TAN number of your organisation

- Tax With holding category -

- Valid From - Valid To - validity / period for which this certificate will be applicable on the purchase transactions being done

- Exemption Limit - Total amount of transactions till which this lower exemption rate will be applicable. Once this limit is crossed normal rate will be applicable as per the standard TDS category

- Exemption Rate (%) - Lower rate at which TDS will be deducted for the purchase transactions

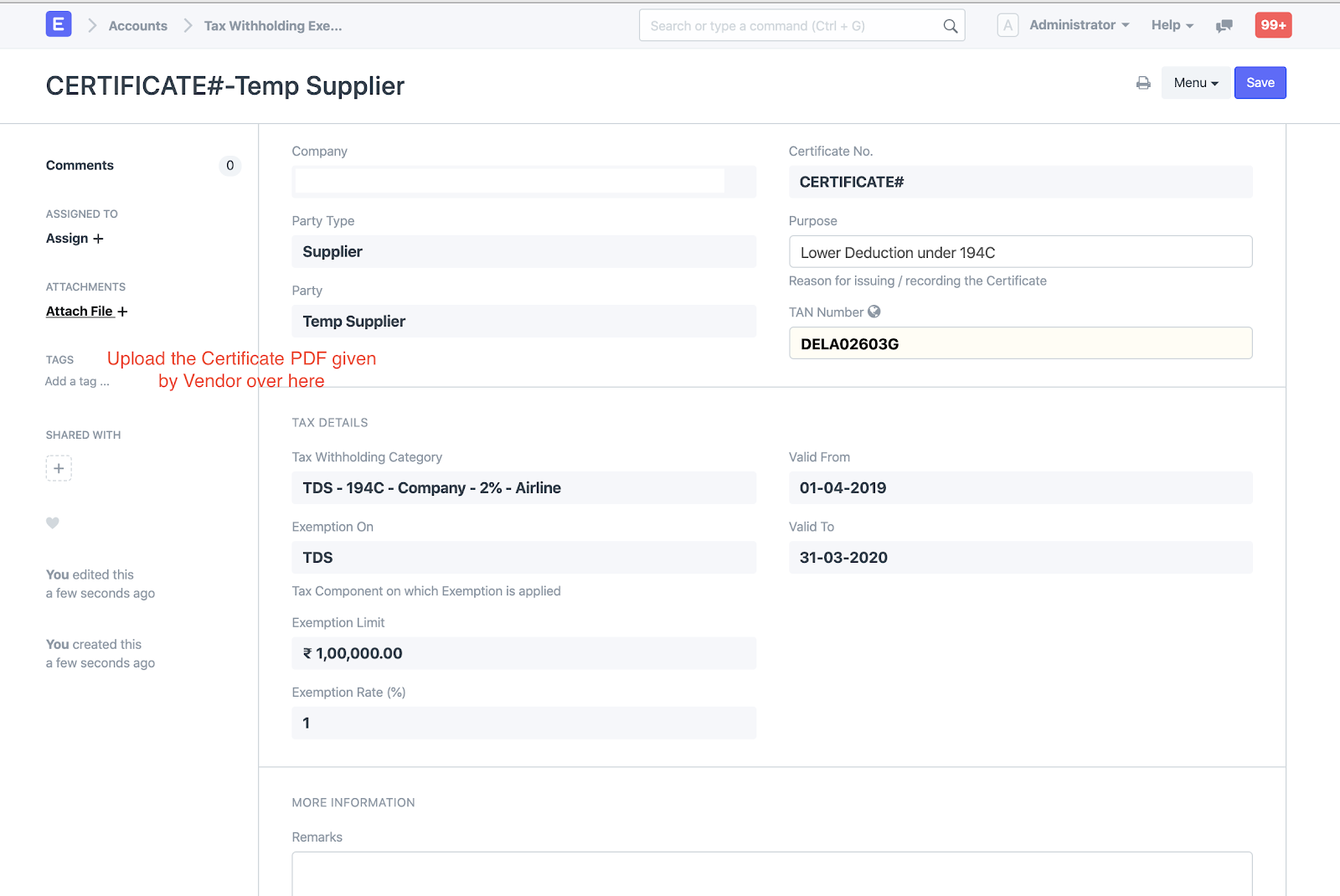

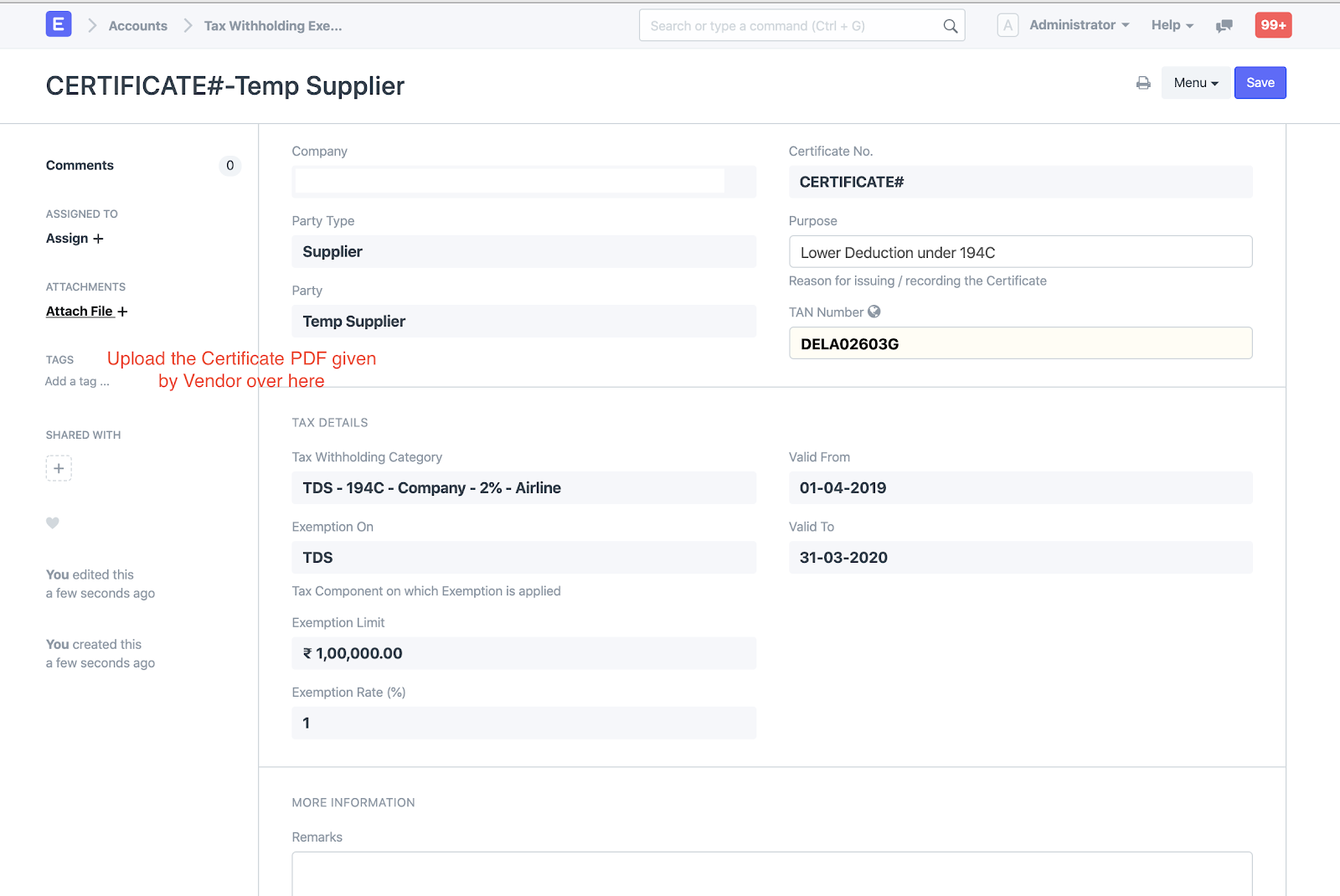

- Once you have saved the details of Lower TDS exemption certificate, you can also upload the digital/scanned copy of the certificate

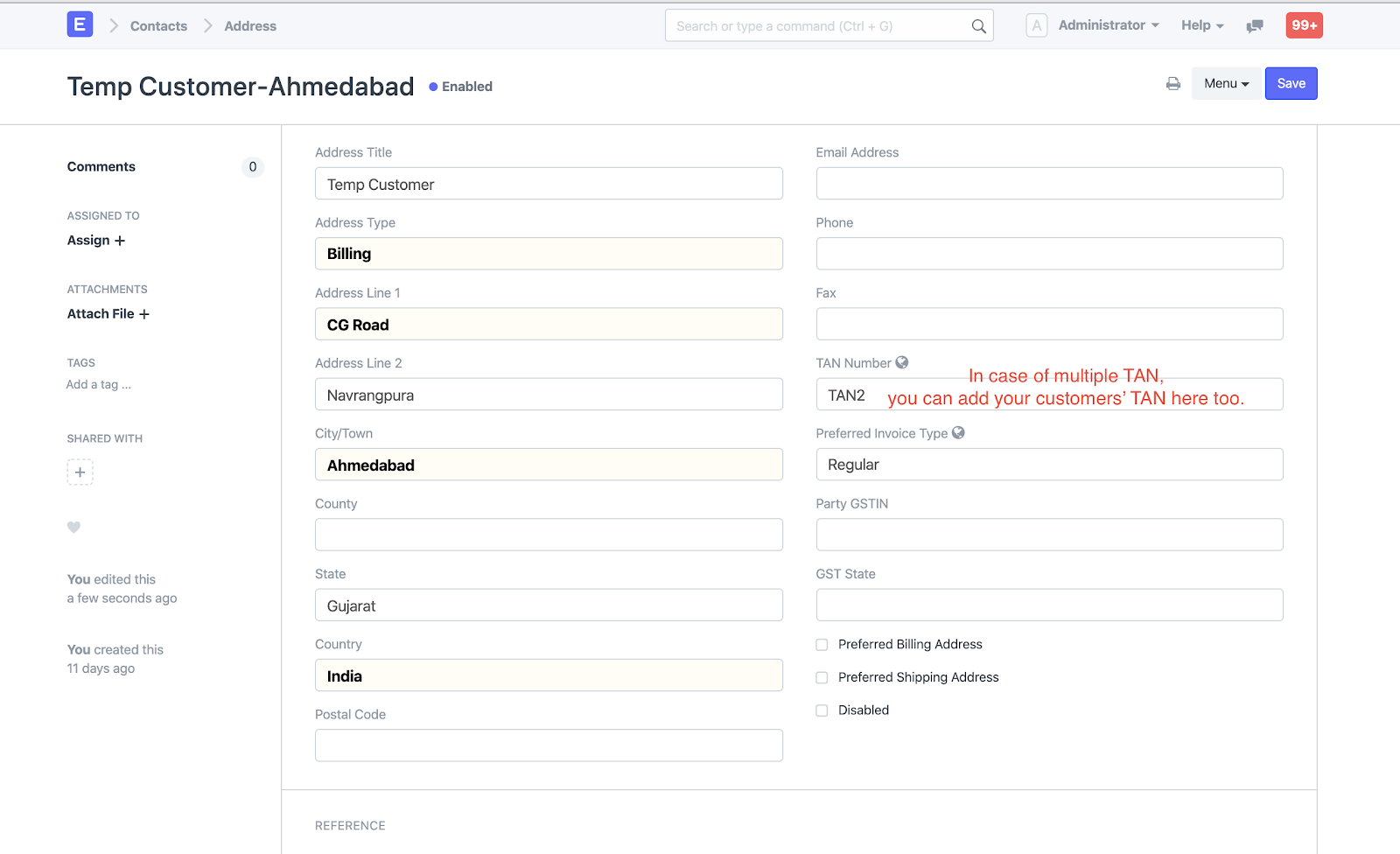

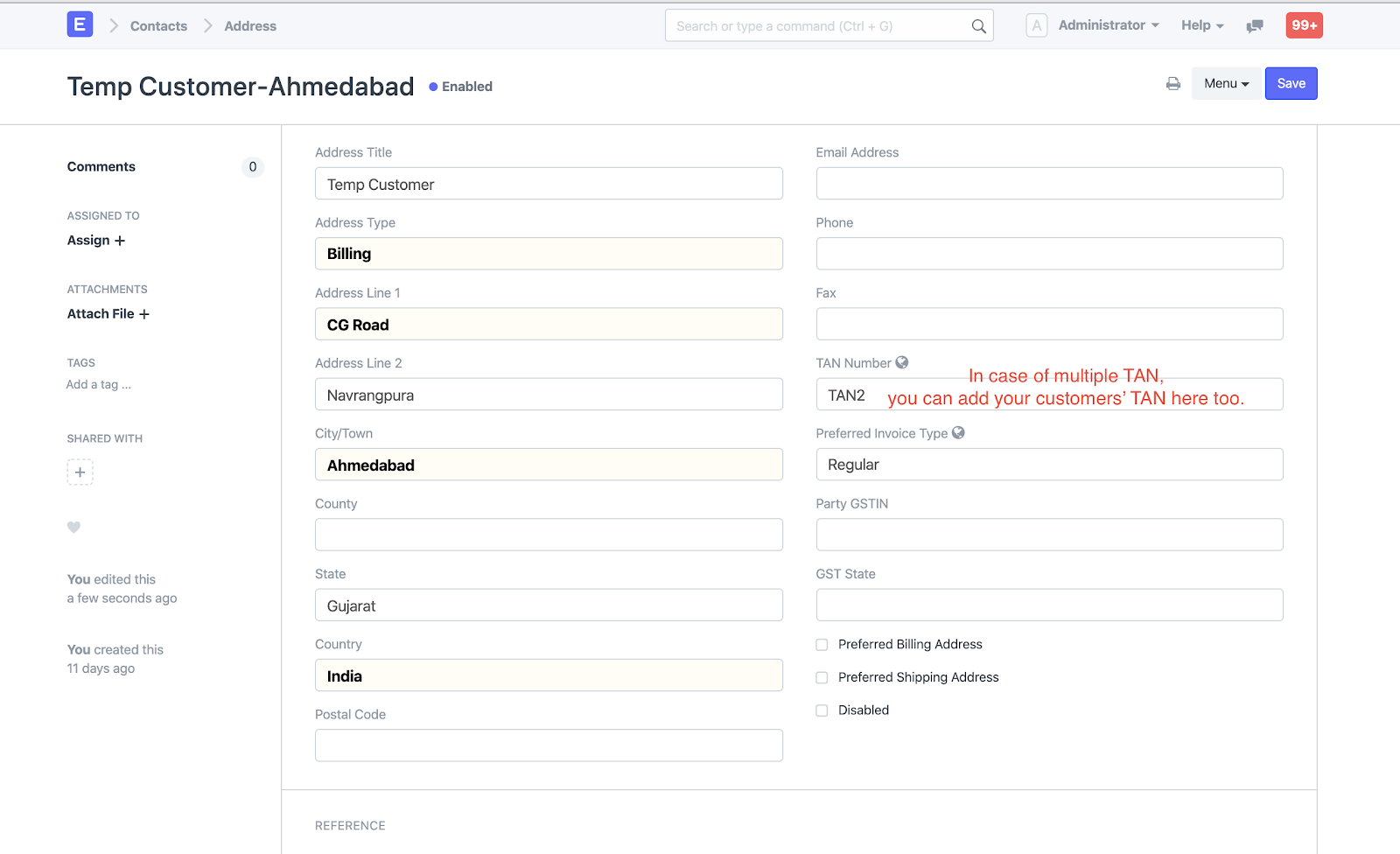

- In some cases, your customer has multiple TANs for each of their Branches

- In that case you can set-up TAN on Address of a customer too as shown in the screenshot below.

Did this answer your question?

Did this answer your question?Related Articles

How to configure Lower TDS Deduction Certificate received from a supplier ?

Suppose Your vendor name is: SQQ INTERNATIONAL LOGISTICS PVT LTD has issued Tax withholding exemption certificate of limit 50,000 , TDS section 194C, Exemption rate : 0.01% , Period : 1Sep 2022 to 28-Feb-2023: How you can add the certificate in ...How to track utilisation of Lower TDS Deduction certificate of a supplier ?

How to track utilisation of Lower TDS Deduction certificate of a supplier ? Helps you in running TDS lower deduction utilisation tracking report Shubham Pachori If one (or few) of your supplier have provided you with Lower TDS deduction certificate ...How to track utilisation of Lower TDS Deduction certificate of a supplier ?

How to track utilisation of Lower TDS Deduction certificate of a supplier ? Helps you in running TDS lower deduction utilisation tracking report Shubham Pachori If one (or few) of your supplier have provided you with Lower TDS deduction certificate ...How to Add TDS for previous fiscal year invoice?

In most of case it's possible that sales invoices are made in 31 March or before that and customer has made payment in month of April or letter. In such cases, to show TDS impact in last year for last fiscal year invoices, there is a simple step ...How To Add Tax Withholding Exemption Certificate

Let Us Understand this by taking the example: Suppose Your vendor name is: SQQ INTERNATIONAL LOGISTICS PVT LTD has issued a Tax withholding exemption certificate of limit 50,000, TDS section 194C, Exemption rate: 0.01%, Period : 1Sep 2022 to ...