How to create a new Item/Head/Charge

In order to create a new Item/Head/Charge we have to create respective ledgers for the same

You have to follow a two-step process in order to create an "Item"

How to create a ledger for the "Item"

In order to create a ledger, you need to follow the given procedure

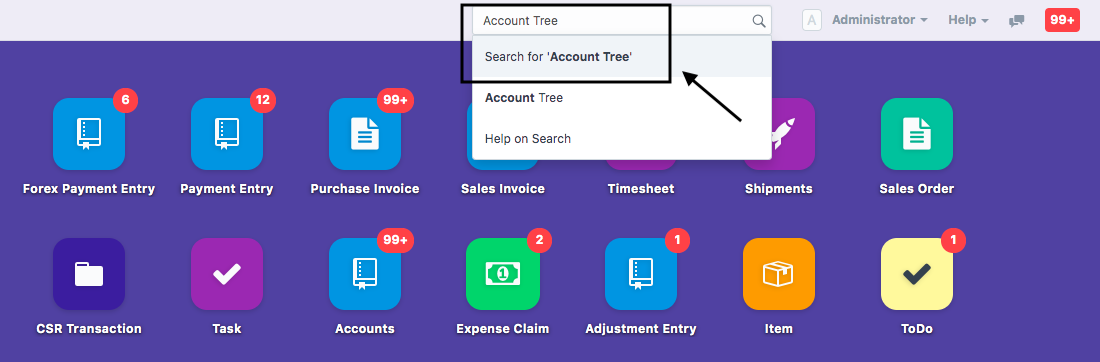

- On the dashboard, search for "Account Tree" in the universal bar (as shown in figure)

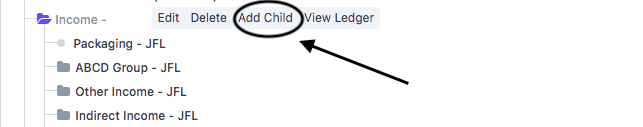

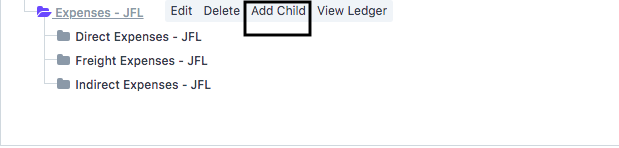

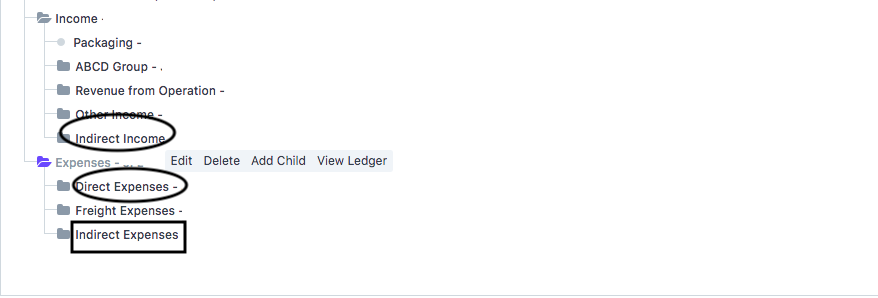

- Select the Ledger under which you want to create the item.

Note:We recommend creating the item under both "Income" as well as "Expense" ledger.

- Click on "Add Child" either under both the Ledgers or within the sub-ledger like Direct Expense,Indirect Expense,Direct Income,Indirect income ( as shown in figure)

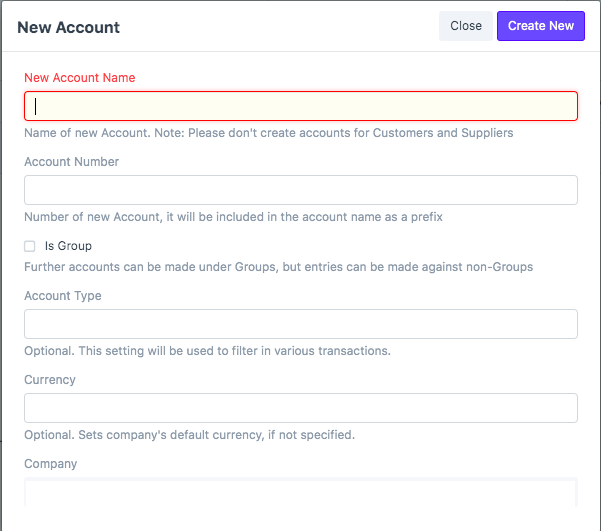

Following modal will open up

- You need to add the name of the Charge/Item in "New Account Name"

Item should be named as "[Name of Item] - Income" and "[Name of Item} - Expense" for bifurcation.

E.g. Ocean Freight Income, Ocean Freight Expense

You also need to enter the Account Type (Income Account/Expense Account) and set the currency as "INR" and click on "Create New".

Your Item Ledger would be created

Note: You need to create ledger for both Income and Expense ledger.

In case you want to create a ledger group, you need to refer article "How to create Ledger Group"

How to create an Item

Once Ledger for the item is created you need to create the respective "Item" for the same

Follow the given procedure to Create a new Item

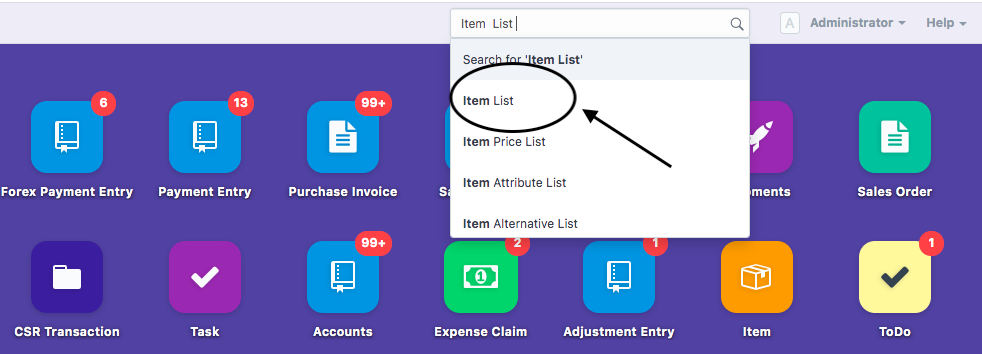

- On the dashboard, Search "Item List" in Global search of your accounting module (as shown in figure)

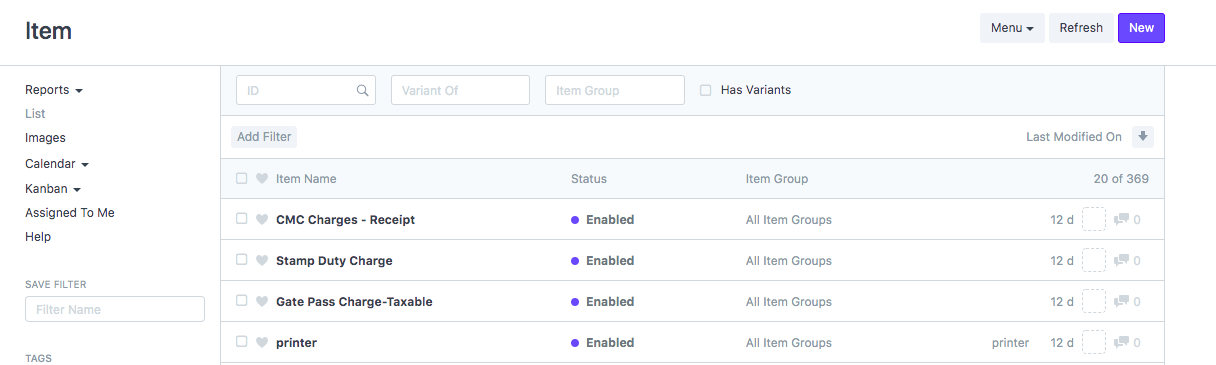

You will see a list of all items created (as shown in figure)

- Click on "New" to create new item

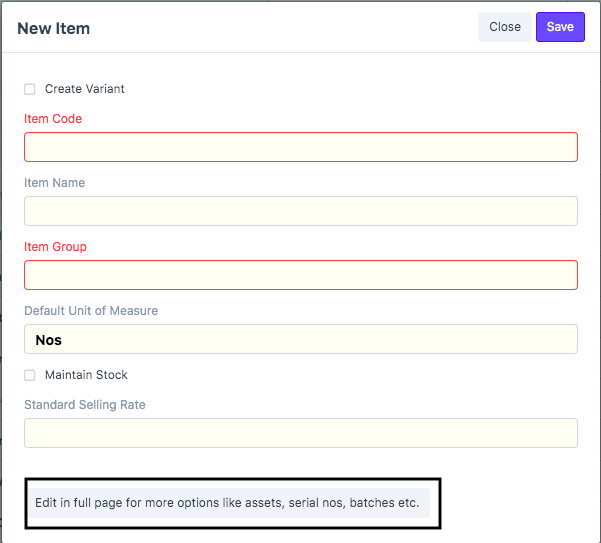

Once you click on "New" you will see the following modal open up

Click on "Edit in full page" (as shown in figure)

You will need to fill up the following details:

- Item Code : You have enter a code for your Item same as your "Item Name" which would show during invoicing purposes

- Item Name: This get auto-filled up on the basis of your "Item Code"

- Item Group: You need to select "All item Groups" in this section

- HSN/SAC: Enter the HSN/SAC Code as per your Item (This is mandatory except Non GST item)

Once you fill up these details you need to link this item to its concerned Ledger also which you have created earlier

You need to add both "Expense" and "Income" ledger against your company which you have created earlier for this item under the section "How to create a ledger for the item"

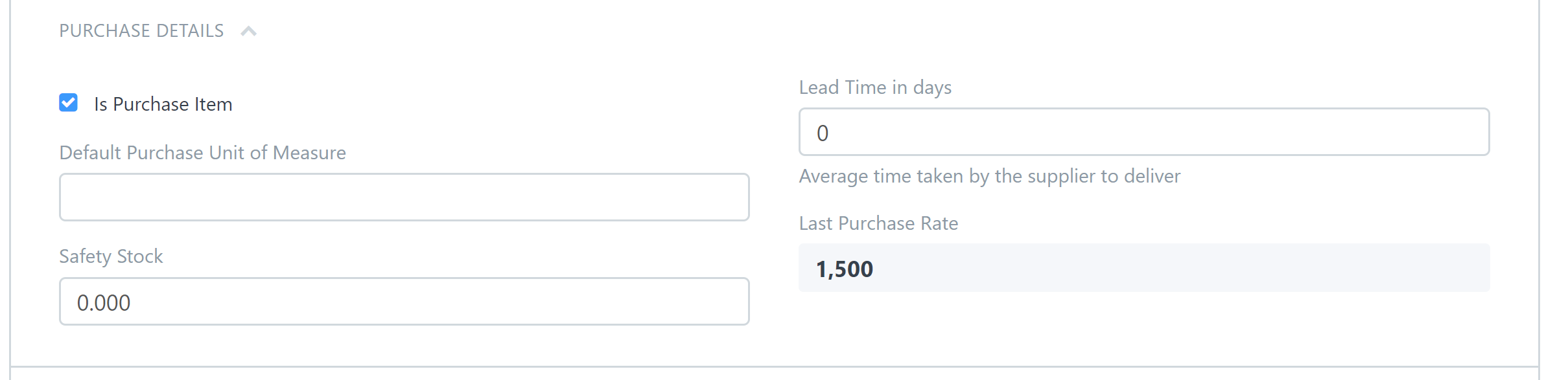

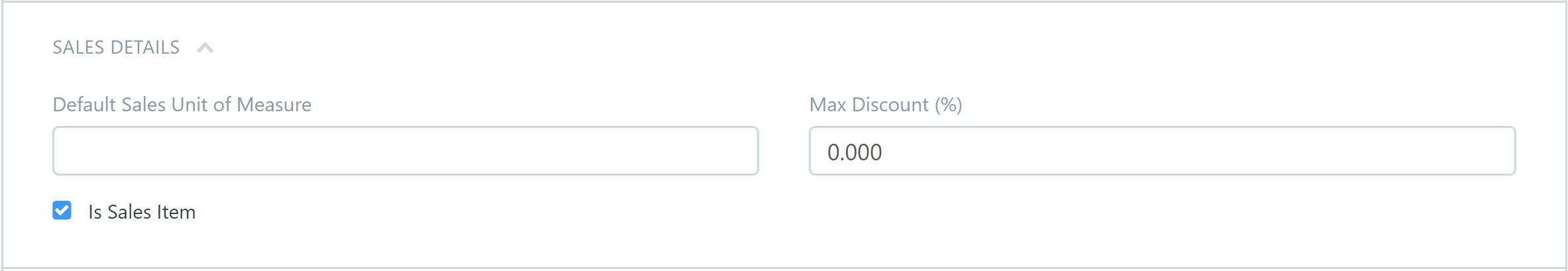

Make Sure to tick the check-box "Is Purchase Item" in Purchase Details section and "Is Sales Item" in Sales Details section.

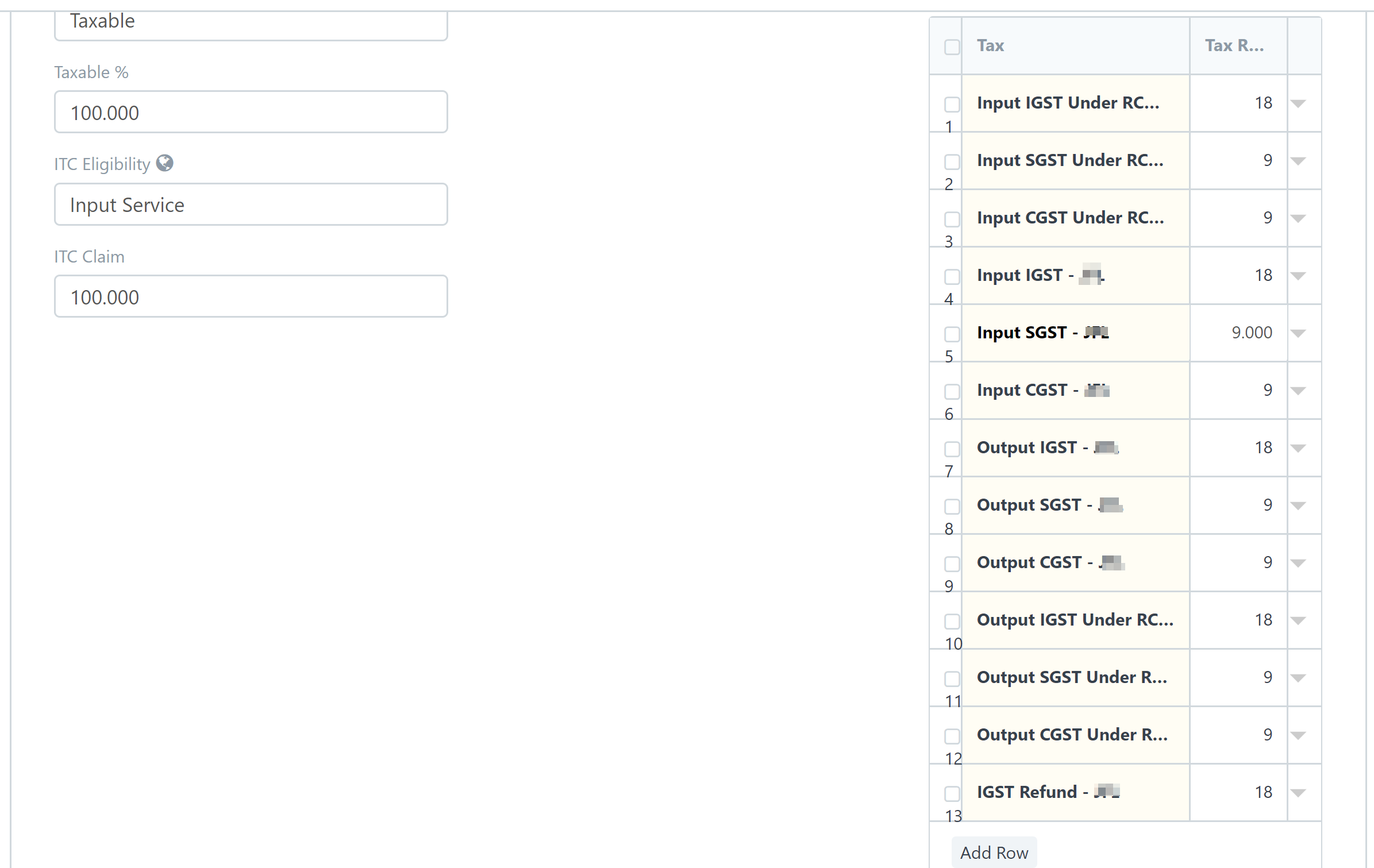

- Add the taxability details of the Item/Charge for automatic calculation in invoicing (as shown in figure)

You need to enter all the tax details as shown in the above figure.

E.g. Tax = Input IGST Under RCM - ABC, Tax Rate = 18 & So on.....

Taxability: You can select your item as taxable,NON-GST, Exempted,Nil-Rated and Pure Agent from the taxability section

ITC Eligibility:You can select your item as Input Service, Ineligible,Capital goods as applicable for your Charge/Item

ITC Claim: You can enter your ITC claim value.

- Click on "Save" (as shown in figure)

Did this answer your question?

Did this answer your question?Related Articles

How to create a new Item/Head/Charge

How to create a new Item/Head/Charge Helps you create a new Item along with its ledger Alok Patel In order to create a new Item/Head/Charge we have to create respective ledgers for the same You have to follow a two-step process in order to create an ...How to create Credit Note against an invoice

How to create Credit Note against an invoice Helps you create a credit note against a particular invoice Alok Patel On Dashboard, search “Sales Invoice List” in the universal Search bar and select it (as shown in figure) Following page will open with ...How to create Credit Note against an invoice

How to create Credit Note against an invoice Helps you create a credit note against a particular invoice Alok Patel On Dashboard, search “Sales Invoice List” in the universal Search bar and select it (as shown in figure) Following page will open with ...How to create a debit note against an invoice

How to create a debit note against an invoice Helps you create a credit note against a particular invoice Alok Patel On the dashboard, search for "Purchase Invoice List" in the universal search bar and select it ( as shown in figure) Following page ...How to create a debit note against an invoice

How to create a debit note against an invoice Helps you create a credit note against a particular invoice Alok Patel On the dashboard, search for "Purchase Invoice List" in the universal search bar and select it ( as shown in figure) Following page ...