HOW TO DO ACTUAL PROVISIONAL ENTRY IN SHIPMNTS?

- Click on Navigation Tab.

- Go to Reports.

- Click on Job profitability charge wise detailed.

Let us understand by taking the example:

For Example Job created in April’2022 but Voucher (Sales & Purchase) Booked after April’2022 or before April’2022.

- Run Job profitability report on Job execution date.

- Select Month > April’2022 > Date Range > 01-04-2022 to 30-04-2022

- Select Shipement Branch (in case of Multiple branches and provisions has to be passed for a particular branch)

- Remove Group By = None

- Apply inline filter on Voucher Date column > apply filter > Greater than 30’April’2022 or less 1’st April’2022

- Apply filter on Income =0

Export the Report in excel to pass provision for expenses.

For passing Provisions for Income apply a filter equal to Expense = 0 and Export the report in excel for passing provisions for income.

Conclusion: In this Report, you will see Jobs that were created in April’2022 and their Income and Expense Vouchers will show those are booked after April.

- You can Export Income and Expense vouchers from this report for creating an Actual Provision JV entry format.

JV Entry For Actual Provisional (Expense Voucher Booked in May but Job in April)

- You need to make Expense Zero in May and book Expenses in April

1 May 2022 By Provisional Expense A/c Dr

To Expense A/c Cr

Second Jv book Expense in Apr’2022.

30 Apr’2022 Expense A/c Dr.

To Provisional Expense A/c Cr.

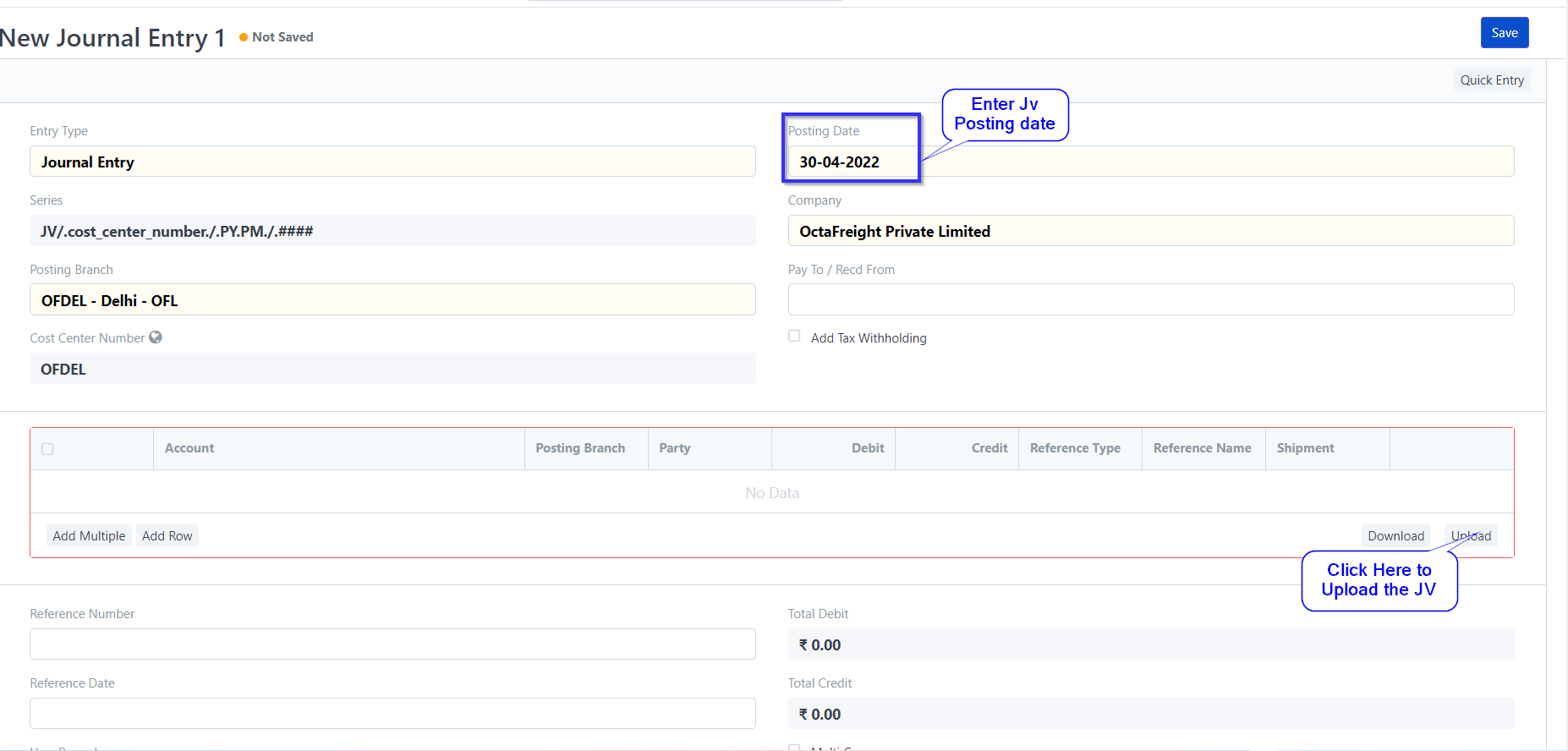

Go to Jv Entry Form enter the date and upload the JV

JV is to be uploaded in the attached format. Provisional Entry JV Format

Related Articles

HOW TO DO ACTUAL PROVISIONAL ENTRY IN SHIPMNTS?

Click on Navigation Tab. Go to Reports. Click on Job profitability charge wise detailed. Let us understand by taking the example: For Example Job created in April’2022 but Voucher (Sales & Purchase) Booked after April’2022 or before April’2022. Run ...HOW TO DO ESTIMATE PROVISIONAL ENTRY IN SHIPMNTS?

Click on Navigation Tab. Go to Reports. Click on Job profitability charge-wise detailed. Let us understand by taking example: For Example : Job created in April’2022 but Voucher (Sales & Purchase) Booked after April’2022. Run Job profitability report ...HOW TO DO ESTIMATE PROVISIONAL ENTRY IN SHIPMNTS?

Click on Navigation Tab. Go to Reports. Click on Job profitability charge-wise detailed. Let us understand by taking example: For Example : Job created in April’2022 but Voucher (Sales & Purchase) Booked after April’2022. Run Job profitability report ...How to Pass Salary Entry in Shipmnts?

Let us understand this by taking an example. Salary to be paid to an employee for the month of september. Total Salary - 50,000 TDS - 5000 Net Salary Payable - 45000 Step 1: Book salary payable against the employee on 30th September. Date 30th ...How to make a Reversal/Cheque bounce entry?

Introduction: “Payment reversal” is a blanket term for any situation in which transaction funds are returned to the party’s bank account. Payment reversals are also known as “credit reversals” or a “reversal payments.” Points should be taken care of: ...