How to Pass GST Challan Payment Entry in Shipmnts?

| Output | ||||

| IGST | CGST | SGST | Sum | Total Amount |

| 68,057.25 | 290,338.95 | 290,338.95 | Add (+) | 6,48,735.15 |

| Input | ||||

| 74,459.23 | 74,459.23 | Less (-) | 1,48,918.46 | |

| GST RCM | ||||

| 2,175.63 | 2,175.63 | Add (+) | 4,351.26 | |

| GST Payable | ||||

| 68,057.00 | 218,055.00 | 218,055.00 | Total | 5,04,167 |

| Interest | ||||

| 537.00 | 1,721.00 | 1,721.00 | 3,979 | |

| Total GST Payment |

5,08,146 | |||

Follow the Below steps to pass the entry:

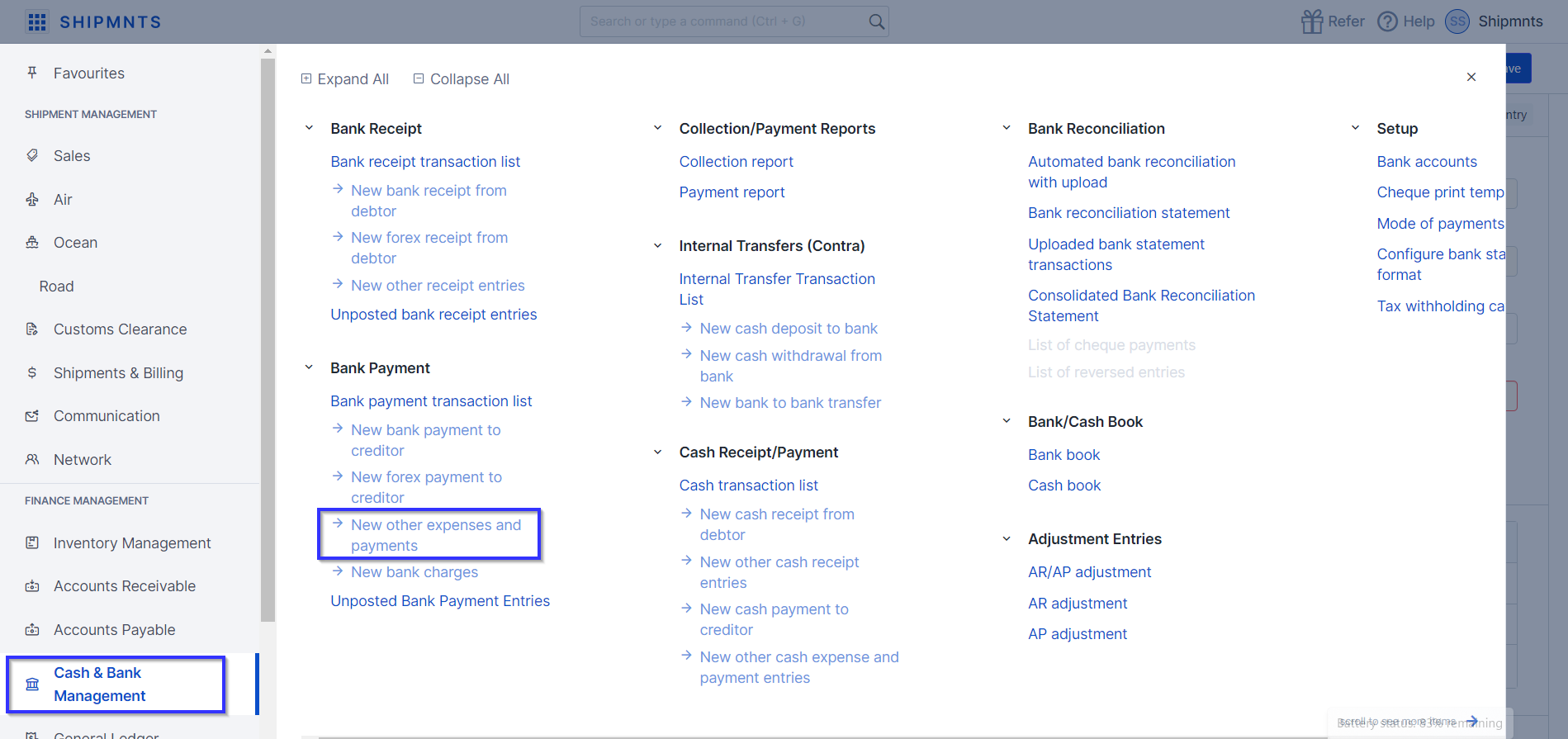

- Go to Cash & Bank Management

- Click on "New other expenses and payments" (Refer to screenshot 1)

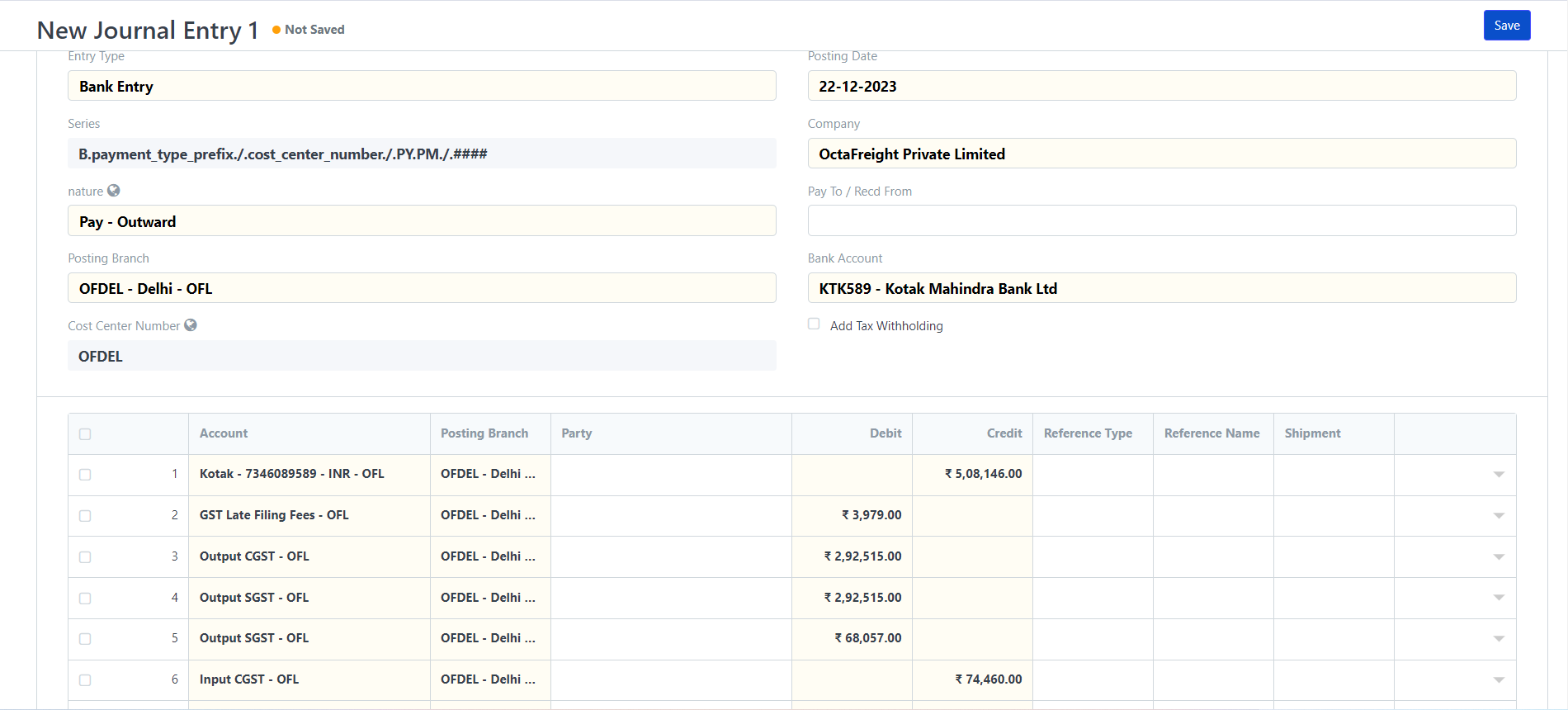

- Select Posting date on which GST challan payment is made (Refer to screenshot 2)

- Start adding the accounts and amounts (Refer to screenshot 2)

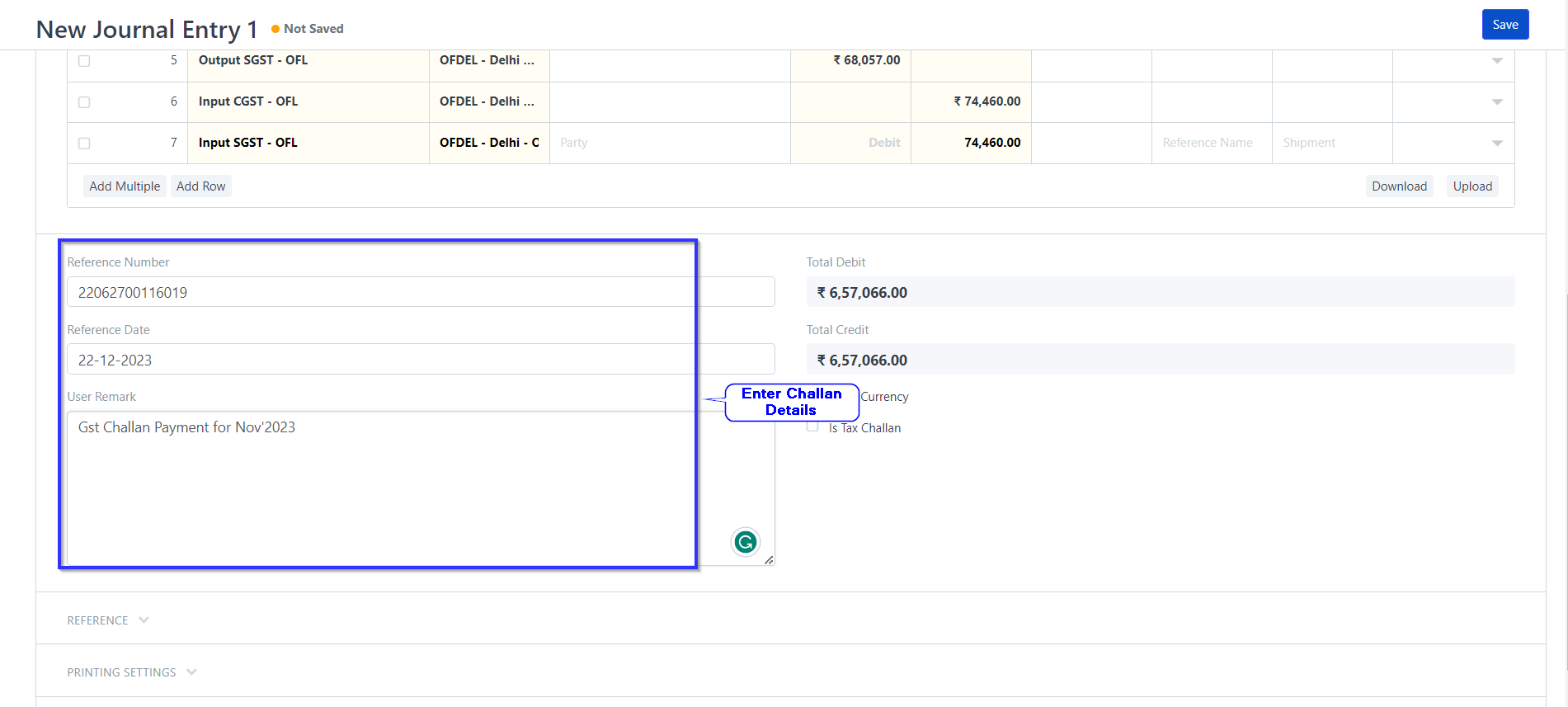

- Add GST challan details (Refer to screenshot 3)

- Save and Submit the entry

Select the Bank account from which GST payment is done

Screenshot 1

Screenshot 2

Screenshot 3

Related Articles

How to Pass GST Challan Payment Entry in Shipmnts?

Output IGST CGST SGST Sum Total Amount 68,057.25 290,338.95 290,338.95 Add (+) 6,48,735.15 Input 74,459.23 74,459.23 Less (-) 1,48,918.46 GST RCM 2,175.63 2,175.63 Add (+) 4,351.26 GST Payable 68,057.00 218,055.00 218,055.00 Total 5,04,167 Interest ...How to Pass Salary Entry in Shipmnts?

Let us understand this by taking an example. Salary to be paid to an employee for the month of september. Total Salary - 50,000 TDS - 5000 Net Salary Payable - 45000 Step 1: Book salary payable against the employee on 30th September. Date 30th ...Bank Payment Entry & Bank Entry From Reconciliation Form

Video With Timestamp 0:00 Bank Payment 0:32 Payment Entry Form 0:40 Add Outstanding Invoice 1:07 Save and Submit 1:22 Accounting Entry 1:57 Customer/ Vendor Copy 2:43 Bank Entry for Expenses 3:44 Journal Entry Form 4:29 Save and Submit 4:44 ...Bank Payment Entry & Bank Entry From Reconciliation Form

Video With Timestamp 0:00 Bank Payment 0:32 Payment Entry Form 0:40 Add Outstanding Invoice 1:07 Save and Submit 1:22 Accounting Entry 1:57 Customer/ Vendor Copy 2:43 Bank Entry for Expenses 3:44 Journal Entry Form 4:29 Save and Submit 4:44 ...How to revise a Payment/Collection entry

How to revise a Payment/Collection entry Helps you modify a payment entry in case of discrepancy made Alok Patel Certain payment entries have to be modified due to mistaken payment entry or due to any discrepancy You can follow the given procedure in ...