How to record TDS deduction in collection entry for third party payments ?

How to record TDS deduction in collection entry for third party payments ? Shubham Pachori

In cases of shipments being executed via subagents or via nomination of overseas agent sales invoices are raised to Subagent or the overseas agent but payment is received from Shipper/Consignee/Actual Customer

In such cases you want to knock-off invoices on the name of Agent, but record TDS Receivable deductions on the name of and TAN number of actual Customer, because it is withheld on the TAN of the customer not the agent (as per Form 26AS)

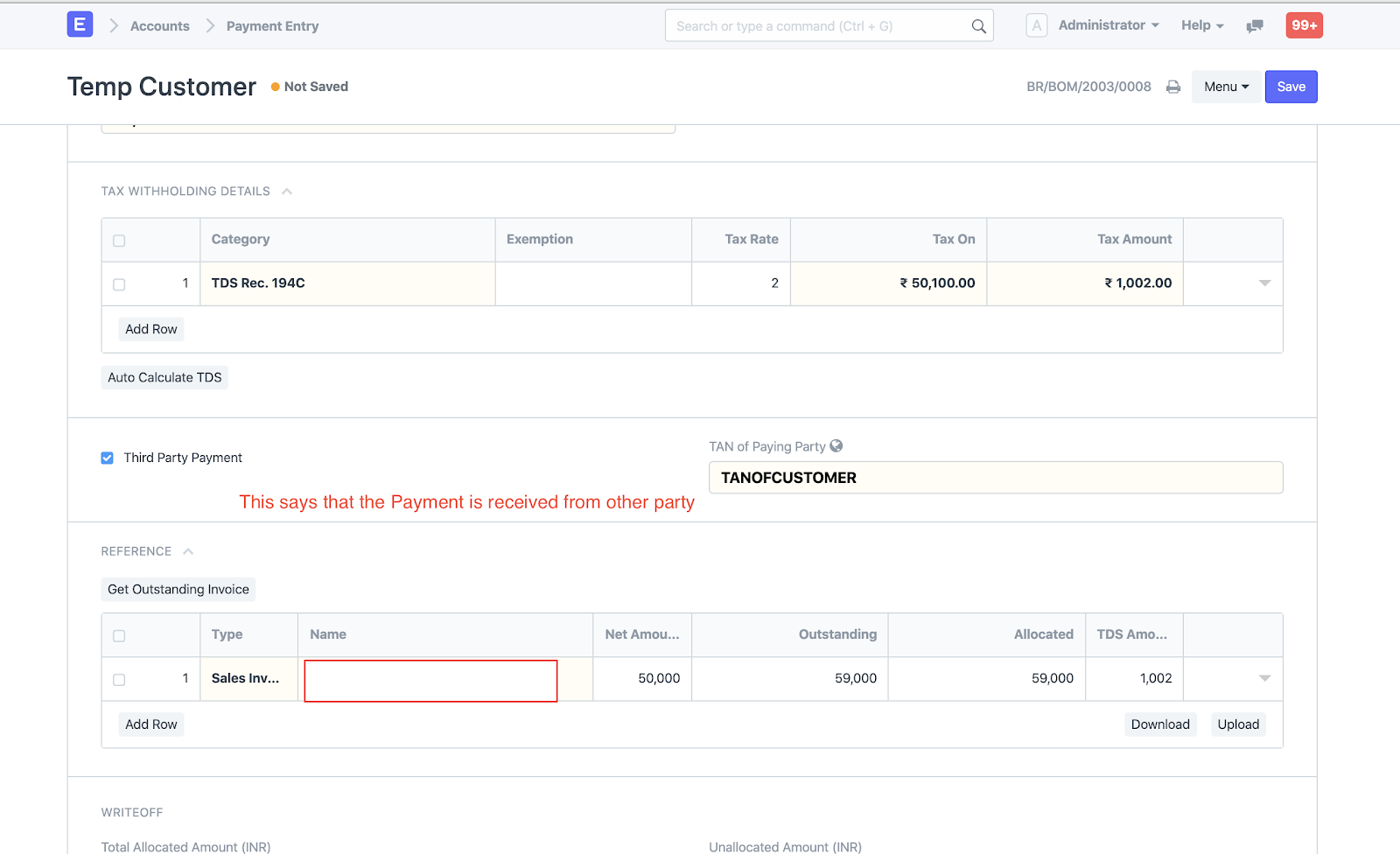

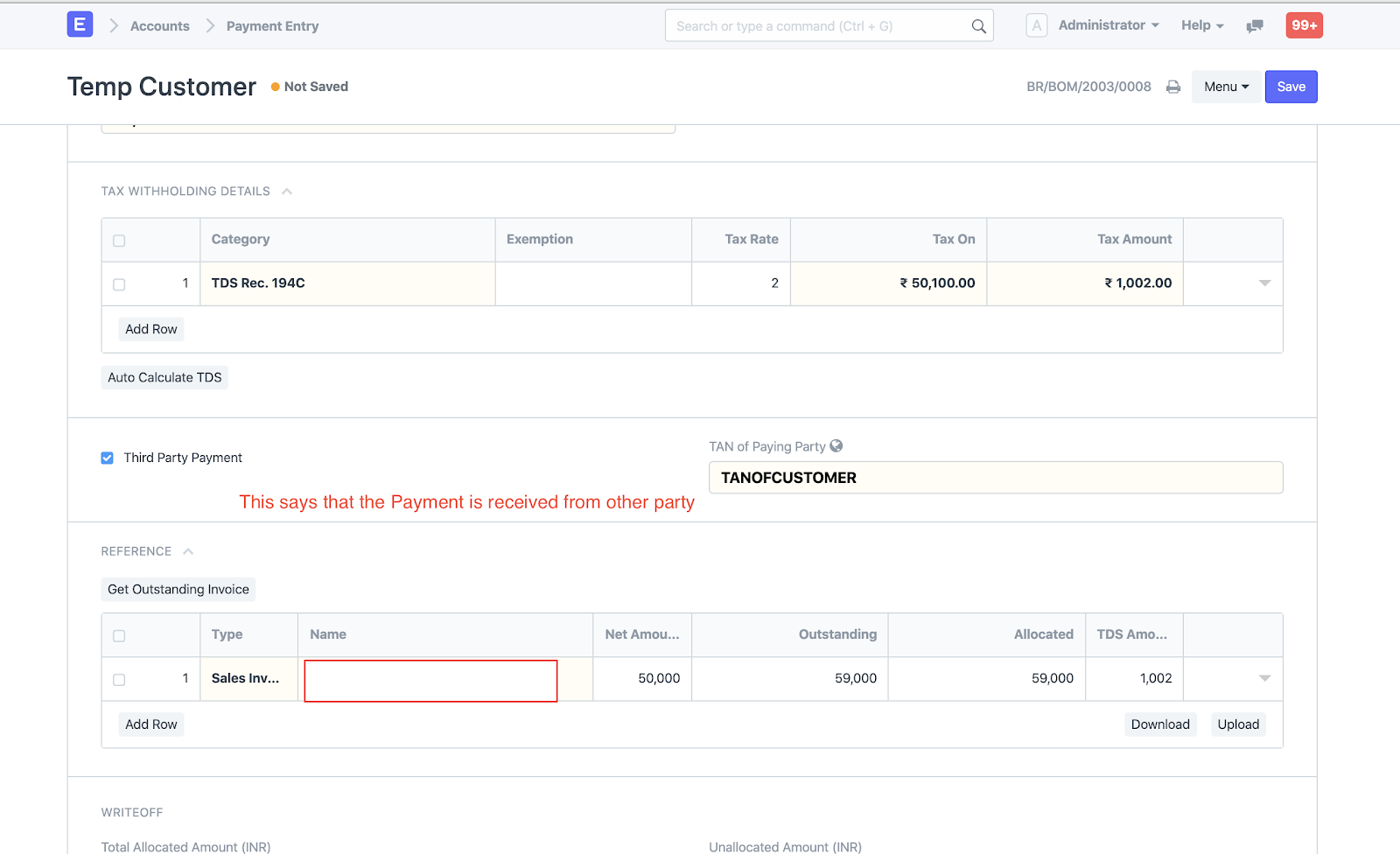

In order to do so while you are recording the collection entry

- Select Third Party Payment checkbox available below the Tax Withholding Details section in the collection entry form

- Enter the TAN of actual customer in the TAN of Paying Party field so that in TDS receivable report you will get details on basis of the entered TAN #.

- If you wish you can record the name of the party in remarks section of the collection entry and the same will appear in the TDS receivable report

Related Articles

How to record TDS deduction in collection entry for third party payments ?

How to record TDS deduction in collection entry for third party payments ? Shubham Pachori In cases of shipments being executed via subagents or via nomination of overseas agent sales invoices are raised to Subagent or the overseas agent but payment ...How to record TDS in collection entry for customers with Single TAN ?

How to record TDS in collection entry for customers with Single TAN ? Helps you record customer's TDS deduction while record collection done from that customer giving you payment Shubham Pachori Generally when you receive payments from customers they ...How to record TDS in collection entry for customers with Single TAN ?

How to record TDS in collection entry for customers with Single TAN ? Helps you record customer's TDS deduction while record collection done from that customer giving you payment Shubham Pachori Generally when you receive payments from customers they ...How to record TDS in collection entry for Customer with multiple TAN ?

How to record TDS in collection entry for Customer with multiple TAN ? Shubham Pachori In the previous article we have seen How to record TDS in collection entry for customers with single tan. In this article how you can handle TDS calculation in ...How to record TDS in collection entry for Customer with multiple TAN ?

How to record TDS in collection entry for Customer with multiple TAN ? Shubham Pachori In the previous article we have seen How to record TDS in collection entry for customers with single tan. In this article how you can handle TDS calculation in ...