How to record TDS in collection entry for Customer with multiple TAN ?

How to record TDS in collection entry for Customer with multiple TAN ? Shubham Pachori

Did this answer your question?

Did this answer your question?

In the previous article we have seen How to record TDS in collection entry for customers with single tan. In this article how you can handle TDS calculation in collection entry for customers which have multiple TAN registration for each branch or unit they have.

Please refer the article on TDS configuration at customer level to know how to configure TDS category at branch / unit level of a customer.

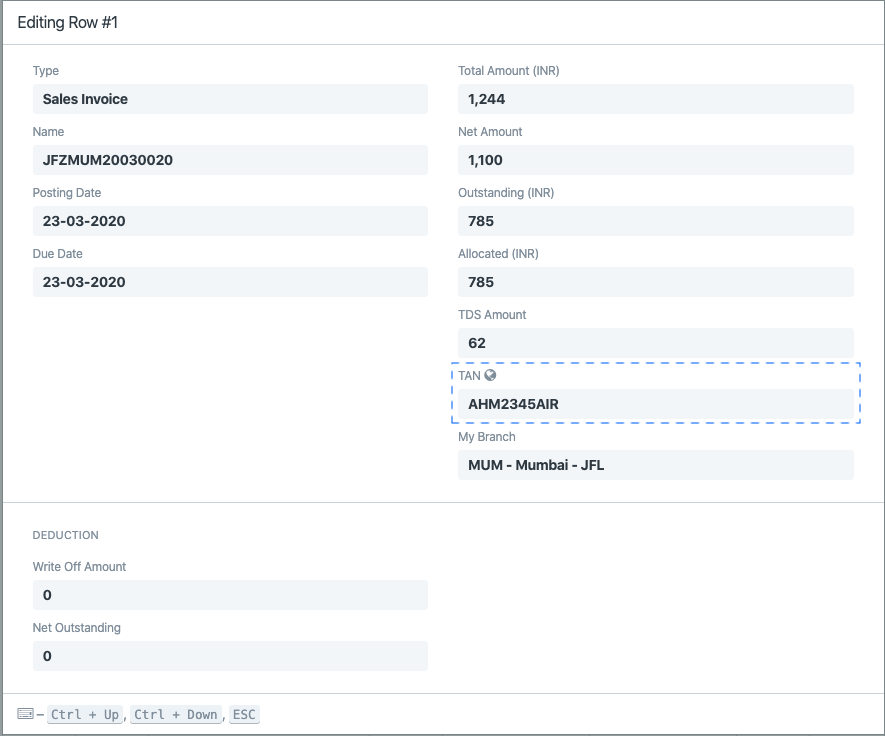

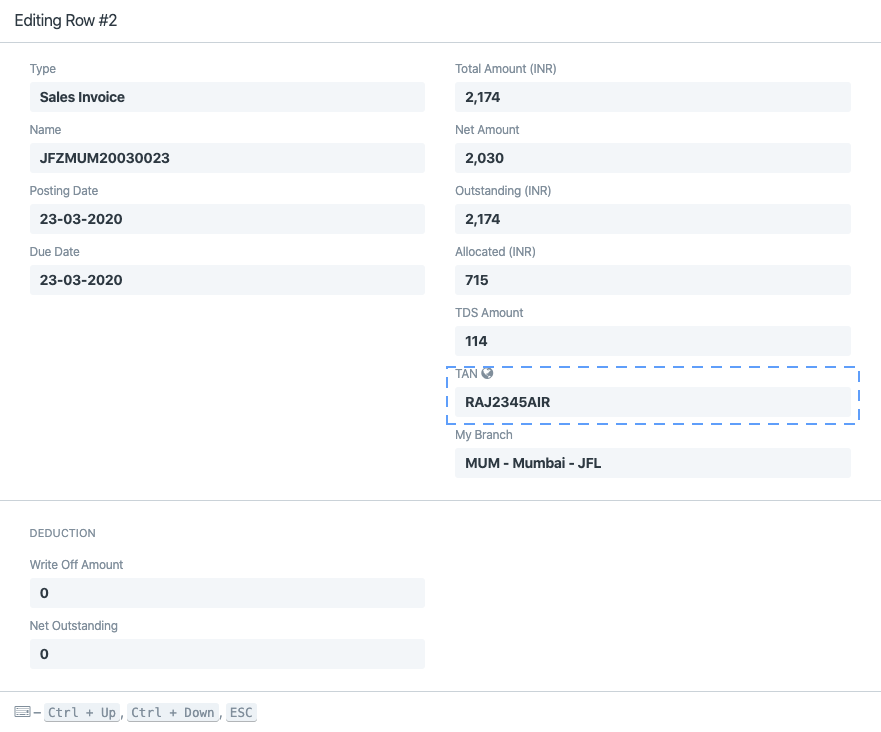

- In case of multiple TAN for a customer for various branches of the customer, system will automatically detect the TDS against TAN by Address entered in the Sales Invoice

- That means if you are knocking-off invoices of a Customer A having 2 different branches with two different TAN registration.

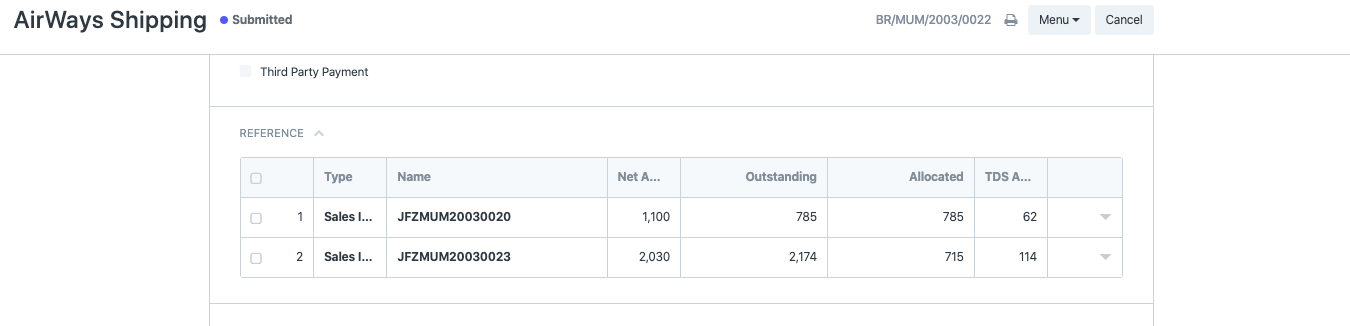

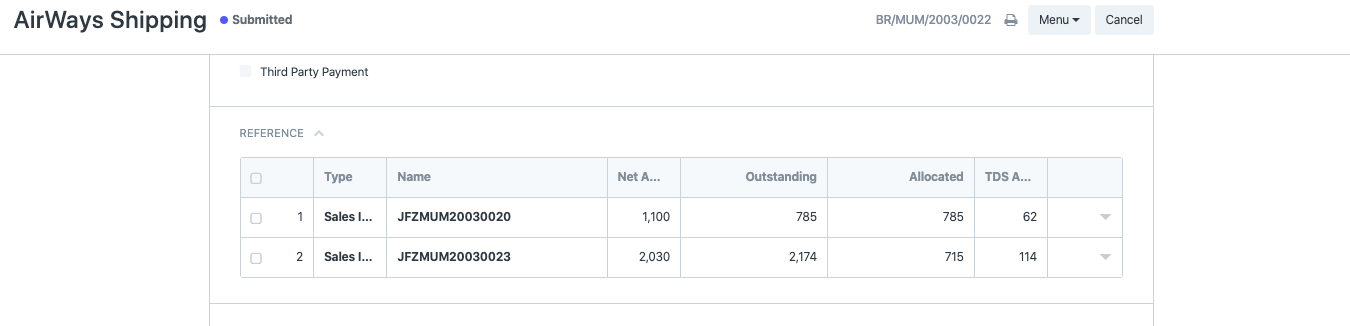

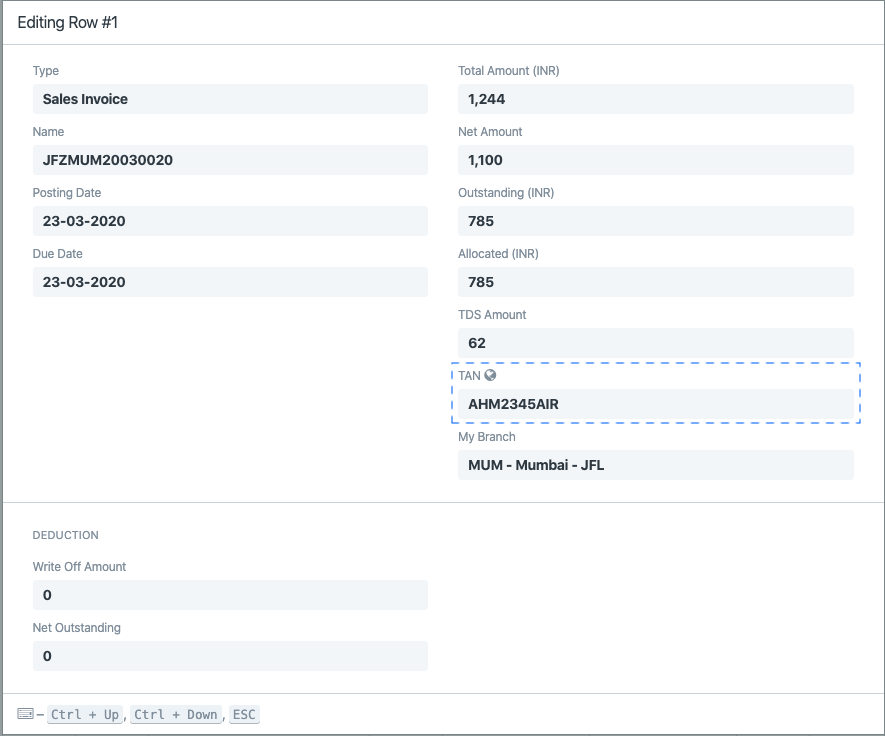

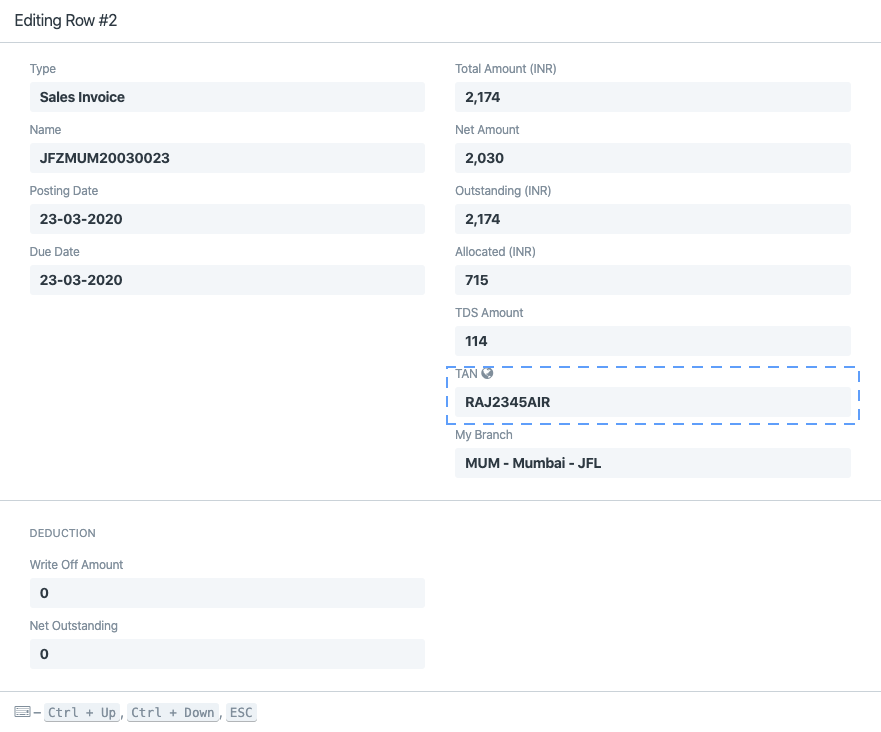

- Now, if you are having 2 Invoices one from branch 1 and one from branch 2 (see screenshot below) and you knock off those invoices in a collection entry, the system will get the TAN from Addresses of branch 1 and branch 2 recorded at time of creating the invoices as shown in screenshots below

Did this answer your question?

Did this answer your question?

Related Articles

How to record TDS in collection entry for Customer with multiple TAN ?

How to record TDS in collection entry for Customer with multiple TAN ? Shubham Pachori In the previous article we have seen How to record TDS in collection entry for customers with single tan. In this article how you can handle TDS calculation in ...How to record TDS in collection entry for customers with Single TAN ?

How to record TDS in collection entry for customers with Single TAN ? Helps you record customer's TDS deduction while record collection done from that customer giving you payment Shubham Pachori Generally when you receive payments from customers they ...How to record TDS in collection entry for customers with Single TAN ?

How to record TDS in collection entry for customers with Single TAN ? Helps you record customer's TDS deduction while record collection done from that customer giving you payment Shubham Pachori Generally when you receive payments from customers they ...How to record TDS deduction in collection entry for third party payments ?

How to record TDS deduction in collection entry for third party payments ? Shubham Pachori In cases of shipments being executed via subagents or via nomination of overseas agent sales invoices are raised to Subagent or the overseas agent but payment ...How to record TDS deduction in collection entry for third party payments ?

How to record TDS deduction in collection entry for third party payments ? Shubham Pachori In cases of shipments being executed via subagents or via nomination of overseas agent sales invoices are raised to Subagent or the overseas agent but payment ...