How to record TDS in collection entry for customers with Single TAN ?

Generally when you receive payments from customers they deduct TDS while making payments. To automate this calculation as per the TDS category of that customer and the Lower Deduction Certificate you may have applied for that customer. Read How to setup TDS Receivables Category for a Customer ?

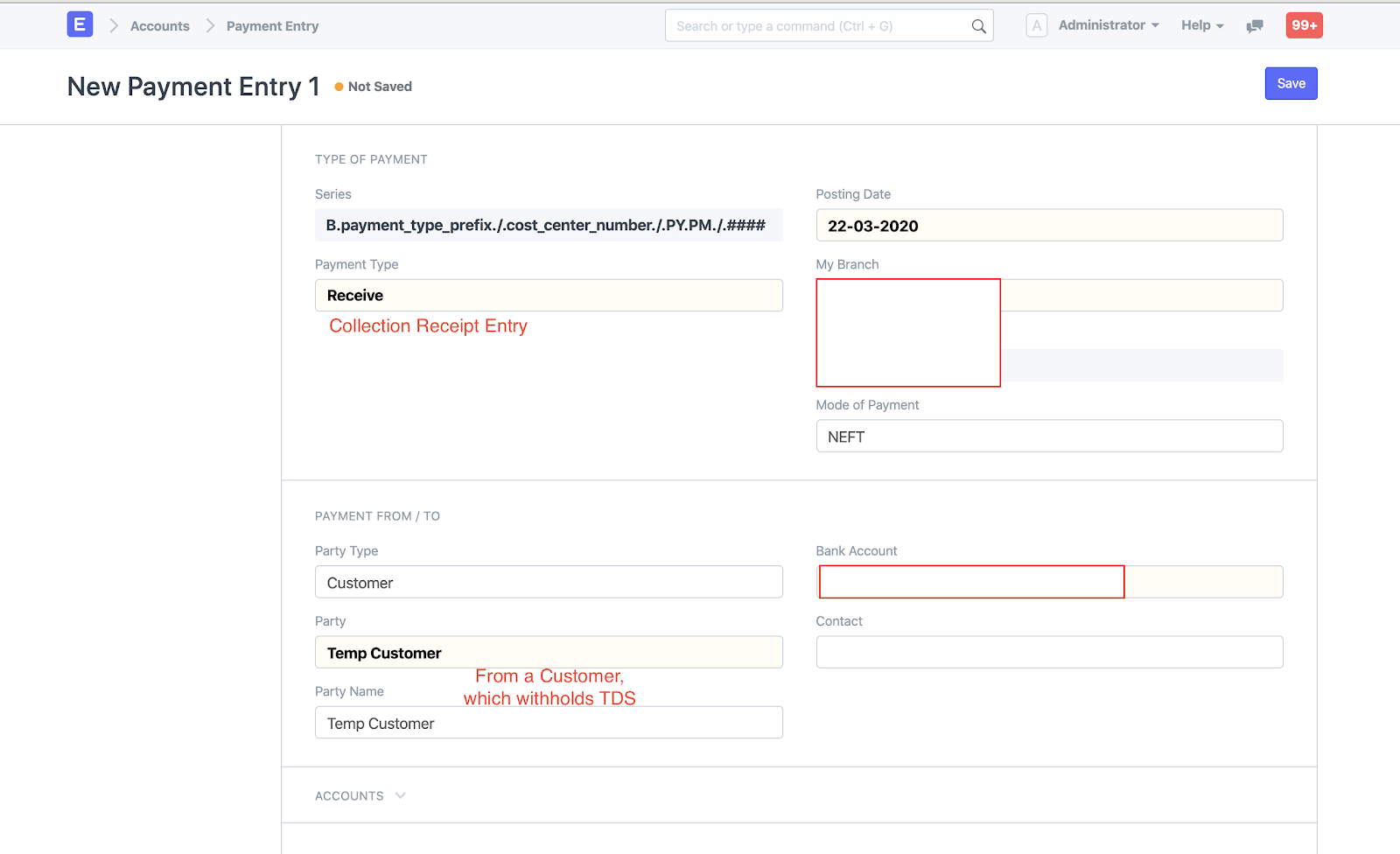

Once you have complete the setup at customer level, you can start recording your collection entry as per the usual steps you follow

How TDS calculation works when you are using get outstanding invoices feature ?

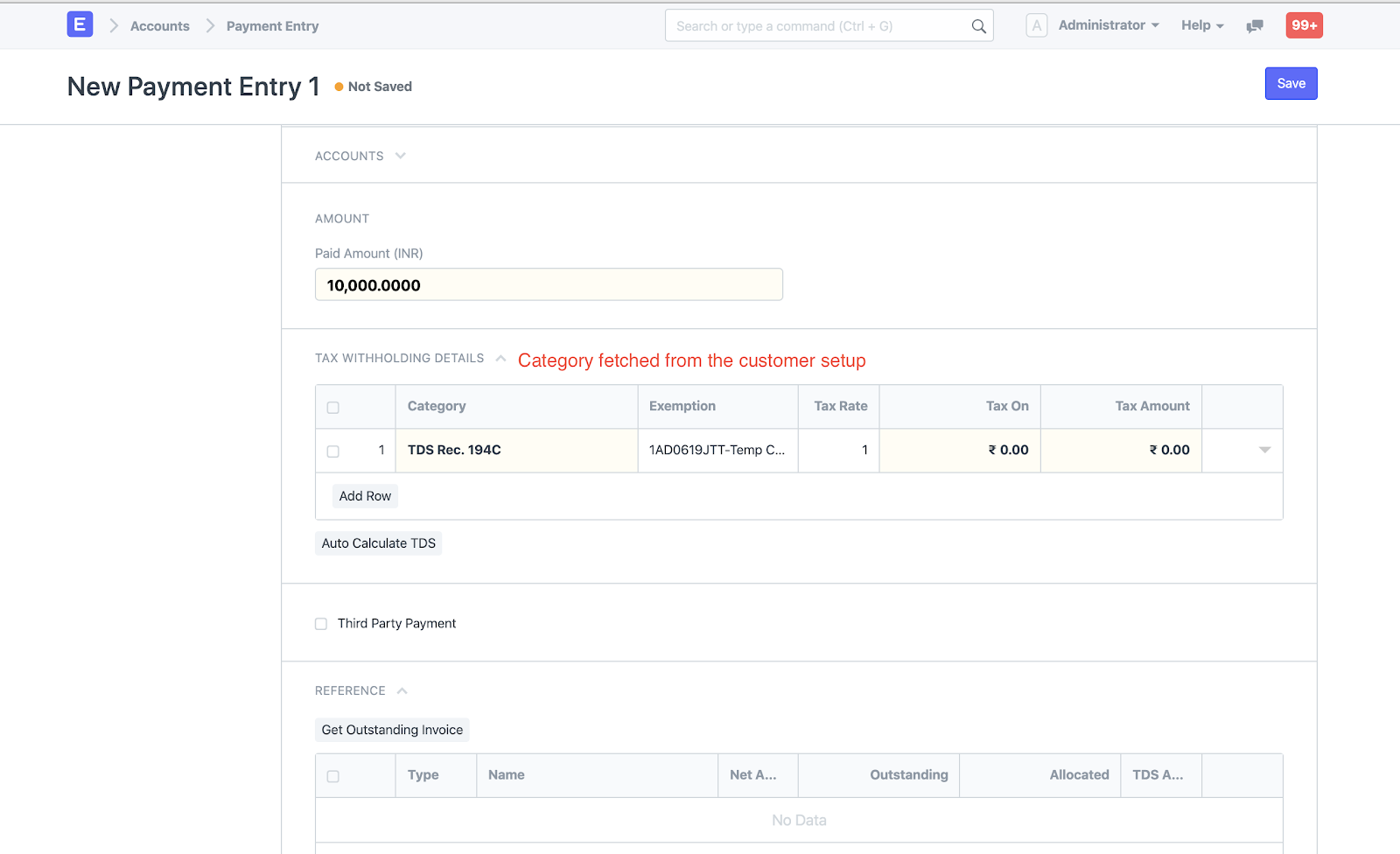

- Once you have entered the customer name and the amount received from that customer, Tax Withholding Details (newly added section) will now show the category if you have configured TDS Receivable Category for that customer

In the references section when you click on get outstanding invoices, TDS calculation will work in the following way

- TDS Amount Will be auto pre-filled based on the Net Amount (excluding GST amount) of Invoice

- TDS amount will be calculated as (Net Amount * Tax Rate) / 100 → Rounded Off to Zero

- TDS amount calculated will be Added in Allocated amount column to knockoff the outstanding amount of that invoice

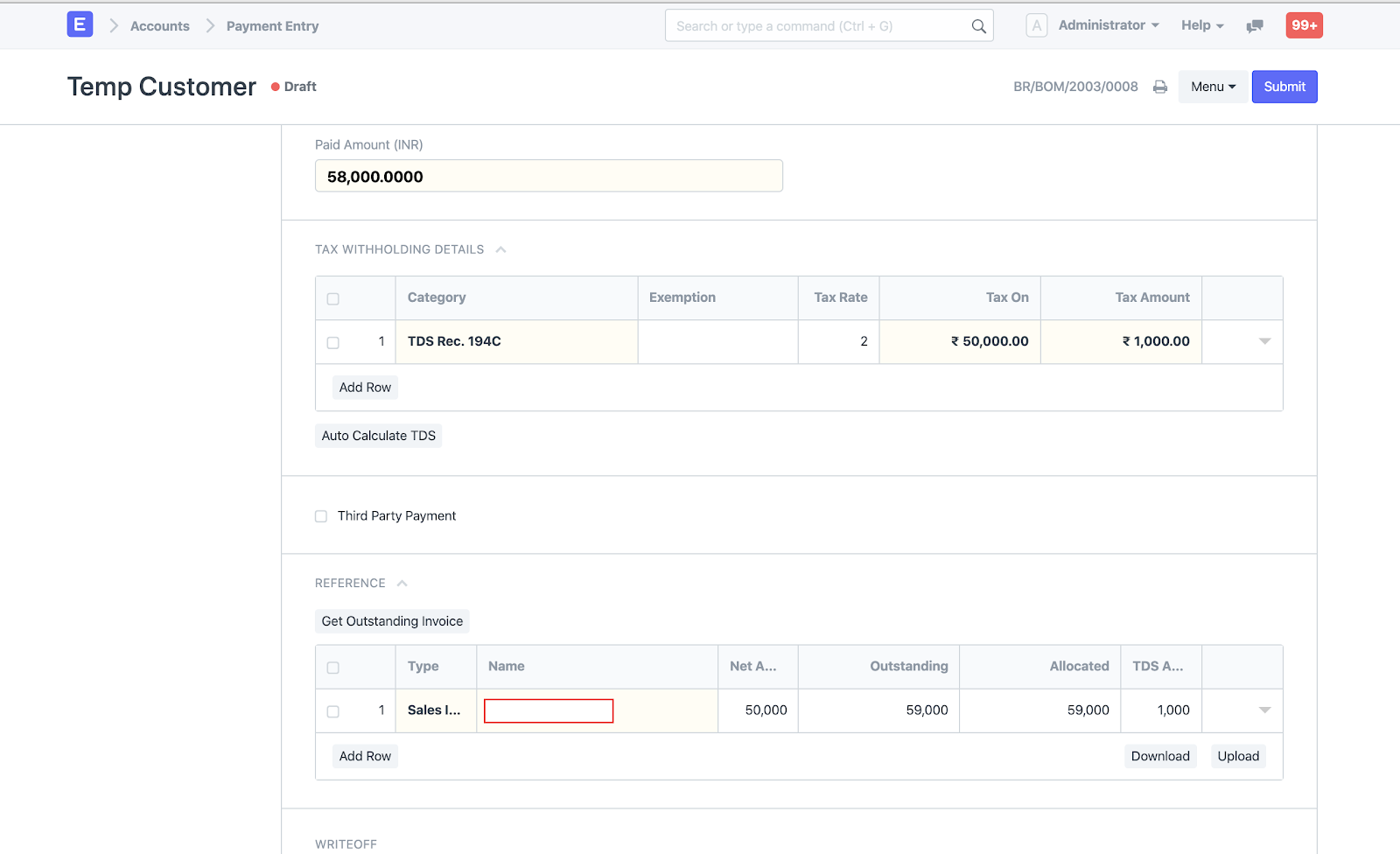

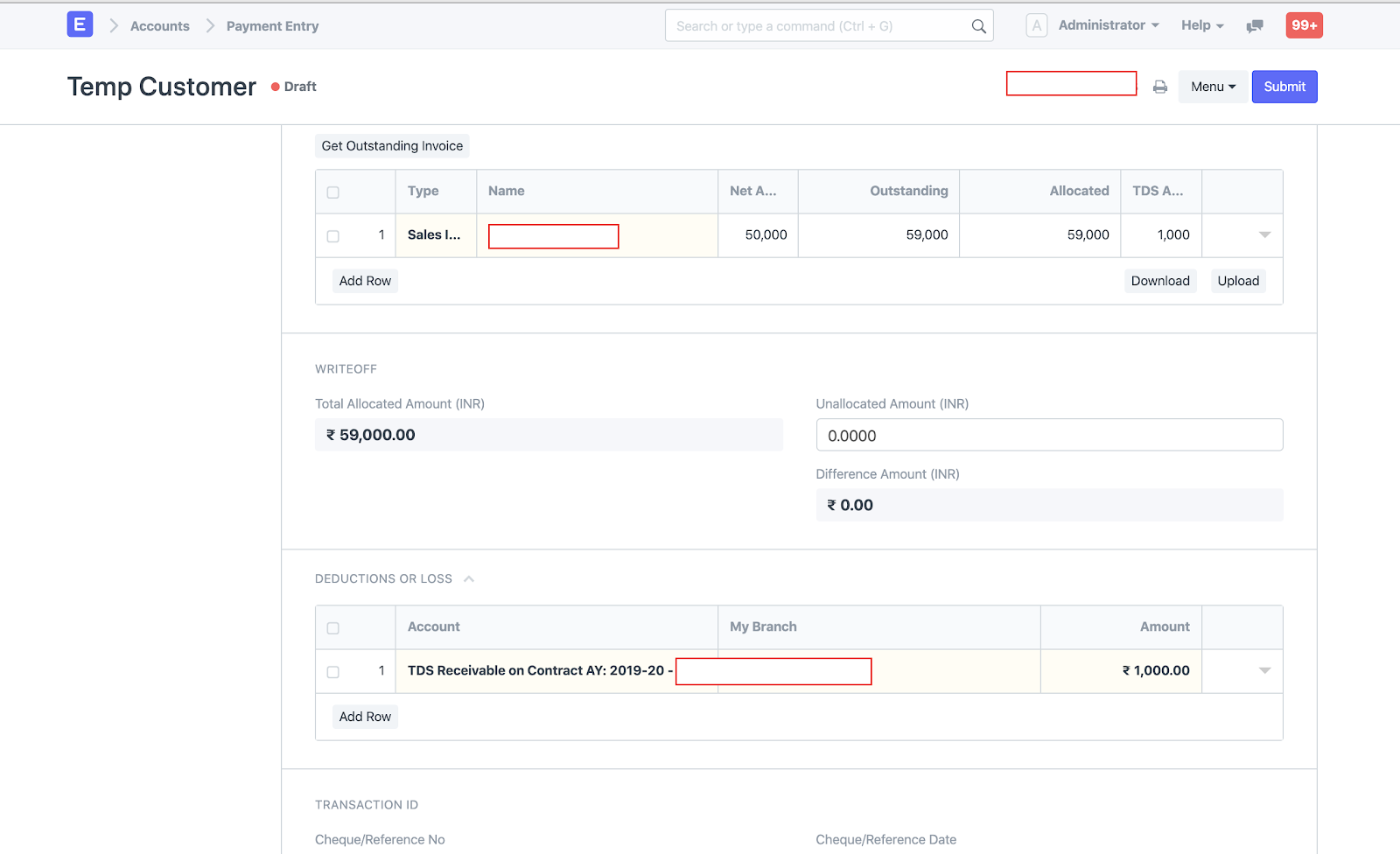

As per below above collection entry example screenshot, payment of 58,000 is received from customer. Invoice outstanding is 59,000 and TDS amount calculated is 1,000. System is allocating 59,000 in total against the invoice ( 58k from the amount received and 1k TDS deduction amount calculated )

- 1,000 TDS amount deducted will be posted to TDS receivable ledger (see the deduction or loss section in below screenshot) configured with Tax withholding category configured at the customer level

How TDS calculation works when you manually entering invoices in references section as per the payment advise of the customer ?

- After inserting all references, one can press Auto Calculate TDS button shown in Tax Withholding Details section for pre-filling TDS Amount in added references

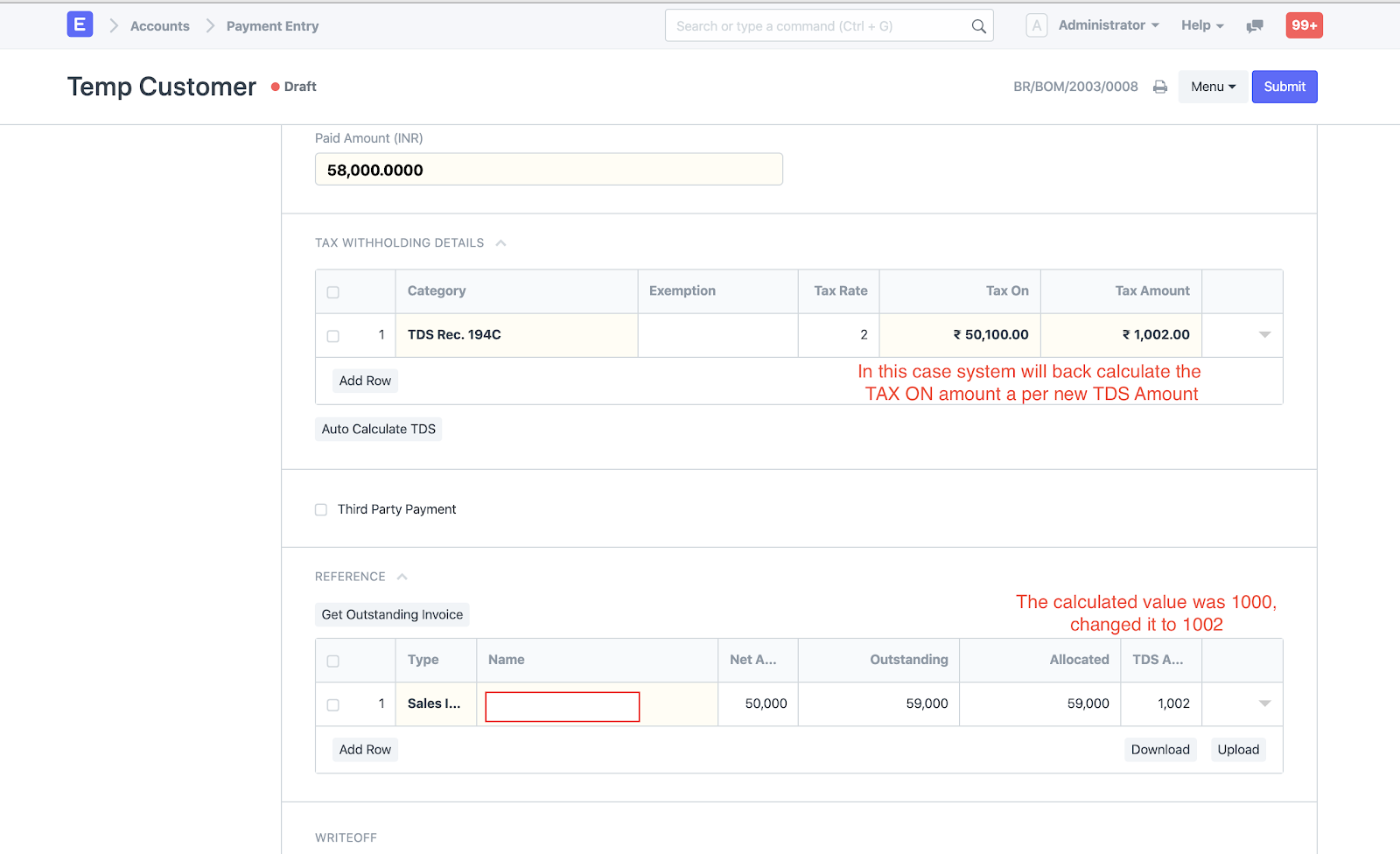

- If auto-calculated TDS amount is not matching with the payment advise you have got from your customer, you can change the TDS amount in the column available in References section as shown below in screenshot

Once you have entered and cross checked all the details save and submit your entry.

Did this answer your question?Related Articles

How to record TDS in collection entry for customers with Single TAN ?

How to record TDS in collection entry for customers with Single TAN ? Helps you record customer's TDS deduction while record collection done from that customer giving you payment Shubham Pachori Generally when you receive payments from customers they ...How to record TDS in collection entry for Customer with multiple TAN ?

How to record TDS in collection entry for Customer with multiple TAN ? Shubham Pachori In the previous article we have seen How to record TDS in collection entry for customers with single tan. In this article how you can handle TDS calculation in ...How to record TDS in collection entry for Customer with multiple TAN ?

How to record TDS in collection entry for Customer with multiple TAN ? Shubham Pachori In the previous article we have seen How to record TDS in collection entry for customers with single tan. In this article how you can handle TDS calculation in ...How to record TDS deduction in collection entry for third party payments ?

How to record TDS deduction in collection entry for third party payments ? Shubham Pachori In cases of shipments being executed via subagents or via nomination of overseas agent sales invoices are raised to Subagent or the overseas agent but payment ...How to record TDS deduction in collection entry for third party payments ?

How to record TDS deduction in collection entry for third party payments ? Shubham Pachori In cases of shipments being executed via subagents or via nomination of overseas agent sales invoices are raised to Subagent or the overseas agent but payment ...