How to revise a Payment/Collection entry

Certain payment entries have to be modified due to mistaken payment entry or due to any discrepancy

You can follow the given procedure in order to revise a particular payment entry

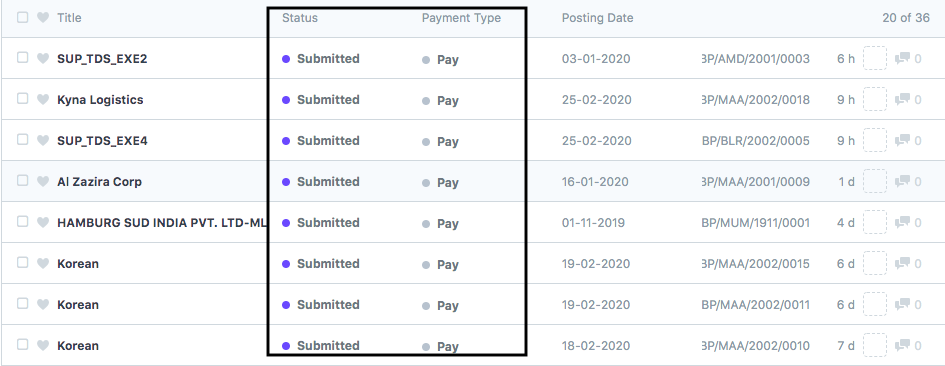

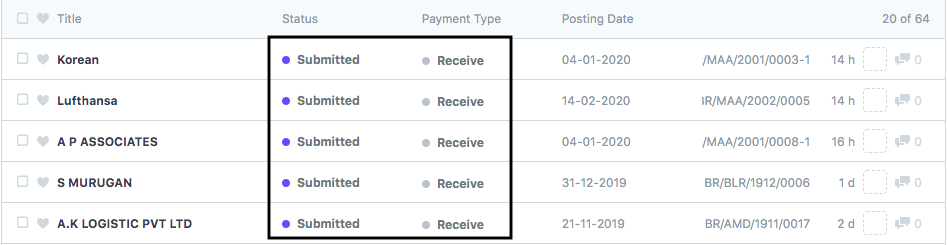

- On the dashboard, go to "Payment Entry List" and select the payment entries that have been marked as "Submitted" under the status header "Pay" or "Receive" depending on the entry which you want to revise

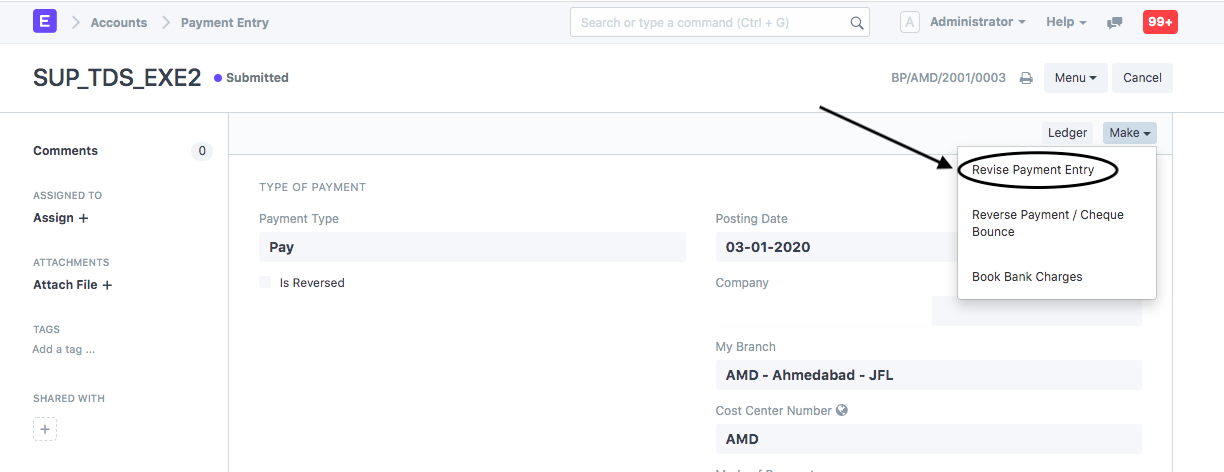

- Click on "Revise Payment Entry" under "Make" section (as shown in figure)

On making a revision of the payment entry, existing payment entry will be cancelled and an amended payment entry will be made.

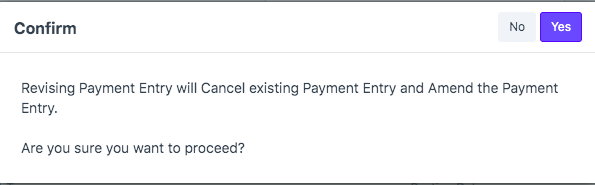

You will get a dialog box to confirm whether you can cancel the respective entry or not.

- Click on "Yes" to confirm and continue the revision of entry

Note:You will not be allowed to change the "Branch","Supplier" or "Party Name" for the same

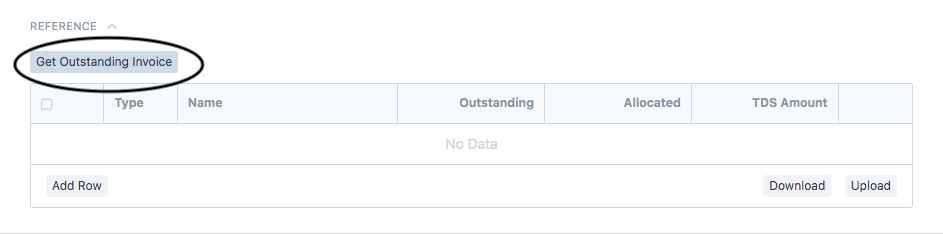

You will only be able to knock off the invoices by getting the pending outstanding invoices for the same or if you want to change the invoices criteria for the same

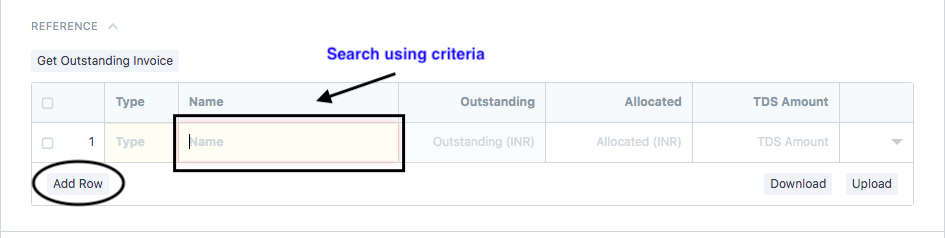

You can also manually enter the respective invoice by searching on the various criteria after selecting the "Type (Sales Invoice,Purchase invoice,Payment Entry and so on)

You can search the respective entries using the following criteria if you want to add them manually Posting date, Supplier, Bill number, Grand Total,Outstanding Amount Project,Master Shipment Number,House Shipment Number ,Container Number.

- Click on "Save" and "Submit" to make the respective revised entry

Related Articles

How to revise a Payment/Collection entry

How to revise a Payment/Collection entry Helps you modify a payment entry in case of discrepancy made Alok Patel Certain payment entries have to be modified due to mistaken payment entry or due to any discrepancy You can follow the given procedure in ...Bank Payment Entry & Bank Entry From Reconciliation Form

Video With Timestamp 0:00 Bank Payment 0:32 Payment Entry Form 0:40 Add Outstanding Invoice 1:07 Save and Submit 1:22 Accounting Entry 1:57 Customer/ Vendor Copy 2:43 Bank Entry for Expenses 3:44 Journal Entry Form 4:29 Save and Submit 4:44 ...Bank Payment Entry & Bank Entry From Reconciliation Form

Video With Timestamp 0:00 Bank Payment 0:32 Payment Entry Form 0:40 Add Outstanding Invoice 1:07 Save and Submit 1:22 Accounting Entry 1:57 Customer/ Vendor Copy 2:43 Bank Entry for Expenses 3:44 Journal Entry Form 4:29 Save and Submit 4:44 ...How to make Bank Payment Entry

How to make Bank Payment Entry This entry is visible under the payment report Alok Patel Payment entry is made when you have paid a certain amount to your supplier or party either against a particular invoice or in advance In order to make a payment ...How to make Bank Payment Entry

How to make Bank Payment Entry This entry is visible under the payment report Alok Patel Payment entry is made when you have paid a certain amount to your supplier or party either against a particular invoice or in advance In order to make a payment ...