How to track utilisation of Lower TDS Deduction certificate of a supplier ?

How to track utilisation of Lower TDS Deduction certificate of a supplier ?

Helps you in running TDS lower deduction utilisation tracking report Shubham Pachori

If one (or few) of your supplier have provided you with Lower TDS deduction certificate and you have configured the same at supplier master level then you will need to track how much of the exemption limit has exhausted.

You can run this report by

- Searching for the report TDS Payable Exemption Report and then adding it to desktop

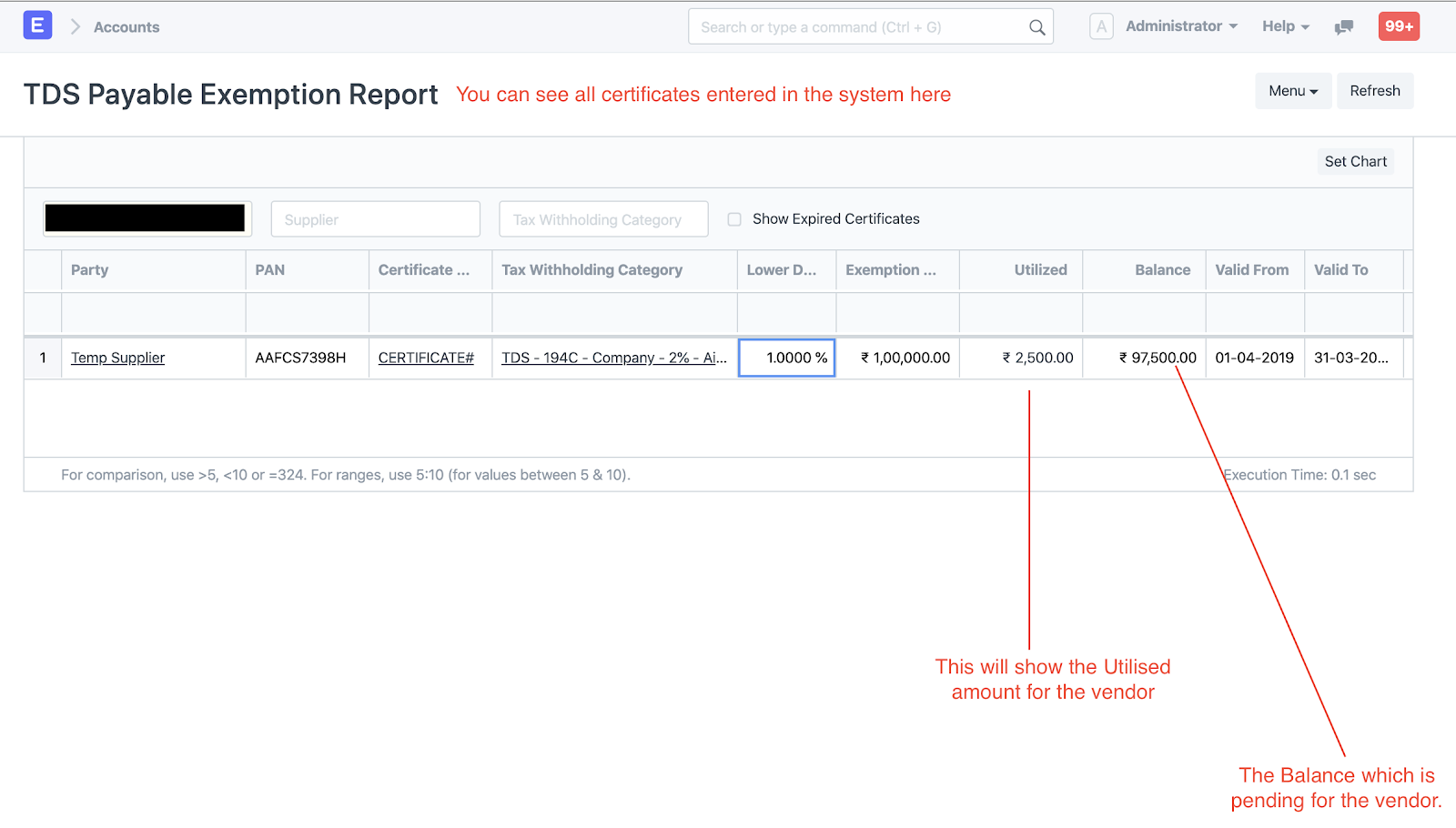

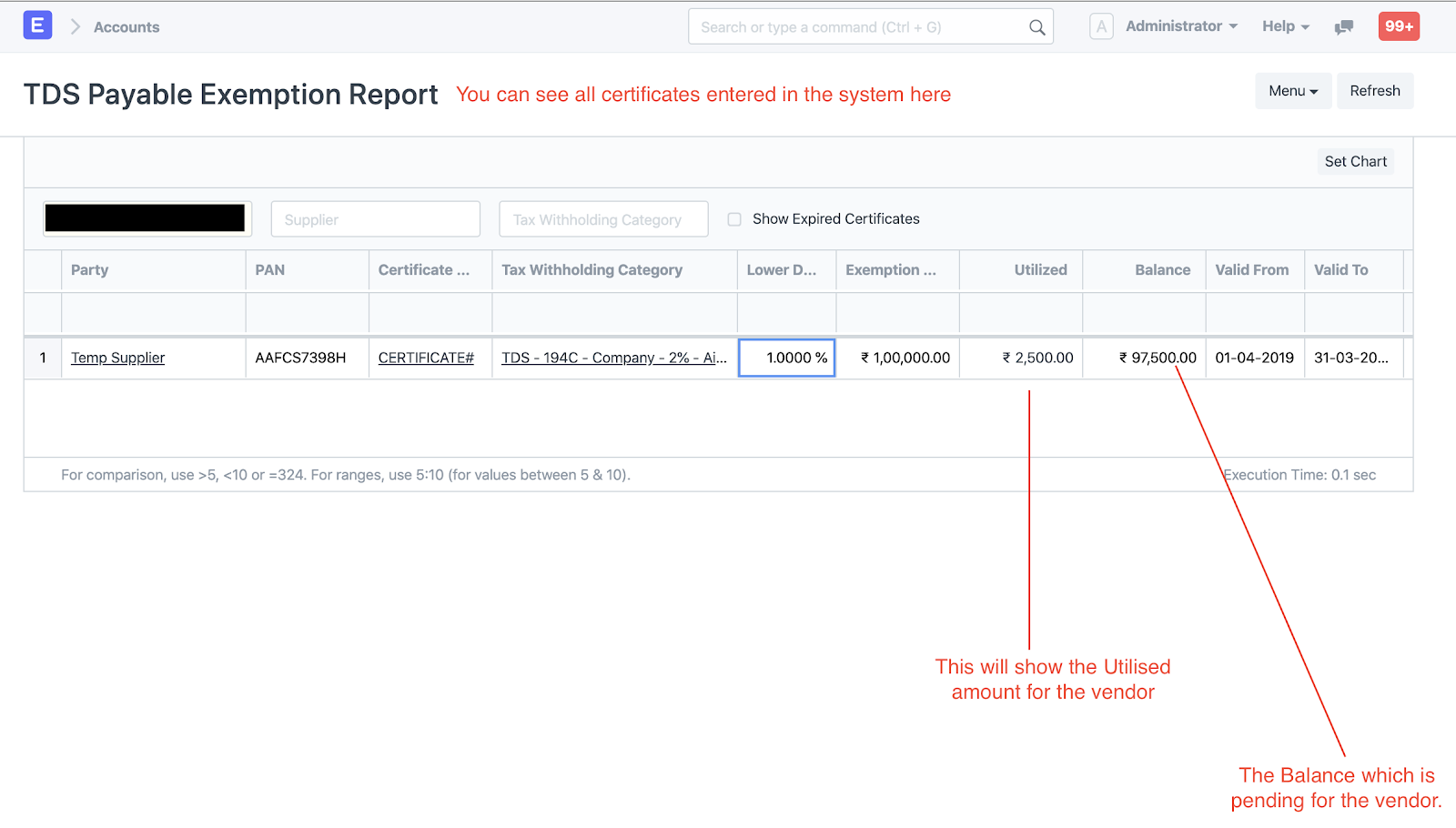

Once you are in the report it will start showing you all the valid lower TDS deduction certificate by parties.

Following are the columns in the report

- Party - Name of the supplier which has provided the lower TDS deduction certificate

- PAN - PAN # of the supplier which has provided the lower TDS deduction certificate

- Certificate # - Will show the lower TDS deduction certificate number

- Tax With holding Category - Will show TDS category (194C, 194H .... ) applicable for that supplier

- Lower Deduction Rate - Will show lower TDS deduction rate as per the certificate

- Exemption Limit - Its the cumulative threshold of purchase transactions (excluding GST) till which this lower TDS deduction rate will be applicable.

For example if the limit is 1,00,000 that means if you receive 5 invoices with net value (without GST) 20,000 from supplier system will deduct TDS at lower rate. Once you record the 6th invoice the limit has already been exhausted hence the normal TDS rate will be applicable

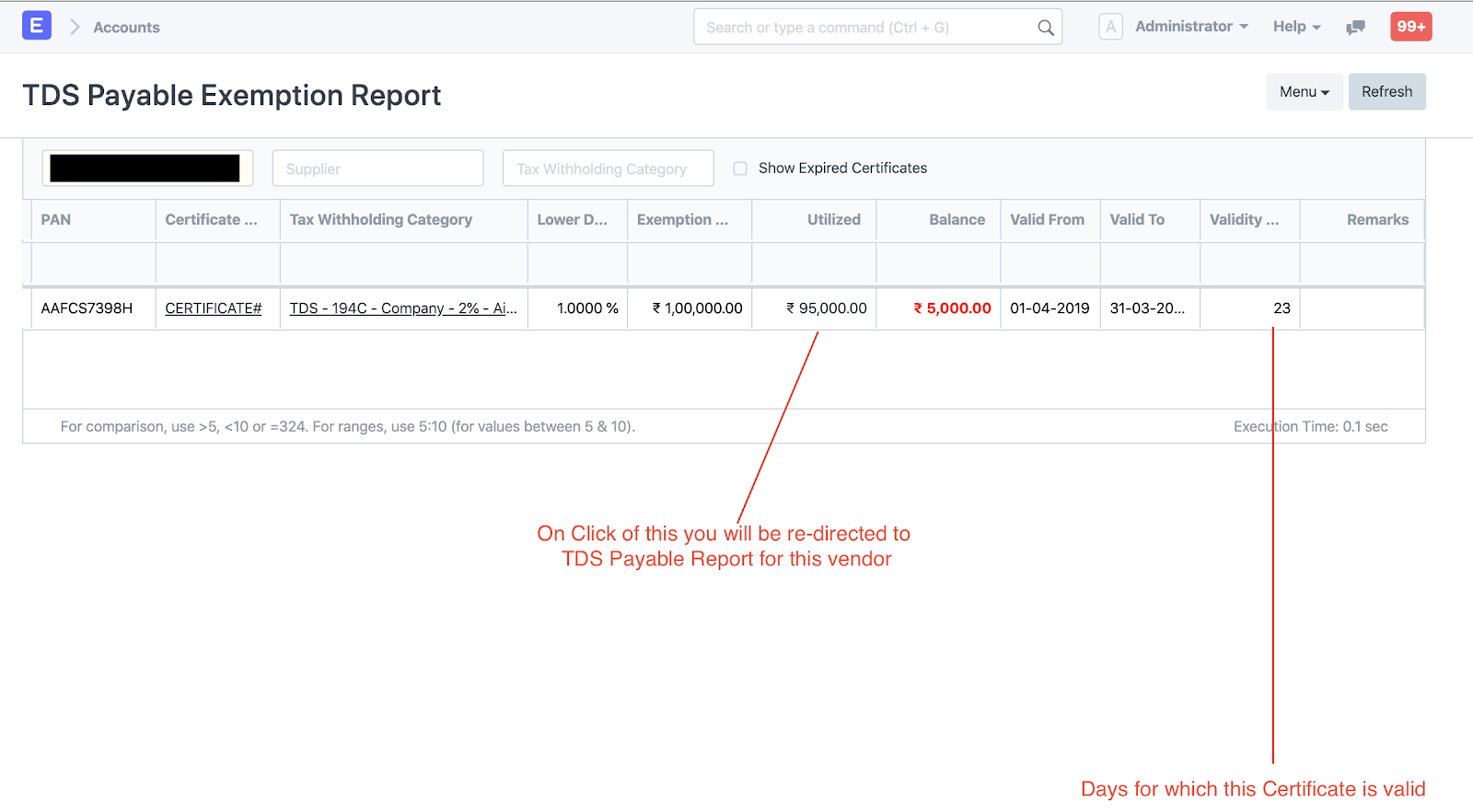

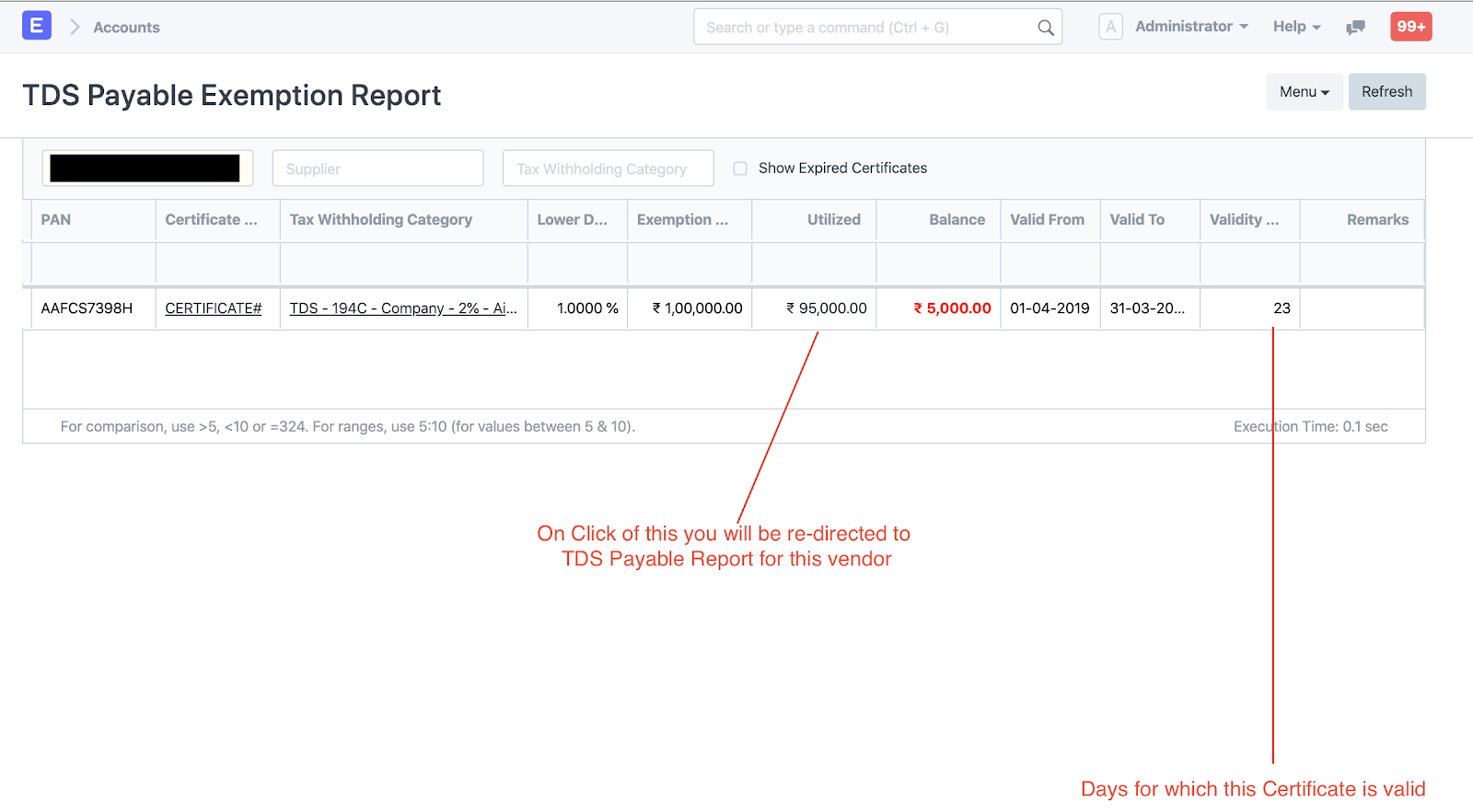

- Utilised - It shows the cumulative value of all purchase transactions (excluding GST) on which lower TDS deduction rate has been applied by system. When you click on this amount it will redirect you to TDS Payable Report where the filter of this certificate will be applied automatically and it will show you all the purchase transactions individually on which lower TDS deduction certificate has been used

- Balance - It shows the difference between Exemption limit and the Utilised amounts

- Valid From - It shows the date from which this lower TDS deduction certificate has to be applied

- Valid To - It shows the date till which this lower TDS deduction certificate has to be applied

Following are the filters in the report which you can use

- Show Expired Certificate - By checking out this box you will start seeing completely utilised and expired certificates as well. This report by default only show valid certificates

Related Articles

How to track utilisation of Lower TDS Deduction certificate of a supplier ?

How to track utilisation of Lower TDS Deduction certificate of a supplier ? Helps you in running TDS lower deduction utilisation tracking report Shubham Pachori If one (or few) of your supplier have provided you with Lower TDS deduction certificate ...How to configure Lower TDS Deduction Certificate received from a supplier ?

Suppose Your vendor name is: SQQ INTERNATIONAL LOGISTICS PVT LTD has issued Tax withholding exemption certificate of limit 50,000 , TDS section 194C, Exemption rate : 0.01% , Period : 1Sep 2022 to 28-Feb-2023: How you can add the certificate in ...How to configure Lower TDS Exemption received from a supplier ?

How to configure Lower TDS Exemption received from a supplier ? Helps you in configuring Lower TDS Exemption certificate along with rates and validity for a supplier Shubham Pachori In cases of where you have high volume and value transactions ...How to Add TDS for previous fiscal year invoice?

In most of case it's possible that sales invoices are made in 31 March or before that and customer has made payment in month of April or letter. In such cases, to show TDS impact in last year for last fiscal year invoices, there is a simple step ...How to record TDS in collection entry for customers with Single TAN ?

How to record TDS in collection entry for customers with Single TAN ? Helps you record customer's TDS deduction while record collection done from that customer giving you payment Shubham Pachori Generally when you receive payments from customers they ...