Purchase Tax Template Automation

Purchase Tax Template Automation feature which has been brought up into the system is to resolve problems getting faced by users such as,

- Manually selecting the tax templates which they end up forgetting to change the Reverse charge as applicable which led to potential errors in Input Credit.

- The RCM tax template where needs to be removed each time and SEZ tax template had to be selected manually for every Overseas agent export case.

- For Transportation charges, manually the RCM tax template had to be selected as RCM should be applicable doesn't get auto-applied based on the item added.

- The same supplier irrespective of being GST registered can supply services in which one is RCM and the other one is not, which in return creates problems while claiming input credits and RCM refunds from the Government.

Purchase Tax Template Automation feature automatically allocates the Tax template as per the Item is configured into the Item Master reflecting in the Purchase Invoice. Tax Template Rule is made configurable for RCM overseas [Supplier Country outside India], Shipment type in export, import or all.

Tax Templates which will get automated into the system based on the item configuration and the State of the supplier address are as follows,

- Regular In-State

- Regular Out-State

- In-State Under RCM

- Out-State Under RCM

- Ineligible In-State

- Ineligible Out-State

- No GST Applicable

Following is the understanding regarding the Tax Templates according to their Preferred invoice types,

- If the item is RCM applicable then, 'In-State Under RCM' or 'Out-State Under RCM' tax template will get automated as of the State of the Supplier address in the Invoice

- If the item is not RCM applicable then, 'Regular In-State' or 'Regular Out-State' tax template will get automated as of the State of the Supplier address in the Invoice

- Find the below diagram for a detailed understanding

- If the item is RCM applicable then, 'In-State Under RCM' or 'Out-State Under RCM' tax template will get automated as of the State of the Supplier address in the Invoice

- If the item is not RCM applicable then, 'No GST Applicable' tax template will get automated in the Invoice

- Find the below diagram for a detailed understanding

- For Job Invoice consisting of Export Shipment, if LUT is applicable then,

'No GST Applicable' tax template will get automated in the Invoice - For Job Invoice consisting of Export Shipment, if there is No LUT applicable then,

'In-State Under RCM' or 'Out-State Under RCM' tax template will get automated as of the State of the Supplier address in the Invoice - For Job Invoice consisting of Import Shipment, 'In-State Under RCM' or 'Out-State Under RCM' tax template will get automated as of the State of the Supplier address in the Invoice

- For Non-Job or Consolidated Invoice, 'In-State Under RCM' or 'Out-State Under RCM' tax template will get automated as of the State of the Supplier address in the Invoice

- Find the below diagram for a detailed understanding

- For Job Invoice consisting of Export Shipment, if LUT is applicable then, No GST Applicable tax template will get automated in the Invoice

- For Job Invoice consisting of Export Shipment, if there is No LUT applicable, then In-State Under RCM or Out-State Under RCM tax template will get automated as of the State of the Supplier address in the Invoice

- For Job Invoice consisting of Import Shipment, In-State Under RCM or Out-State Under RCM tax template will get automated as of the State of the Supplier address in the Invoice

- For Non-Job or Consolidated Invoice, In-State Under RCM or Out-State Under RCM tax template will get automated as of the State of the Supplier address in the Invoice

- Find the below diagram for a detailed understanding

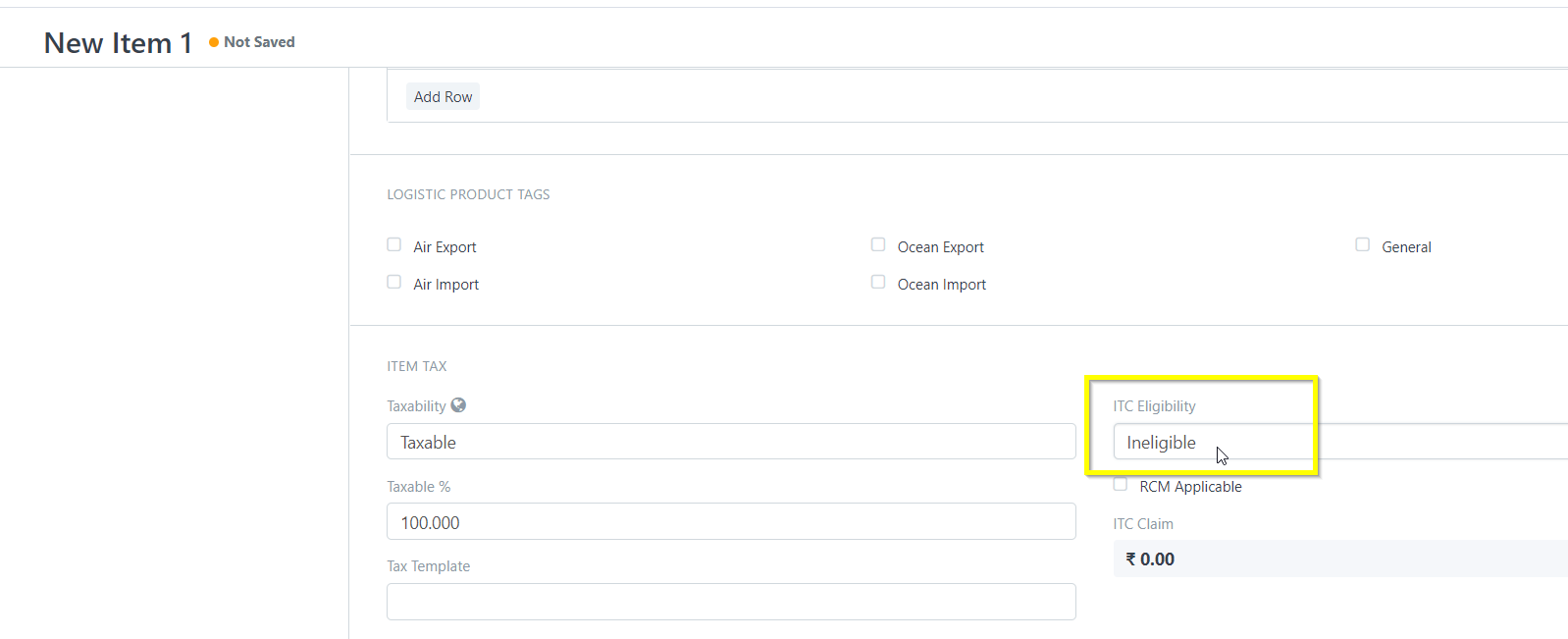

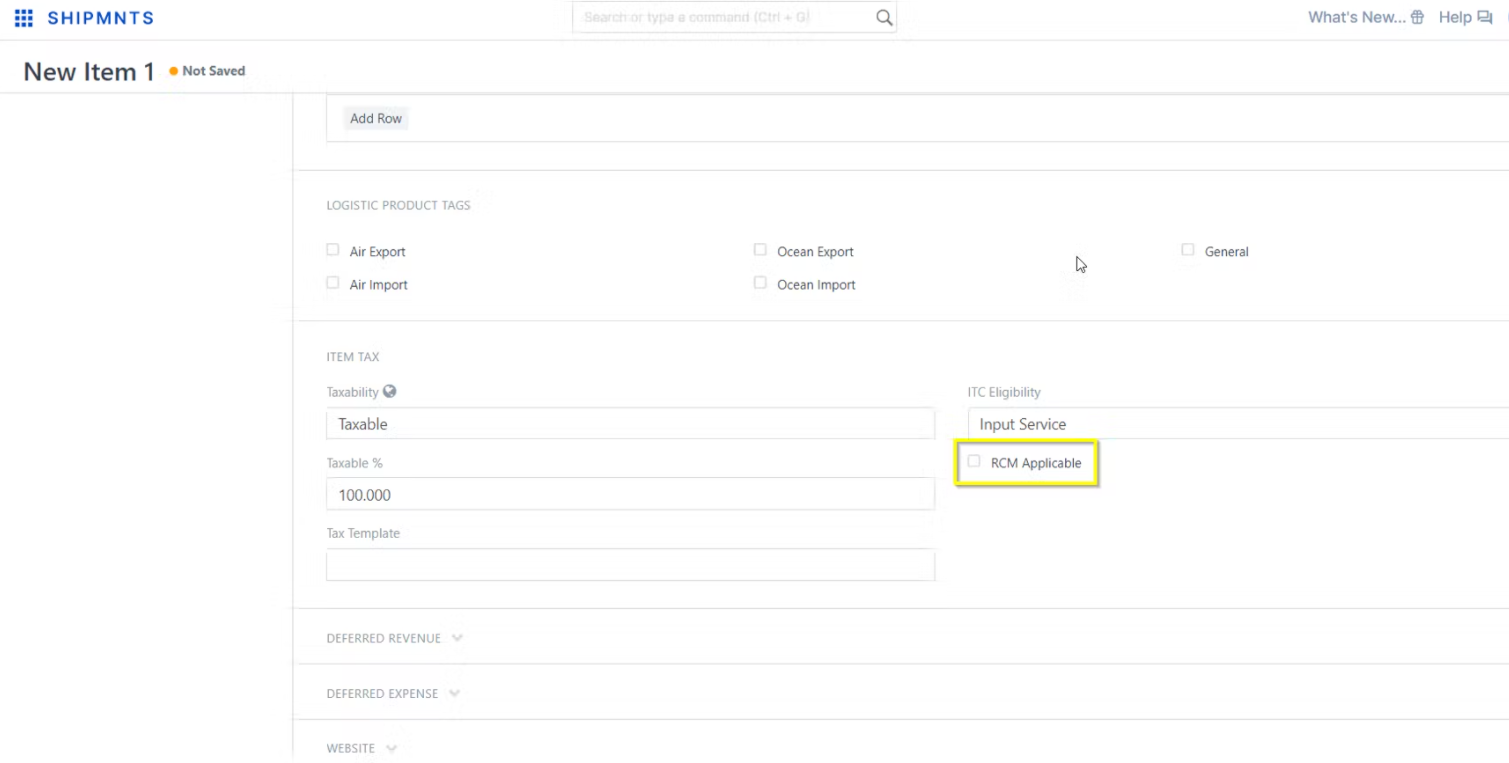

Item Master Configuration

- If the ITC Eligibility of any item is marked as Ineligible in the item master, then no matter what the State of the Supplier is, the Ineligible Tax template will get automated in the invoice.

- Enable the RCM applicable checkbox into the item master in order to create an item as RCM applicable

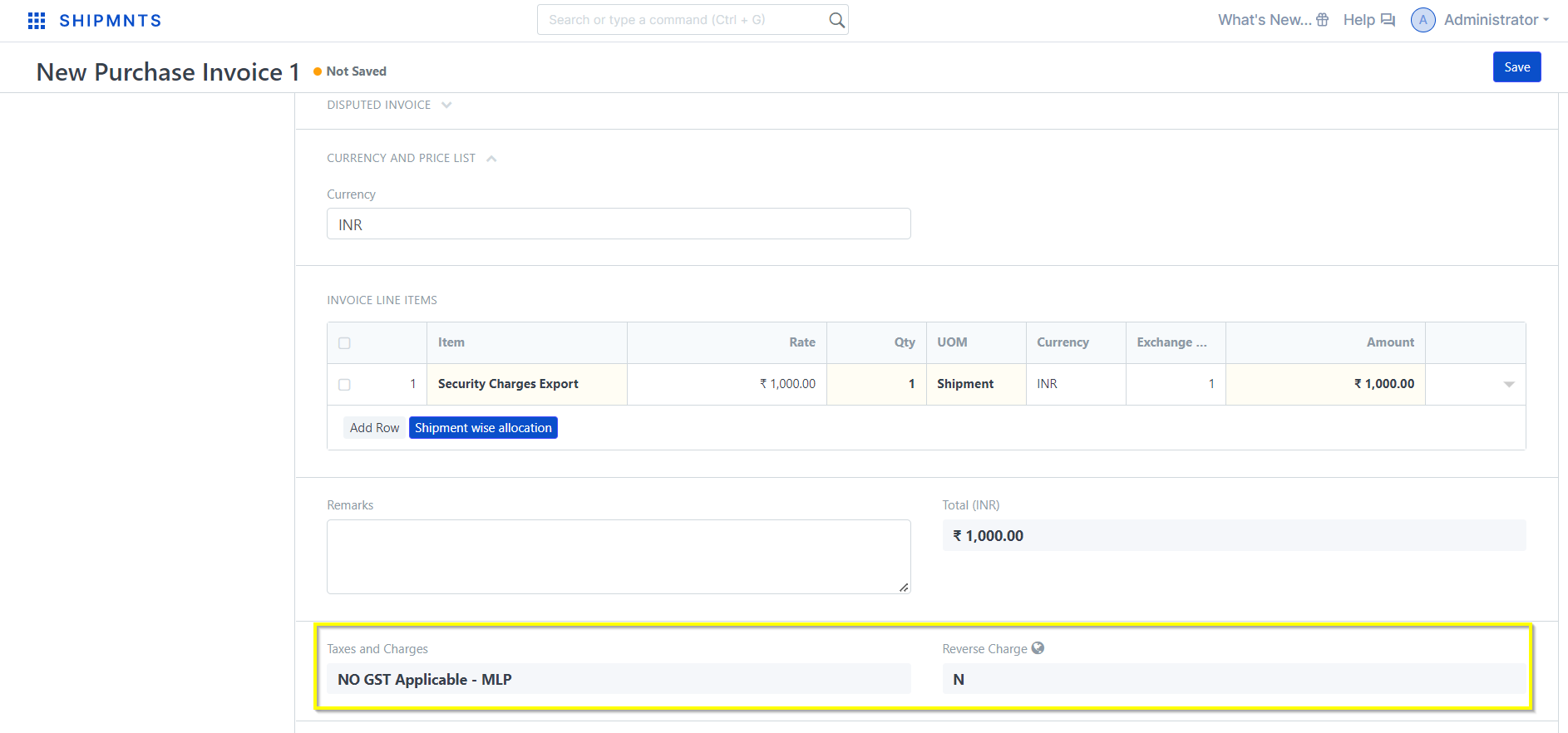

- While generating the Purchase invoice the Taxes and Charges section will be disabled along with the Reverse Charge field and will be automated based on the Item configuration and the State of supplier address.

Note:

- No item can be configured as RCM applicable and ITC Ineligible at the same time.

- If invoice has to be raised against any Ineligible item, then invoice must contain ineligible items only.

- If invoice has to be raised against any RCM Applicable item, then invoice must contain RCM applicable items only.

- Invoice containing both RCM applicable and Ineligible items altogether will not be allowed.

Related Articles

How To Add Tax Withholding Exemption Certificate

Let Us Understand this by taking the example: Suppose Your vendor name is: SQQ INTERNATIONAL LOGISTICS PVT LTD has issued a Tax withholding exemption certificate of limit 50,000, TDS section 194C, Exemption rate: 0.01%, Period : 1Sep 2022 to ...How To Add Tax Withholding Exemption Certificate

Let Us Understand this by taking the example: Suppose Your vendor name is: SQQ INTERNATIONAL LOGISTICS PVT LTD has issued a Tax withholding exemption certificate of limit 50,000, TDS section 194C, Exemption rate: 0.01%, Period : 1Sep 2022 to ...Purchase Invoice Training

Learn with us How to Book Purchase Invoice in SHIPMNTS Video with Timestamp 0:00 Intro 0:01 Navigation Purchase Invoice Pending Report 0:17 Purchase Invoice Pending Report Mechanism 3:07 Estimate for the Purchase (Buy Rate) 3:31 Add Supplier against ...Purchase Invoice Training

Learn with us How to Book Purchase Invoice in SHIPMNTS Video with Timestamp 0:00 Intro 0:01 Navigation Purchase Invoice Pending Report 0:17 Purchase Invoice Pending Report Mechanism 3:07 Estimate for the Purchase (Buy Rate) 3:31 Add Supplier against ...How to prepare a configuration for Uploading Bulk Purchase Reconciliation Format

How to prepare a configuration for Uploading Bulk Purchase Reconciliation Format Helps you configure an upload format for PD and link it to a particular supplier Alok Patel Pre-deposit Amount or PD is a statement that helps you make purchase invoices ...