How to Create a courier invoice

When a shipment/job is made and the invoicing team wants to raise a courier invoice for the shipper, they can do so by following the given procedure:

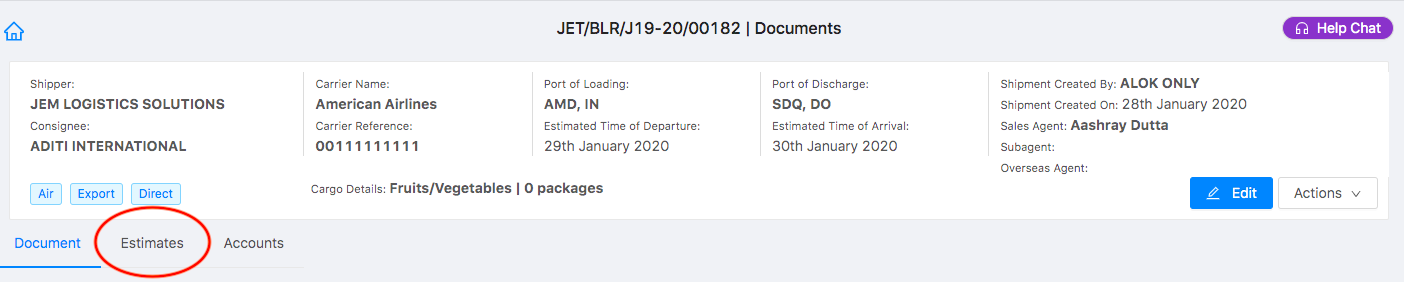

- Select the job for which you want to create a courier invoice, and go to "ESTIMATES" tab (as shown in figure)

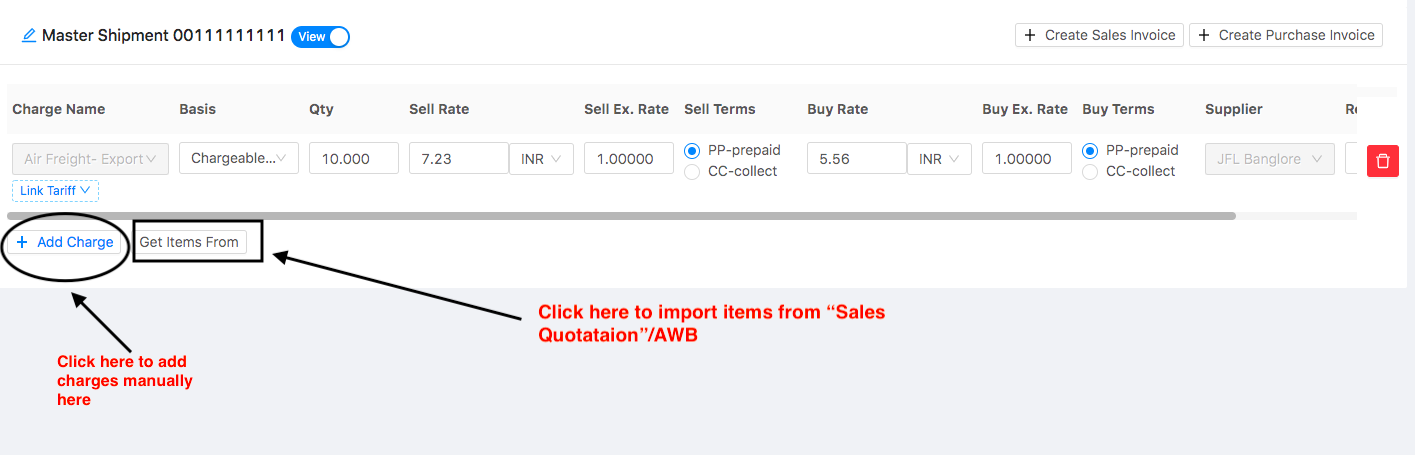

Verify your data and click on “Create Sales Invoice” to create courier invoice directly from the job.

You can add charges manually by clicking on “Add Charge” or import it from “Sales Quotation” or “AWB” by Clicking on “Get Items from”

Refer the Article:”How to get items from AWB ” and “How to get items from Sales Quotation ” to understand more in detail

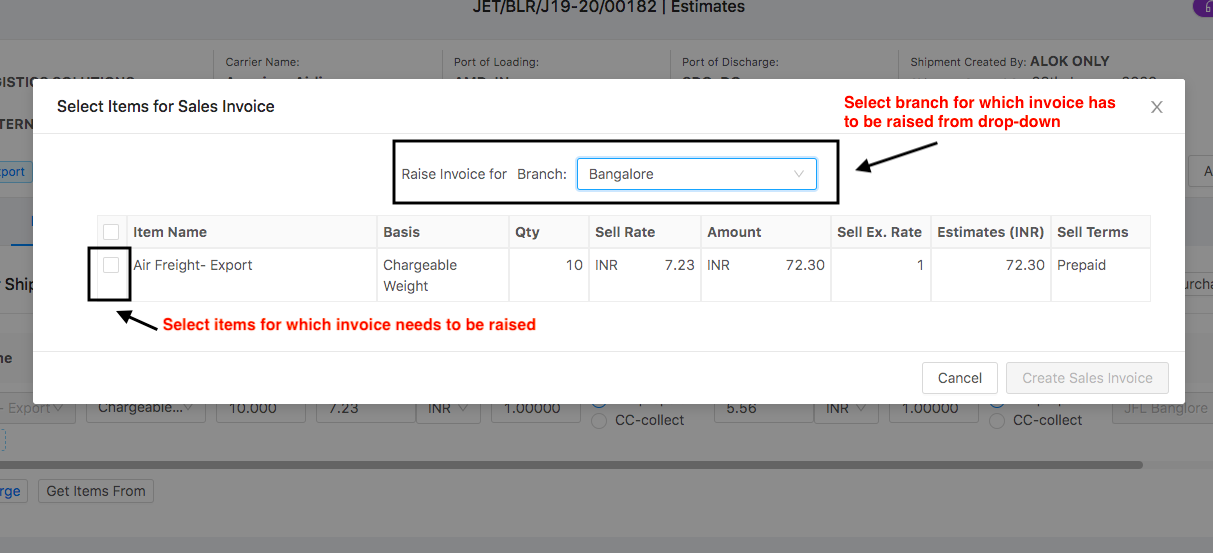

Once you click on “Create Sales Invoice” following pop-up would appear

- Select the branch for which you want to raise the invoice and items which have to be included in the respective invoice

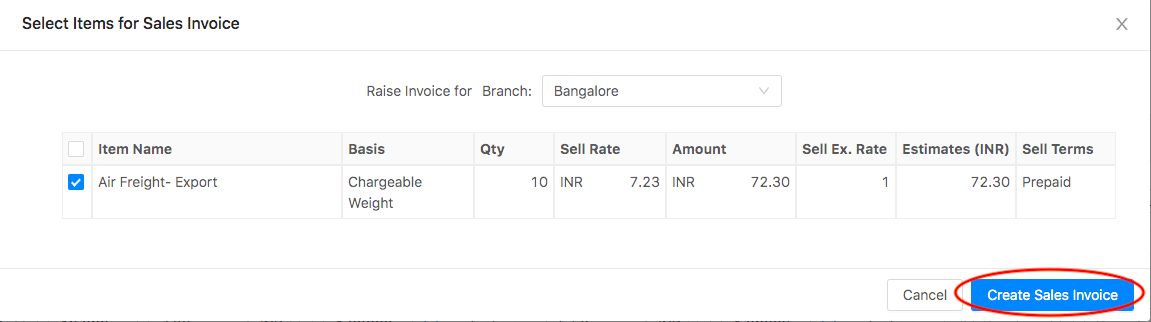

- Click on “Create Sales Invoice” (as shown in figure)

You will now be redirected to the “Finance” module of Shipmnts.

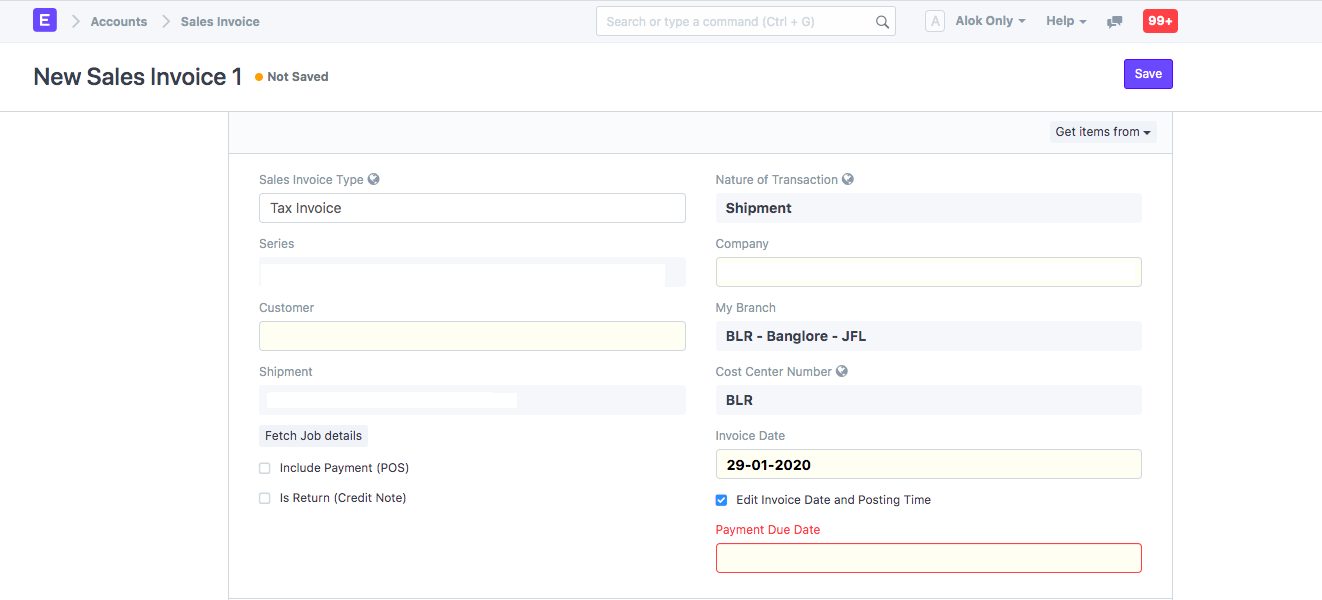

- Details page will open up to create a new courier invoice with data auto-filled from the job (as shown in figure)

You need to enter the following details:

- Sales Invoice type:You can choose the invoice type from here (Tax Invoice, Bill of Supply,Reimbursement Invoice)

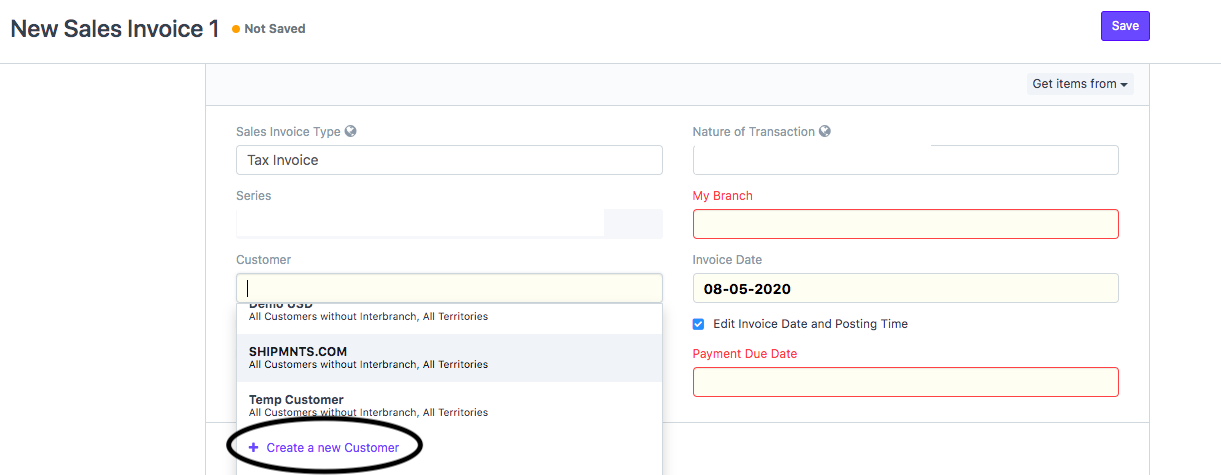

By default, it would be "Tax invoice" - Customer: Enter the customer name for whom you want to raise the invoice

If the customer does not exist, click on "Create New Customer" to create a new customer (as shown in figure)

Note: For further steps you can refer the article "How to create a new customer"

- Invoice Date: Would be by default as current date.

- Payment Due Date: Would be auto filled based on the customer template set

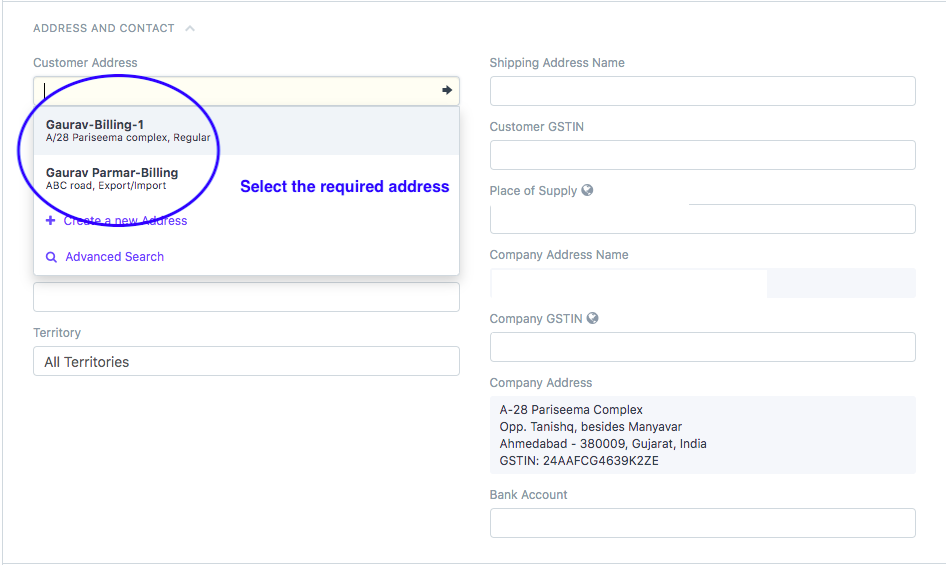

- Address and contact details will be auto-filled by the Customer name

If a customer has multiple addresses, you can select the required address for which invoice is raised from the drop-down (as shown in figure)

Note:If the Address does not exist click on "Create New Address"

Refer "How to Add Customer Address during sales invoice creation " to know the process

- You need to select the currency in which you want to create the invoice from the Currency section (as shown in figure)

By default it would be the currency set as per your company

If your courier invoice has to be raised in some other currency, you can do so

Refer article: How to create NON-INR sales Invoice to know the process in detail

- You can "Add Items/Charges" additionally along with its rate for which you want to create invoice in the given section (as shown in figure)

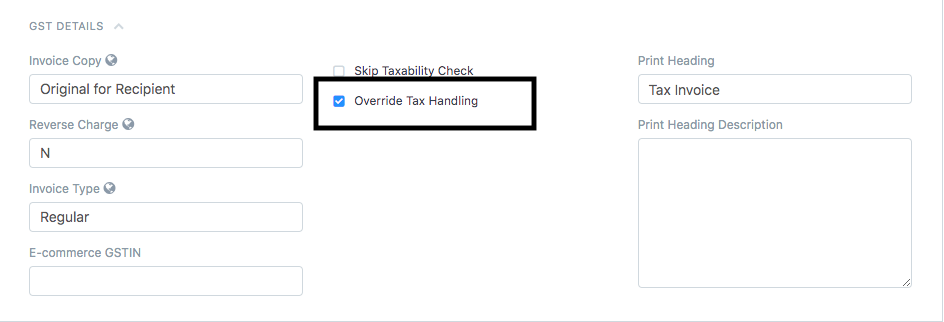

You must always be charged IGST for the items/charges here ( as in courier invoice only IGST is charged irrespective of the address of the customer)

If you are charged CGST and SGST on this invoice, based on "Address" of the customer, you can change it to IGST

How to change the calculation to IGST for courier invoice

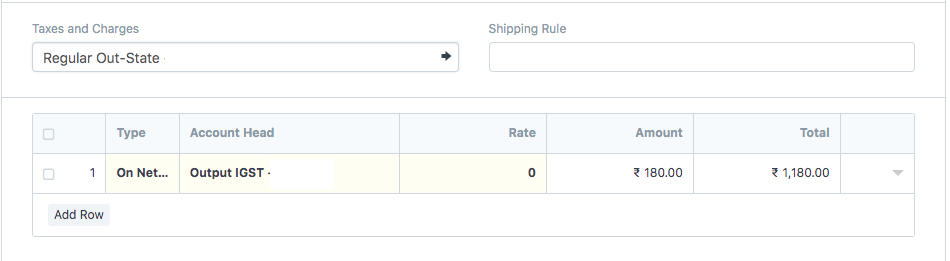

- For the IGST tax calculation, you need to go to the GST section and check "Override tax handling" (as shown in figure)

- Once you check this box, you will be able to change the template of tax and charges.

Change the template to "Regular Outstate" to calculate IGST (as shown in figure)

Now, you can proceed with further process

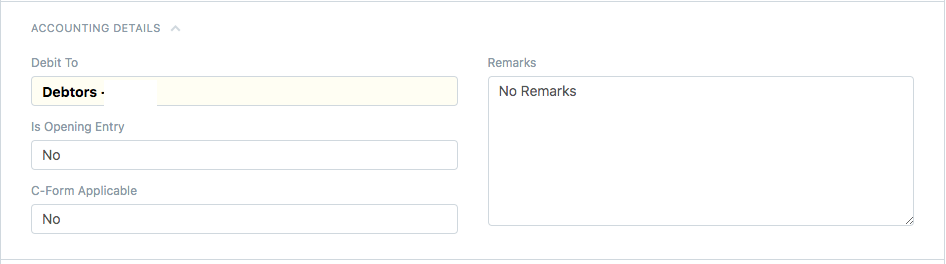

- You can enter any remarks you want to in the "Remarks" section (as shown in the figure)

Click on “Save and “Submit” in the end

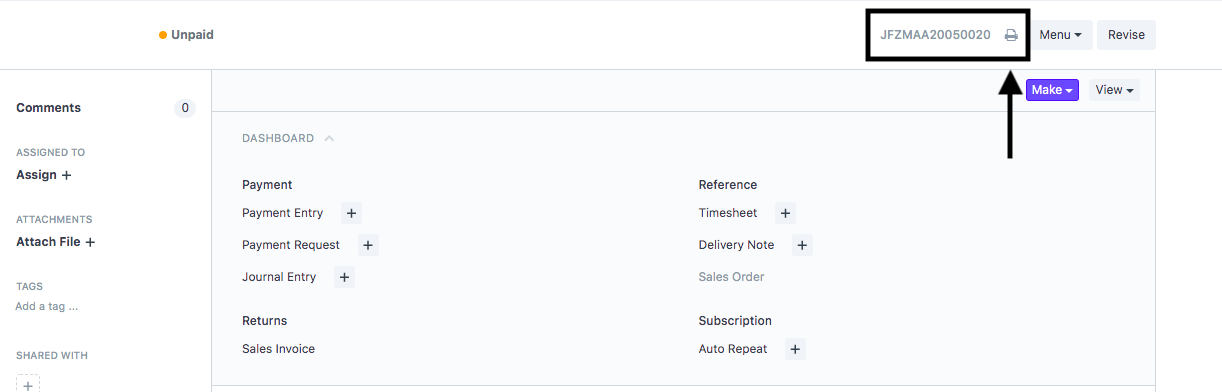

How to print a courier invoice

- Once you have made the invoice, you can print the invoice by clicking the print icon (as shown in figure)

On clicking the icon, you will be able to see the preview of your invoice before printing

- Select the format in which you want to print your invoice and then click on "Print"(as shown in figure)

Did this answer your question?

Did this answer your question?

Related Articles

How to Create a courier invoice

How to Create a courier invoice Helps you create a courier invoice for which you are always charged IGST despite the address of the customer Alok Patel When a shipment/job is made and the invoicing team wants to raise a courier invoice for the ...How to create Reimbursement Invoice.

How to create Reimbursement Invoice. An invoice generated by freight forwarder to the shipper (customer) for charges paid by him(Freight Forwarder) on behalf of the shipper. Alok Patel Log on to Shipmnts Operations Module and select the job for which ...How to create Reimbursement Invoice.

How to create Reimbursement Invoice. An invoice generated by freight forwarder to the shipper (customer) for charges paid by him(Freight Forwarder) on behalf of the shipper. Alok Patel Log on to Shipmnts Operations Module and select the job for which ...How to Create Purchase Invoice (Without Job)

How to Create Purchase Invoice (Without Job) Helps you create a purchase invoice where job/shipment is not related Alok Patel On the dashboard, search for "Purchase Invoice List" in the universal search bar and select it ( as shown in figure) ...How to Create Purchase Invoice (Without Job)

How to Create Purchase Invoice (Without Job) Helps you create a purchase invoice where job/shipment is not related Alok Patel On the dashboard, search for "Purchase Invoice List" in the universal search bar and select it ( as shown in figure) ...