How to book bank charges when payment entry is made

When a bank deducts charges it is a kind of expense made from your end and you can record the deducted bank charge as "Purchase Invoice" in our system

To record any charge as "Purchase" you need to have a supplier along with its address for the concerned charge.

In this case your supplier would be the concerned "Bank" which has deducted the charges for the payment you have made or will be making in future transactions

Refer: "How to create "Bank" as a supplier" to understand this in detail

How to make "Purchase Invoice" for a payment made

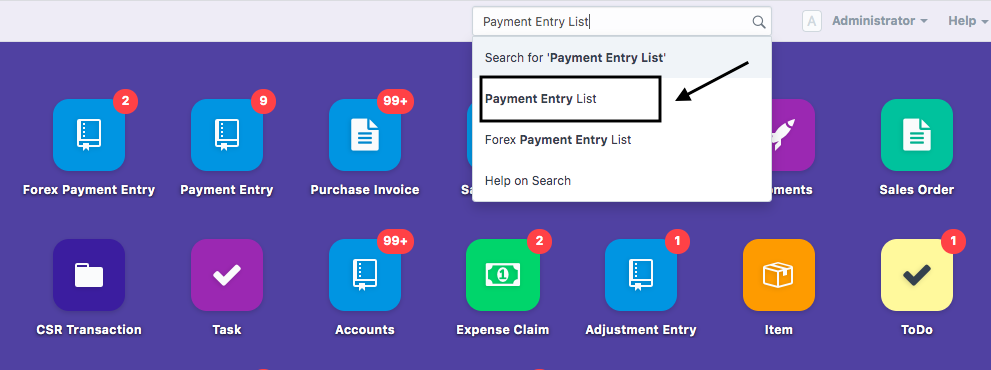

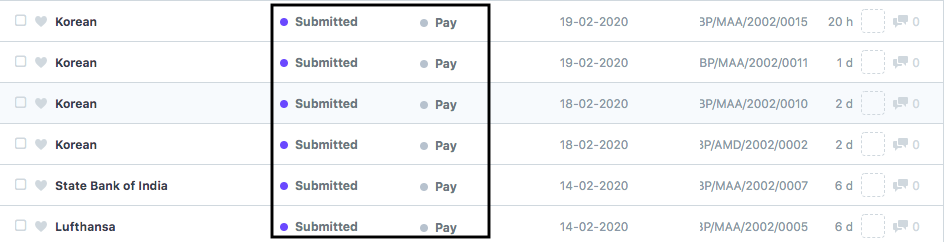

- On the dashboard, search for "Payment Entry List" and filter for entries whose type is "Pay" and status is "Submitted" (Refer Figure as shown)

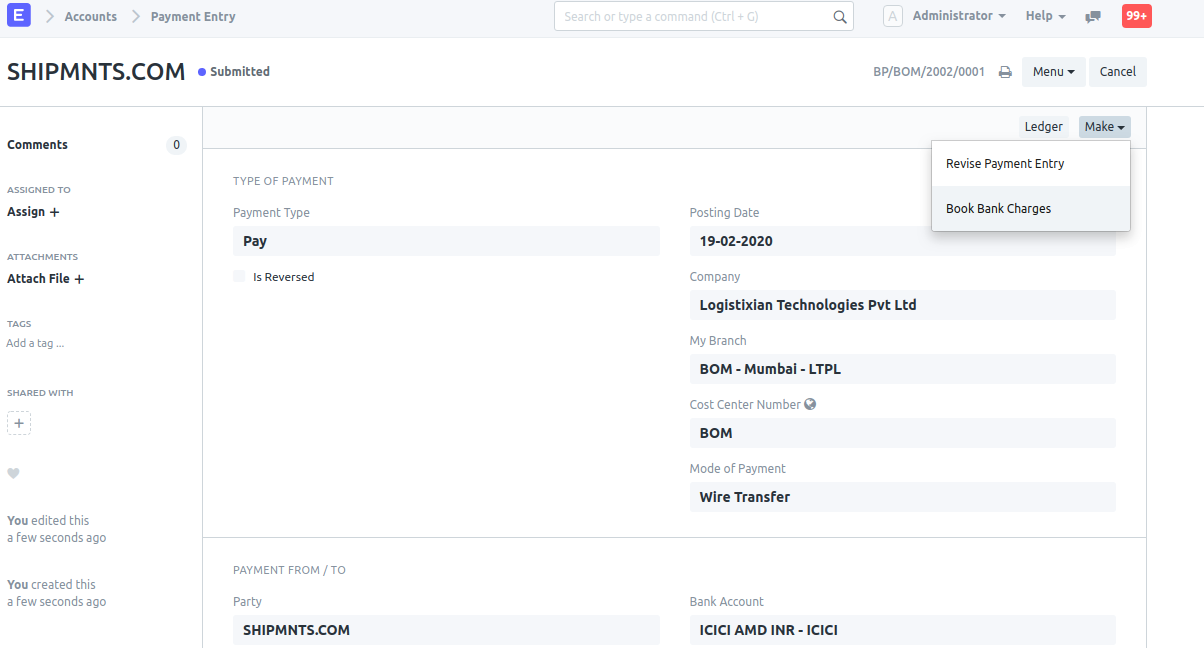

- Open the respective "Payment Entry" for which you want to book the charges and select "Book Bank Charges" under "Make" button (Refer figure as shown)

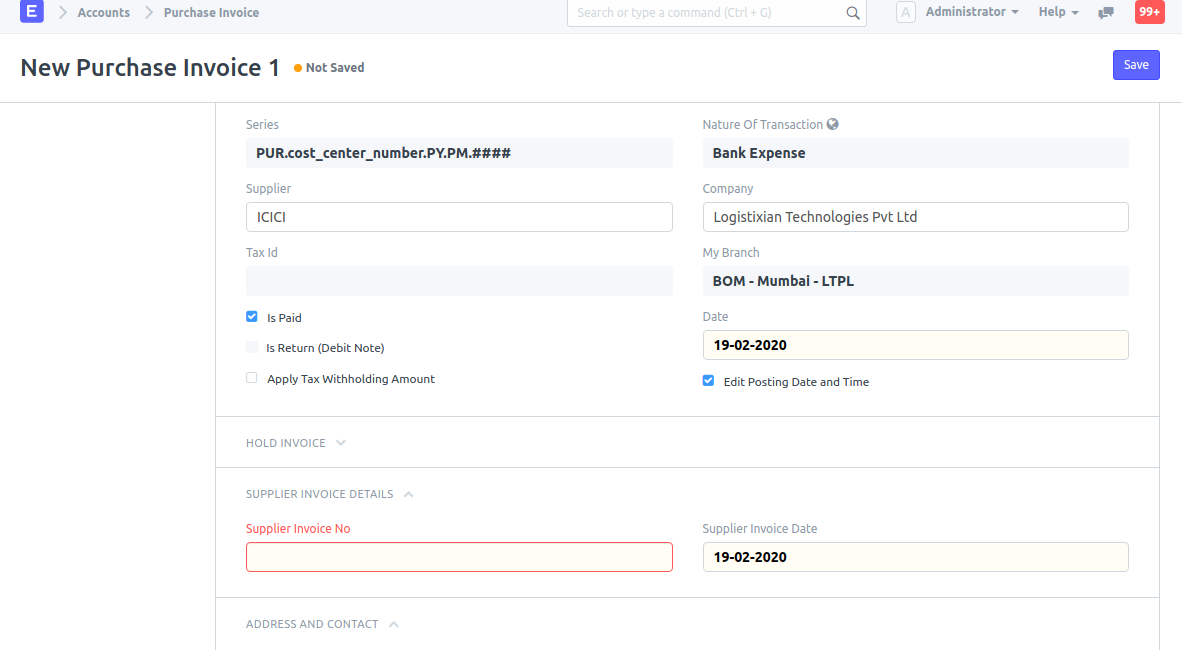

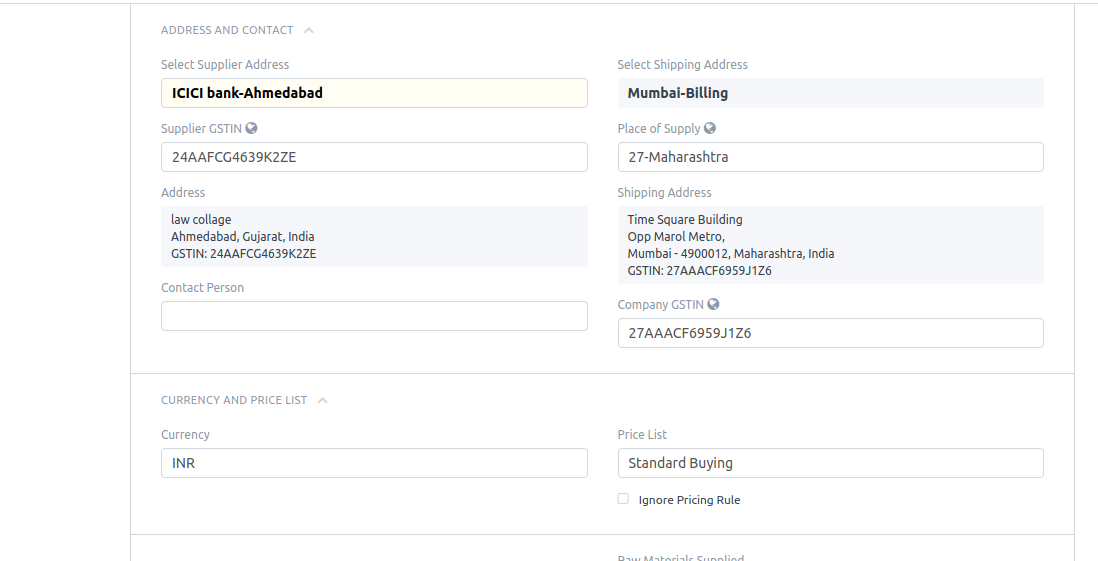

- You will see page of "Purchase Invoice" open up with all the basic details such as Supplier (Bank which has deducted the charges) ,Branch (Your company's branch for which charges has been deducted) , Cost center , Address of the bank and account currency auto-filled as per the payment entry you have made

Note: Bank accounts must be linked with Bank as supplier in Address reference table

In case, its not linked, Refer article "How to Link Bank Account with Bank Supplier address"

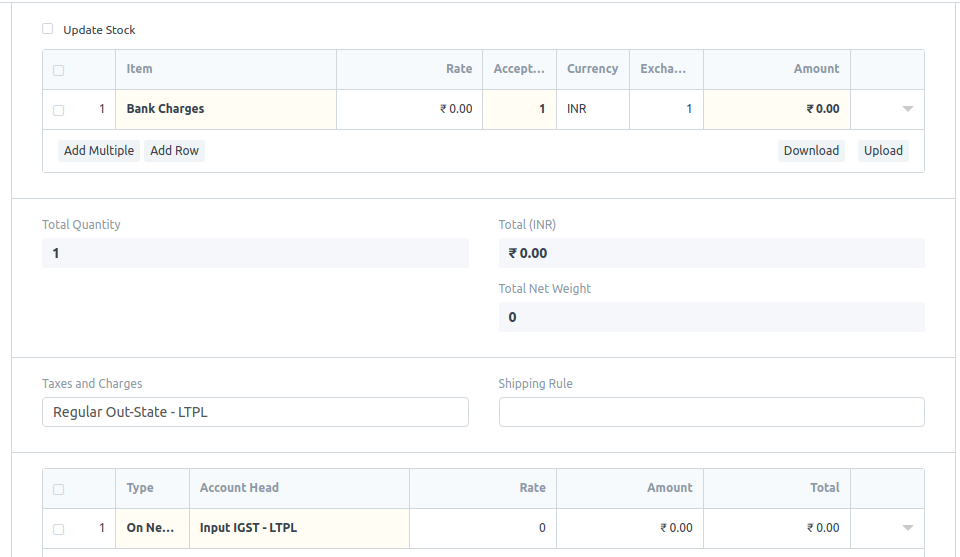

Scroll down to the "Update Stock" section

Bank charges as "Item" would be autofilled and you only need to fill amount of bank charge amount.

All tax and charges will be auto-filled based on the address of the supplier and calculation will be based on the rate you enter in respect to "Bank Charges" item

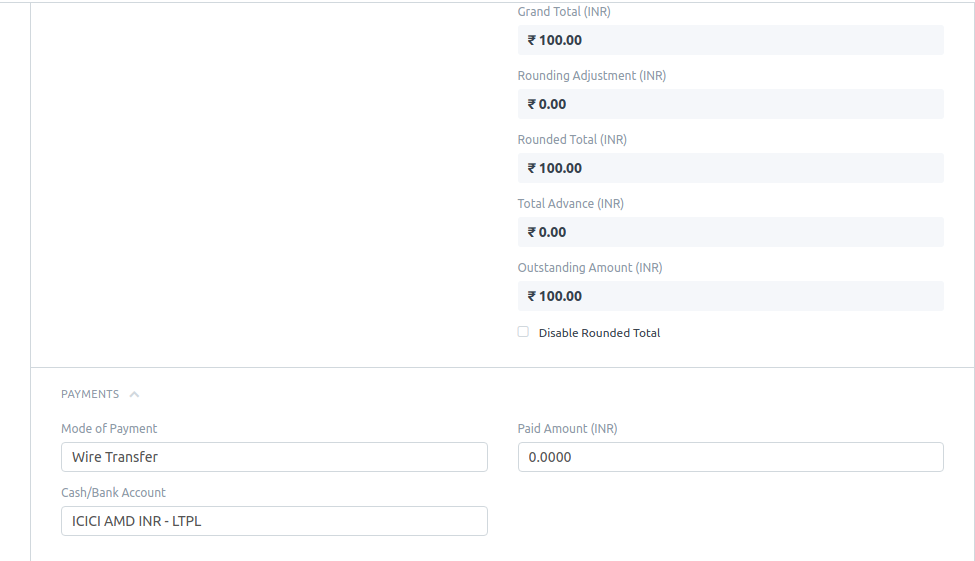

Payment section will also be auto-filled

- Mode of payment and Cash/bank account will remain the same as the mode of payment and ledger account of selected bank account mentioned while making "Payment entry"

In case no mode of payment is entered, it will remain "Wire Transfer" by default

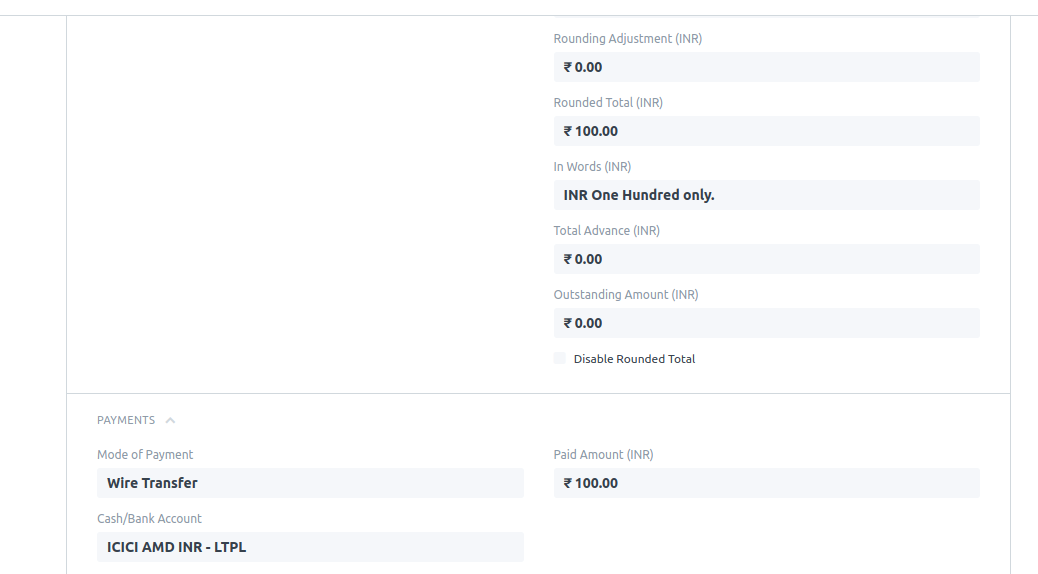

Here paid amount is autofill on save and submit of purchase invoice

How to see Ledger of this Purchase Invoice

In case you want to see the ledger entry of this purchase invoice, you can do so by directly clicking" the Ledger option given on the same page.

Related Articles

How to book bank charges when payment entry is made

How to book bank charges when payment entry is made Helps you book the charges deducted by bank when payment entry has been recorded Alok Patel When a bank deducts charges it is a kind of expense made from your end and you can record the deducted ...How to Book Bank charges while making Contra entry

How to Book Bank charges while making Contra entry Alok Patel On the dashboard, search for "Journal Entry List" and filter for entries whose entry type is "Contra Entry" (Refer Figure as shown) Open the respective "Payment Entry" for which you want ...How to Book Bank charges while making Contra entry

How to Book Bank charges while making Contra entry Alok Patel On the dashboard, search for "Journal Entry List" and filter for entries whose entry type is "Contra Entry" (Refer Figure as shown) Open the respective "Payment Entry" for which you want ...How can we make bank entry in book directly from bank reconciliation?

When you are doing bank reconciliation few of entries are not made in bank book, then you no need to go payment screen and bank entry screen to make entry. You can direct made it from bank reconciliation. Open that bank transaction entry from bank ...How to book operational/job Bank payment entry?

For Bank Payment, Go to Menu > Cash & Bank Management > Bank Payment > New other expenses and payments - It will open the form of bank entry where nature selected as “Pay - Outward” for pay entry. Select the Posting Date Select the Company(if multi ...