Making Payment For a Cash Expense

Case on case basis reimbursement

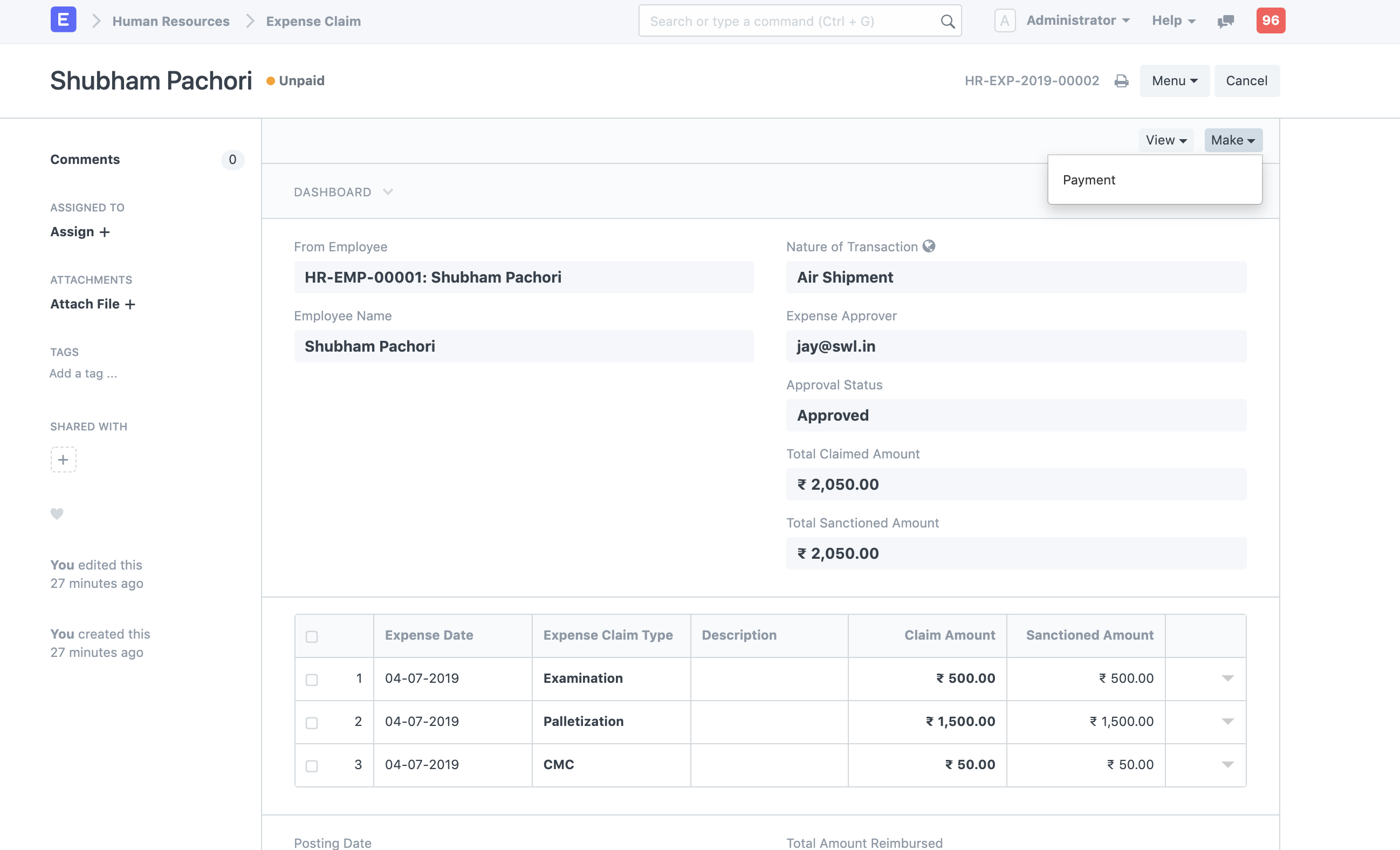

In case where an employee has already paid for expense claim you can may reimburse the employee by making a payment en have been recored you can make payment entry for that expense claim by going to Make menu and Select Payment

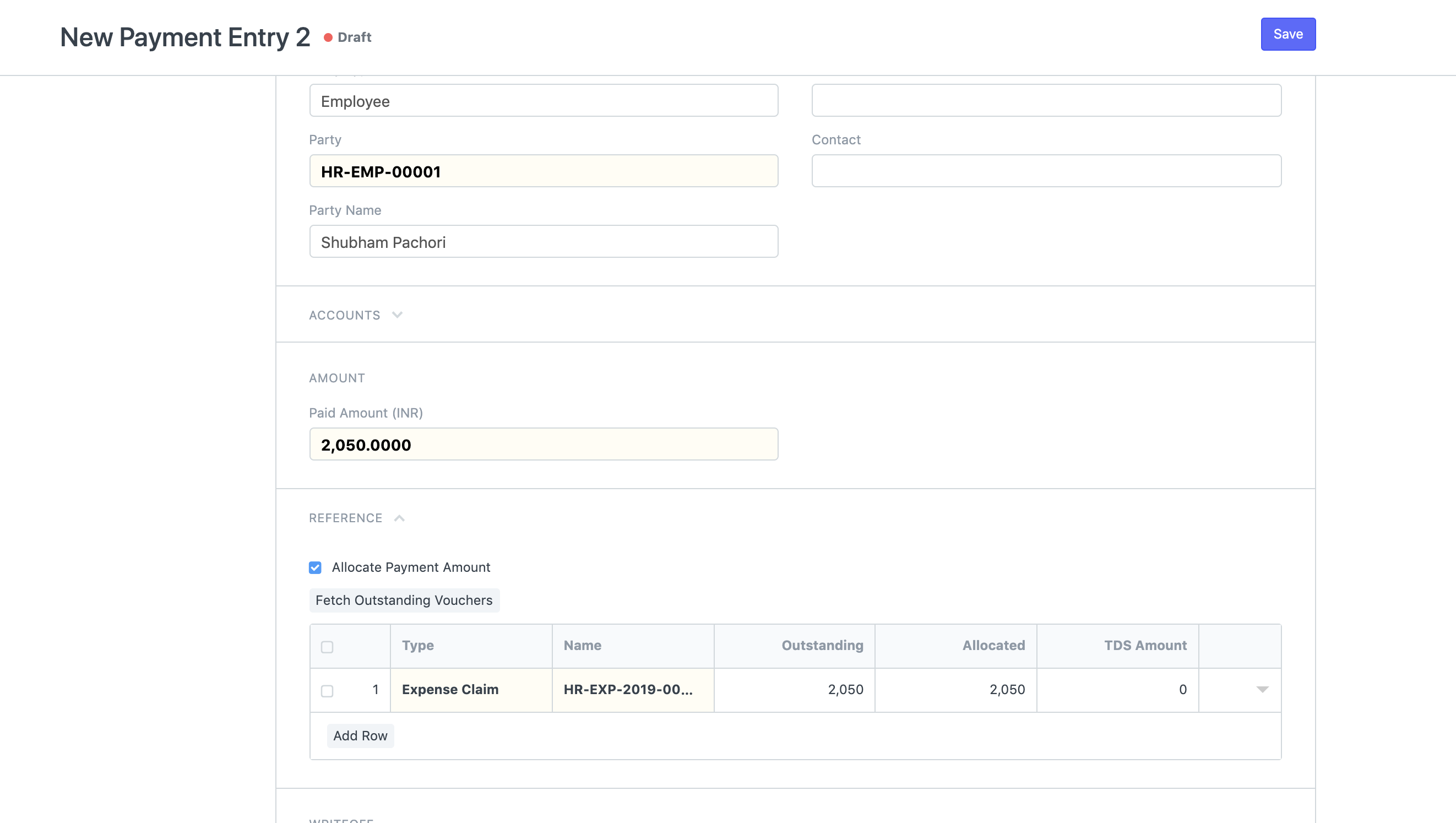

When you will click on Payment, payment entry form will open with all the details of employee and expense claim as reference for allocation filled up.

If you are reimbursing the employee in cash you have to select Mode of Payment as Cash, and Select Cash Account in Account Paid From

If you are reimbursing the employee by direct bank account transfer select Mode of Payment as NEFT/RTGS/Cheque and select the bank account of the company from which it is being transferred

Weekly Reimbursements

If you reimburse an employee for all the expenses done in a week, fortnight or a month, you can directly go to payment entry form.

Select payment type as pay, Party Type as Employee and in Party select the name of the employee

In reference section click on fetch outstanding vouchers to get all expense claims which have not been paid yet, allocate the amount and submit the entry

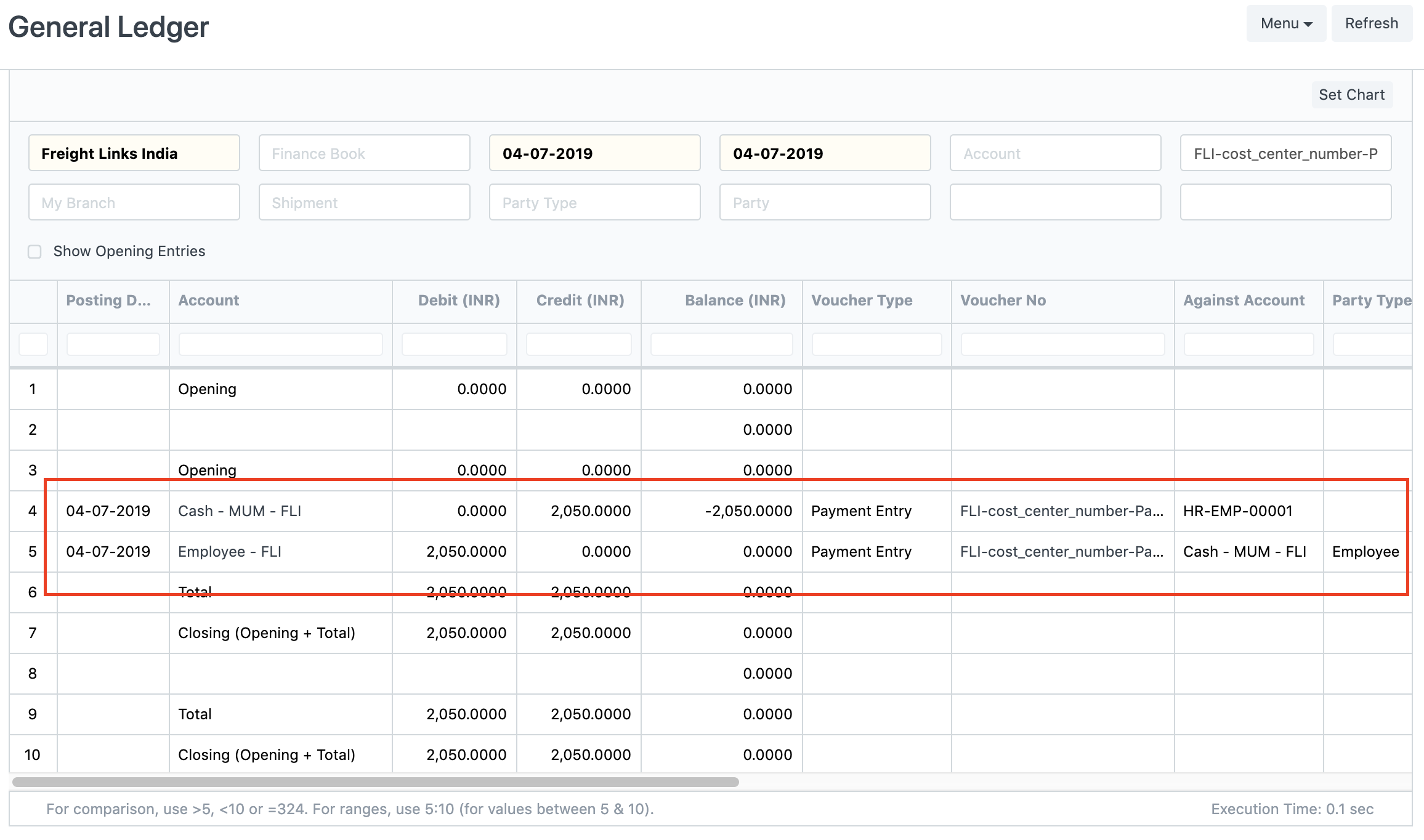

Once you submit the entry system an marks the expense as paid against the employee account entry and makes entry in Cash or Bank Account as selected by you

Did this answer your question?

Did this answer your question?Related Articles

Making Payment For a Cash Expense

Making Payment For a Cash Expense How to reimburse your employee for a cash expense Shubham Pachori Case on case basis reimbursement In case where an employee has already paid for expense claim you can may reimburse the employee by making a payment ...How to book bank charges when payment entry is made

How to book bank charges when payment entry is made Helps you book the charges deducted by bank when payment entry has been recorded Alok Patel When a bank deducts charges it is a kind of expense made from your end and you can record the deducted ...How to book bank charges when payment entry is made

How to book bank charges when payment entry is made Helps you book the charges deducted by bank when payment entry has been recorded Alok Patel When a bank deducts charges it is a kind of expense made from your end and you can record the deducted ...Settling Advance Paid To an Employee Against a Cash Expense

Settling Advance Paid To an Employee Against a Cash Expense How to settle advance paid to an employee against an expense claim Shubham Pachori In case you pay employee advances for the cash expense they may do at port of operations, you can settle ...Settling Advance Paid To an Employee Against a Cash Expense

Settling Advance Paid To an Employee Against a Cash Expense How to settle advance paid to an employee against an expense claim Shubham Pachori In case you pay employee advances for the cash expense they may do at port of operations, you can settle ...